GBPJPY Price Analysis – September 30

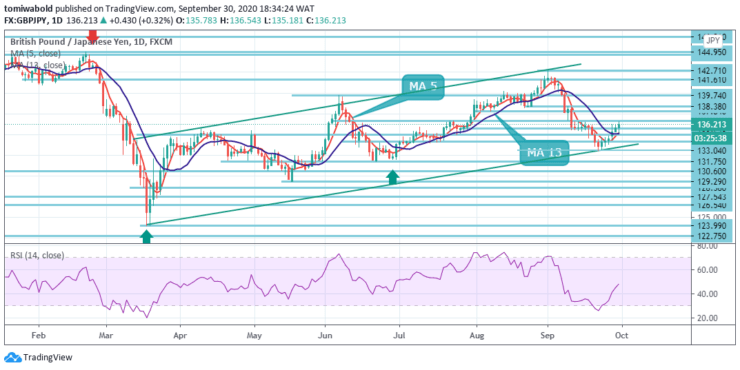

GBPJPY is increasing for the 5th day in a row while maintaining a bullish bias beyond the 136.00 level. Earlier, the dip–buying assisted to limit any meaningful slide near the key 135.00 psychological marks as bulls are seen making a fresh attempt as momentum eases.

Key Levels

Resistance Levels: 147.95, 142.71, 136.62

Support Levels: 133.12, 131.75, 129.29

The GBPJPY may begin to consolidate between 135.00 and 136.62 levels. If it tries to breach and carry beyond 136.62 levels more growth appears probable. The initial aim is seen at level 136.62, led by level 137.84.

As long as the level of resistance is 147.95, a potential downside breakout stays in order. Even so, the steady breach of the 147.95 marks may increase the probability of a bullish long-term reversal. The emphasis for validation may then be shifted to a 156.59 resistance level.

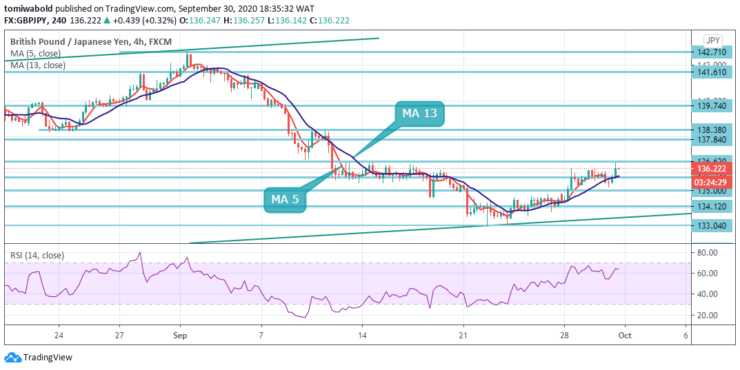

GBPJPY’s recovery from the 133.04 level is still in progress on the 4-hour timeframe, but so far fails to take out the 136.62 resistance level. The intraday bias stays impartial and may come to play with further correction. The fall from 142.71 level and goal 61.8 percent retracement from 123.99 to 142.71 at 131.75 levels may continue the breaking of 133.04 level on the downside.

Nevertheless, for a steeper recovery, the firm breach of 136.62 level may imply short-term bottoming and turn bias back to the upside. If the decline is induced by the present momentum shift in GBPJPY, the main support to track is seen at the levels of the 134.12/50 band.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.