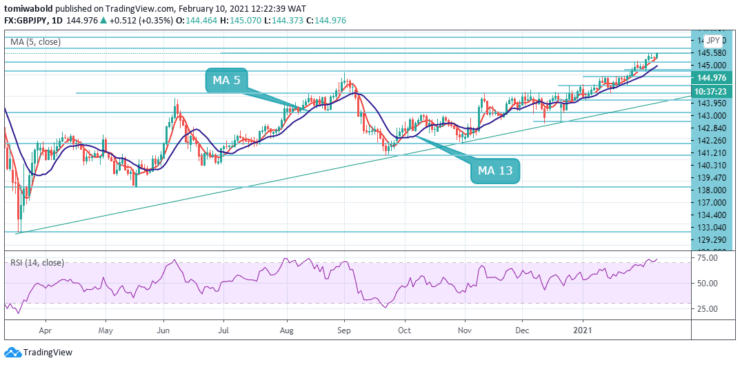

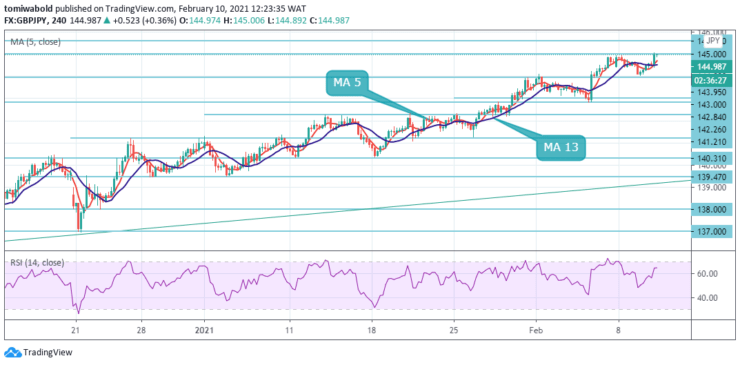

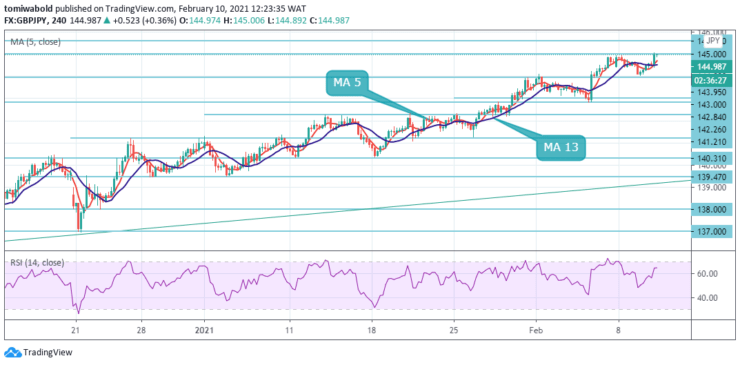

GBPJPY Price Analysis – February 10

The GBPJPY pair picks up bids following its bounce off the prior days’ low level of 144.03. Looking at the pair’s continuous upside trading its price jumps past 145.00 level during the early European session. The GBPJPY upside run is benefitting from UK’s lead in terms of the coronavirus vaccination drive.

Key Levels

Resistance Levels: 147.95, 146.81, 145.58

Support Levels: 143.95, 142.84, 141.21

The GBPJPY pair surged to its highest level since February 2020 at 145.06 level on Wednesday after a rebound from lows of 144.03 from the prior day. The technical analysis highlights that an extremely large bullish reversal pattern is still valid in the older time frames. Buy on a dip in the main strategy for medium to long term traders of the GBPJPY as long as the price holds above 144.00 level.

In the larger context, the increase of 123.99 level is seen as the third phase of the sideway trend from 122.75 (low) level. The breach of 147.95 level will target the 156.59 resistance (high) level. On the downside, a breach of the 133.04 support level is required to validate the completion of the increase from the 123.99 level. Otherwise, the continuous increase may stay in support even in the scenario of a retreat.

As can be seen from the shorter timeframe, the overall trend in GBPJPY remains on the upside as further advance is expected to continue with minor support at 143.95 intact. An unstable rally from 142.84 should target fresh highs at 145.58. However, a plunge beneath 143.95 could change the short-term trend with a steeper drop below 142.84 level.

On the flip side, with the 143.95 support intact, further rise is expected on GBPJPY. The current uptrend from 133.04 should target 147.95 key medium-term structural resistance. The continuous breach there will carry larger bullish implications. On the downside, however, the break of 142.84 support would now indicate short term topping and turn bias to the downside for a deeper pullback.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.