GBPJPY Price Analysis – April 19

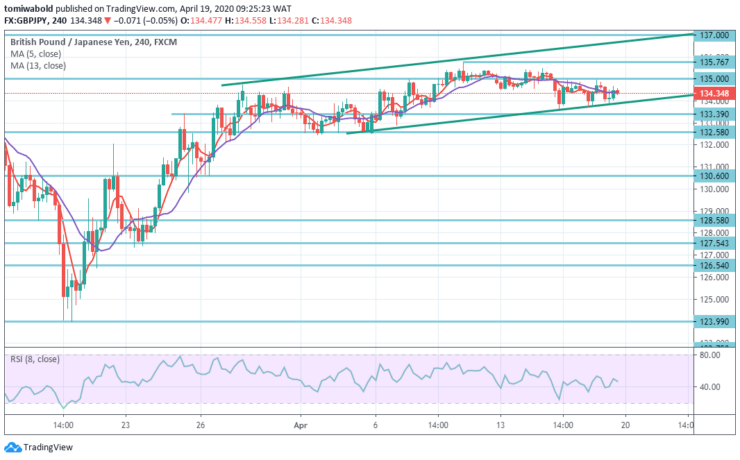

GBPJPY posted a recovery within the near-term ascending channel while raising offers to sub-135.00 levels, up 0.25 percent from its recent lows as of Friday, the pair records lower volatility compared to recent days following the risk-tone situation of coronavirus (COVID-19).

Key Levels

Resistance Levels: 147.95, 139.18, 135.76

Support Levels: 133.39, 127.54, 122.75

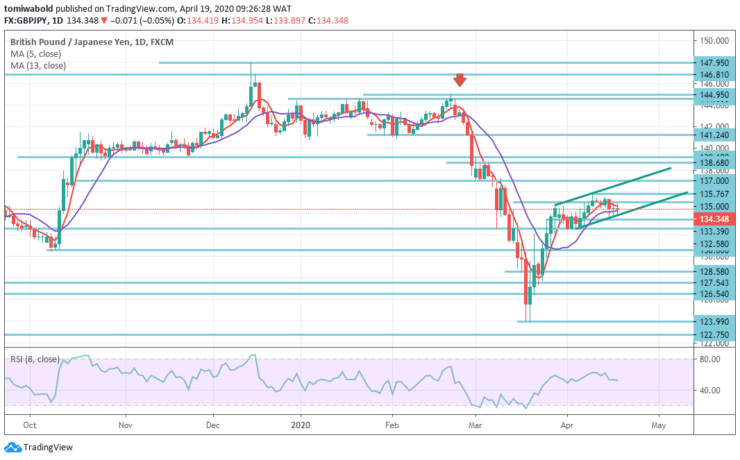

GBPJPY Long term Trend: Ranging

GBPJPY is shifting marginally lower over the last few days trading within the moving average of 5 and 13 following the 50.0 percent retracement level of the downward phase from 144.95 to 123.99 at 134.34 levels, technically the RSI indicator is testing the neutral mark of 50, while the MA 5 and 13 inches higher though moving with such sluggish traction.

In the broader sense, 122.75 (low) level price behavior is primarily a horizontal consolidation trend, that has been concluded at level 147.95. Larger downward trend from level 195.86 (high) and that from level 251.09 (high) may continue. The trend may in some rare instances stay bearish as long as the level of resistance maintains 147.95.

GBPJPY Short term Trend: Bullish

Last week, GBPJPY stayed in a close range below 135.76 temporary top level. Secondly, the initial bias stays neutral this week. Can’t simply leave out another increase. But to conclude the corrective recovery from 123.99 level, upside should be constrained by 61.8 percent retracement from 144.95 to 123.99 at 137.00 levels.

On the downside, a break of level 132.58 may shift intraday bias back to the downside. Although bullish technical structure on the 4-hour time frame supports the pair’s run-up, the top of the near-term ascending channel near to 135.76 level may offer a substantial upward barrier before the subsequent growth.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.