GBPJPY Price Analysis – January 10

In the new week, GBPJPY is likely to retain its upside traction beyond the mid 140.00 level while endorsing positive price action. Earlier GBPJPY has been on the back foot with GBP struggling on lockdown concerns.

Key Levels

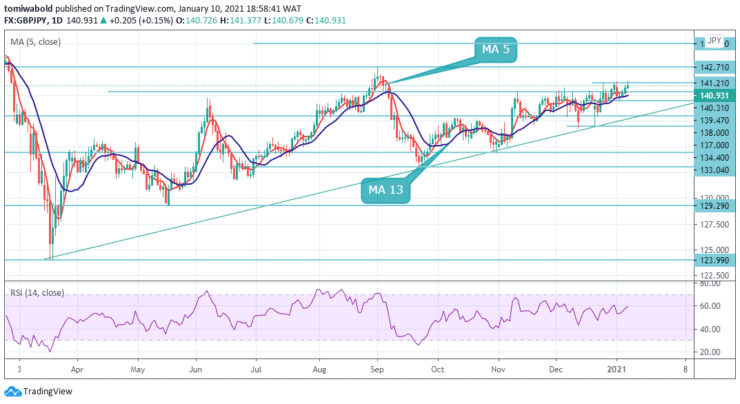

Resistance Levels: 145.00, 142.71, 141.21

Support Levels: 139.47, 138.00, 137.00

The technical indicators on the daily chart have continued gaining momentum and support the prospects to retain upside traction beyond the mid 140.00 level. A subsequent move to swing highs around 141.27 remains in place and, on the other hand, another move to swing lows around 139.47 in the event of a fall looks very likely.

Meanwhile, any significant pullback could be seen as a buying opportunity around 139.00. Failure to protect said support will exacerbate a strong barrier near current levels and leave the GBPJPY cross vulnerable to an accelerated slide towards 138.38.

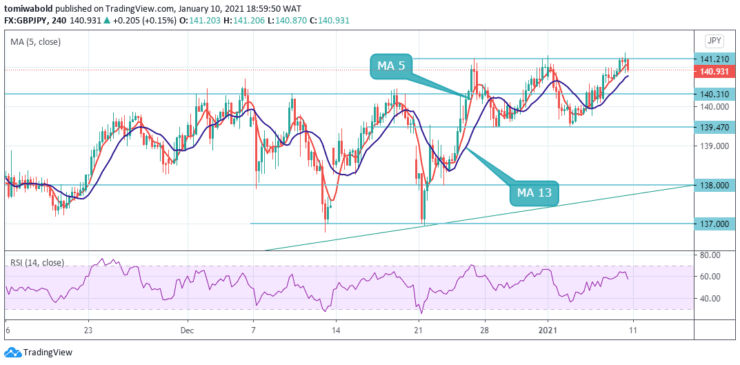

As can be seen from the shorter timeframe, the overall trend in GBPJPY has changed slightly as further advance is expected to be moderate with minor support at 139.47 remaining. An unstable rally from 137.00 should target the 141.21 high. However, a plunge beneath 139.47 could change the short-term bearish trend to a steeper drop below 138.00.

Near the bottom edge, there is support for the uptrend line at 137.00. A break below this level will open the door, technically speaking, to a move back to the 136.00 areas and then to the psychological 133.03 level (the latter being the bottom of the aforementioned recent range).

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.