GBPJPY Price Analysis – July 5

The sterling may accumulate gains on a quiet session going into the new week from Friday. GBPJPY stayed positioned sideways at around 134.00 level, with downside attempts confined by buyers at 133.70 level. In addition to this, mild risk aversion, cases of coronavirus coupled with Brexit uncertainty are easing the pound market.

Key Levels

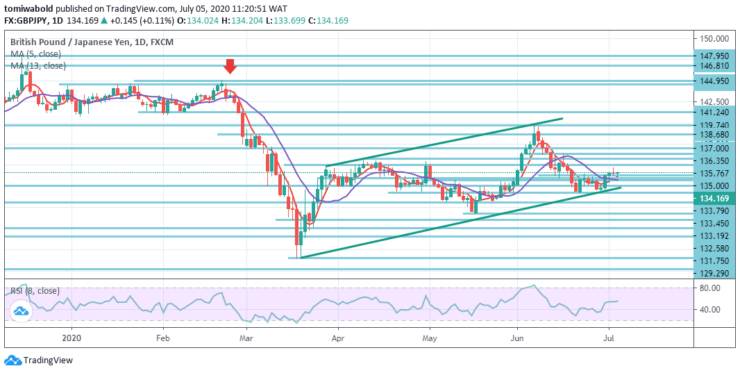

Resistance Levels: 147.95, 139.74, 136.35

Support Levels: 133.79, 131.75,129.29

The downturn of GBPJPY from a recent high of 134.70 level seems to have stabilized close to 134.00 level— the resistance of the double top line, which was pierced to the higher side mostly during the preceding week.

From a technical standpoint, the pair retains the near-term upbeat tone beyond 133.70 (low) level with the next support levels being 132.58 and 131.75 levels respectively. Initial resistance on the upside lies at level 135.00 and beyond at 136.35 level (June 16 high).

Last week’s GBPJPY breach of 134.00 handles suggests that declining from level 139.74 may have ended at level 131.75. First of all, initial bias is marginally on the upside for resistance level at 136.35.

The breach may validate this scenario and require a high level of the retest of 139.74. Though a breach of the support level of 132.58 may restart the fall across main support levels of 131.75 to 129.29.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.