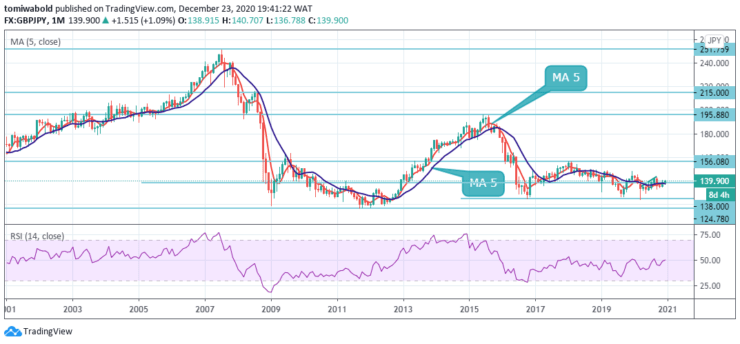

GBPJPY Price Analysis – December 23

The Japanese Yen is without much love heading into 2021 Global stimulus eroding market volatility. As of December 2020, the current rate of GBPJPY is around 136.78 to 140.70 levels and data indicates that the currency rate has been stagnating for the past 1 year in a range. This is because the British pound has to deal with Brexit, but at the same time, the Japanese yen is considered to be a safe currency.

Key Levels

Resistance Levels: 165.07, 156.08, 145.00

Support Levels: 138.00, 133.00, 124.78

Breaking down from elevated levels and back to highs, the monthly relative strength index has shown that the GBPJPY has mostly traded around the confluence zone at 138.00 level. The GBPJPY pair will likely end the year trading at about 140.00 level.

The maximum and minimum levels for December are 136.78 and 140.70 level. This implies that the GBPJPY rate will be slightly lower compared to where it is today. This makes it prudent to wait for some follow-through selling beneath tops, around mid-139.00s, under which the GBPJPY cross could aim back towards the 138.00 psychological marks.

Last week, GBPJPY rebounded strongly but struggled to push through the resistance of 140.70. Second, this week’s initial bias holds firm. The choppy recovery from 133.03 may restore the steady breach of 140.70 to re-test 141.71 strong on the upside. On the downside, however, for 134.40 support first, breach of 136.78 may shift bias to the downside.

The increase from 123.94 is seen in the wider context as an increasing part of the sideway consolidation trend from 122.75 (low). A potential downside breakout stays in support as long as 147.95 resistance persists. Even then, the steady breach of 147.95 may increase the risk of a bullish turnaround in the long term. For validation, attention will then be switched to 156.59 resistance in 2021.

Conclusion

While maintaining the drive upwards from the 138.00 handles, the pair is currently encountering the upper zone. In conclusion, GBPJPY remains volatile, restrained within the lower and upper boundaries of 136.78-137.02 and 140.43-140.69. Any declines below the 133.00 psychological number could switch the market to the downside.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.