GBPJPY Price Analysis – September 2

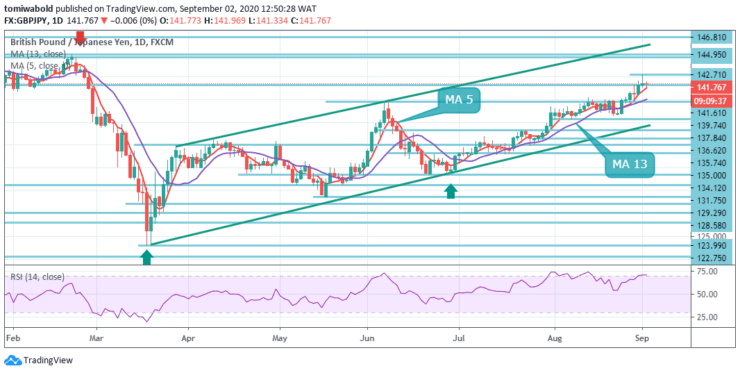

GBPJPY holds moderately buying around level 141.76 amid the initial trading on Wednesday. And during further upside of the quote past level 141.61, the cross may inspire buyers ahead of taking them to the yearly high of level 144.95. Although this makes a significant achievement for the bulls, it is far from clear that the rally may proceed.

Key Levels

Resistance Levels: 147.95, 144.95, 142.71

Support Levels: 139.74, 135.74, 134.12

The substantial bullish run of the British pound over the last several weeks drove the pair above the psychologically significant threshold of 140.00. However, as long as the 147.95 resistance level holds, an eventual downside breakout remains in favor.

As such, the pair could witness a pullback to the psychological support level of 141.00, which, if violated, would shift the focus down south. Meanwhile, the firm break of 147.95 level will raise the chance of long term bullish reversal. Then its focus will then be turned to the 156.59 resistance level for confirmation.

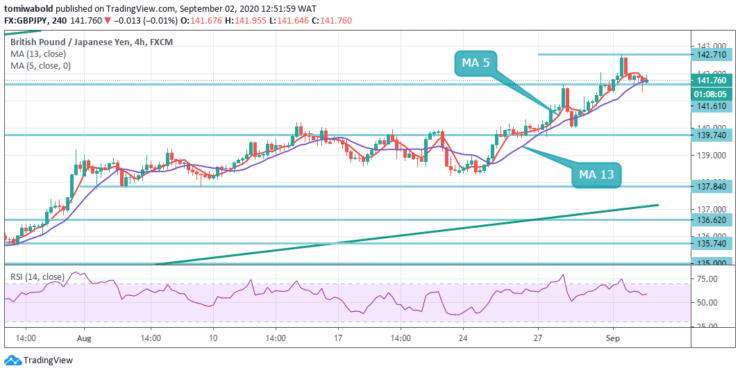

The 4-hour chart indicates the relative strength index being bearishly divergent. A bearish divergence occurs when the indicator charts lower elevations, which contrasts higher market highs and is indicative of exhaustion from the uptrend.

A transient peak with the present retreat is created at level 142.71. For some convergence, the intraday bias is made neutral. But as long as the 139.74 support level holds it is expected to grow higher. The 142.71 level breach may aim a forecast of 161.8 percent from 123.99 to 135.74 levels at 147.95 level from 129.29.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.