GBPJPY Price Analysis – September 13

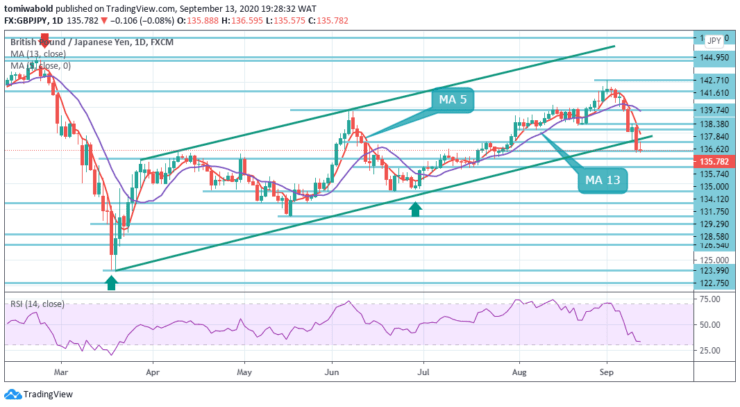

Moving lower for the 2nd day consecutively, GBPJPY closed the week lower at 135.57 level after losing early gains on Friday. The weekly close at 135.57 marks the lowest registered closing price in 2 months. The Sterling Pound collapsed on Brexit chaos, ending the week at levels last seen in early July.

Key Levels

Resistance Levels: 147.95, 142.71, 138.38

Support Levels: 135.74, 131.75, 129.29

After trading as low as 135.57 during the end of the prior week, the currency edged a little higher and found support at 135.74 level. After having been unable to move lower than 135.57 in the prior session, GBPJPY is likely to find buyers again around the same price level today at 135.57 level.

As long as the 147.95 resistance level continues to hold, an impending downside breakout stays in line for GBPJPY. Even so, a strong breach of 147.95 level may raise the chance of long term bullish reversal. Validation of the target would then be shifted to the resistance level 156.59.

On the lower time frame, the fall in GBPJPY from level 142.71 last week intensified lower. Firstly, the initial trend stays on the downside this week. The continuous breach from 123.99 to 142.71 at 135.54 levels of 38.2 percent retracement may indicate that the entire recovery from 123.99 level in total.

A wider decline at the next phase of 131.75 level could then be seen to retrace 61.8 percent. Nevertheless, a quick recovery from the current level, preceded by a breach of 138.38 minor level of resistance, may shift bias back to the upside instead for a 142.71 level retest.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.