GBPJPY Price Analysis – July 19

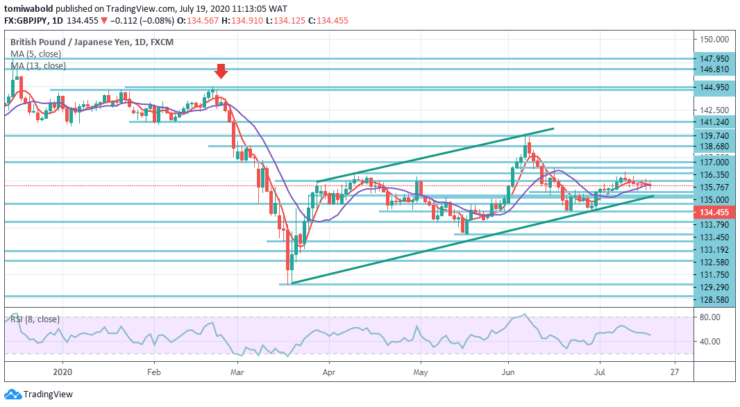

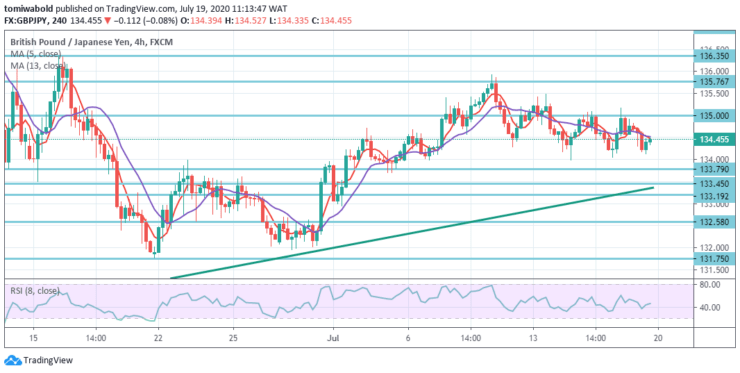

GBPJPY holds at a level of 134.45 after easing its directional movement in the prior session, as the pair is now confined to the price channel indicating sideways bias beneath the 135.00 marks. To confirm further growth, the asset has to breach the moving averages and the upside border of the channel to fix beyond level 135.76.

Key Levels

Resistance Levels: 147.95, 139.74, 136.35

Support Levels: 133.79, 131.75,129.29

Last week, GBPJPY held beneath 135.76 level in consolidation and the trend is intact. First this week the initial bias stays neutral. Yet more growth may be in support as long as it maintains a level of 133.79 minor support.

On the upside beyond level 135.76 may expand the recovery from level 131.75 to high level 139.74. Similarly, a breach of the level of 133.79 may propose that the recovery is over. Instead, the intraday bias is pulled back to the downside for support level 131.75.

Despite the absence of directional momentum, the short-term oscillators look biased towards sideways. The RSI is slightly beyond 40 and is moving to a neutral threshold.

GBPJPY displays a short-term neutral bias, and an initial breach of either level 136.35 or level 131.75 may restart a fresh trajectory.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.