GBPJPY Price Analysis – March 4

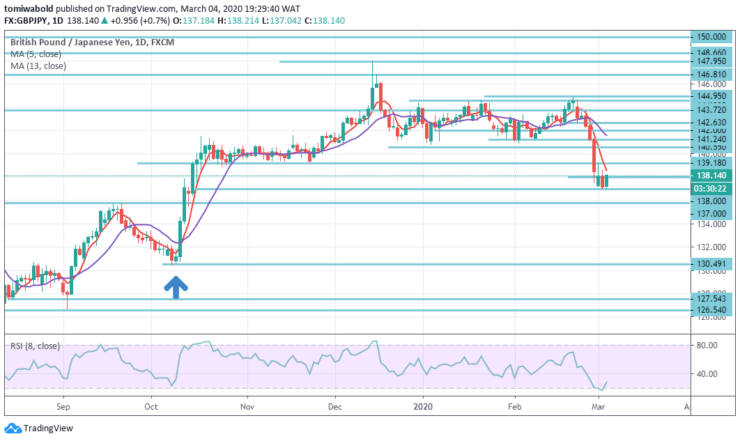

The price is moving south with a positive momentum of selling, while the pair’s inability to record any significant recovery from the important merger area near the 137.00 level suggests that the recent selling pressure may still be far from stopping. While the market fear of coronavirus (COVID-19) continues to put pressure on the pair, recent positive results in Asian stocks seem to have supported the pair.

Key Levels

Resistance Levels: 148.66,144.95, 141.24

Support Levels: 137.00, 130.49, 126.54

GBPJPY Long term Trend: Ranging

The high of September 2019, surrounding 135.75 level, may attract the attention of bears as soon as the pair closes beneath the 137.00 level on the daily chart. Meanwhile, any recovery beneath the November 2019 low close to 140.55 level seems perfect.

In the long run, a deviation from the resistance level of 148.66 suggests that an increase from the level of 126.54 is probably only the third stage of the consolidation model from the level of 122.75 (low level). A break of the support level of 126.54 will resume a stronger downtrend from 195.86 (high) level to a low of 122.75 level.

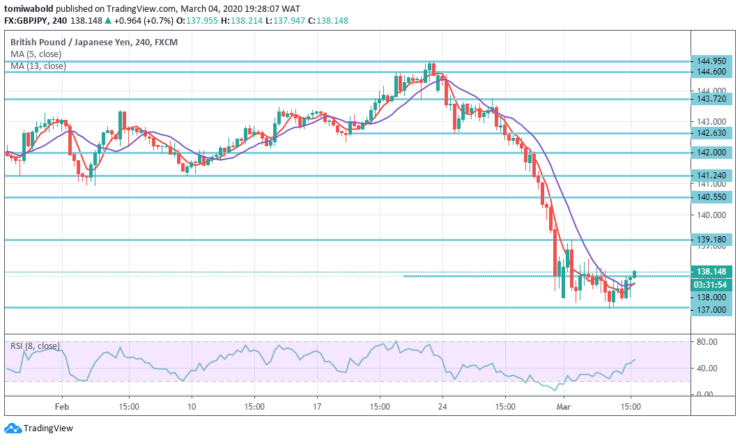

GBPJPY Short term Trend: Bearish

The intraday bias in GBPJPY stays at a downward level with a slight resistance level of 139.18, while the current decline from 147.95 level may approach a partial pullback of 126.54 to 147.95 from 130.49 level in the following.

On the other hand, secondary resistance levels past 139.18 can primarily change the neutrality of intraday bias. But the risk may quite stay on the downside, while the resistance level of 144.95 stays unchanged.

Instrument: GBPJPY

Order: Buy

Entry price: 138.00

Stop: 137.00

Target: 139.18

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.