GBPJPY Price Analysis – December 9

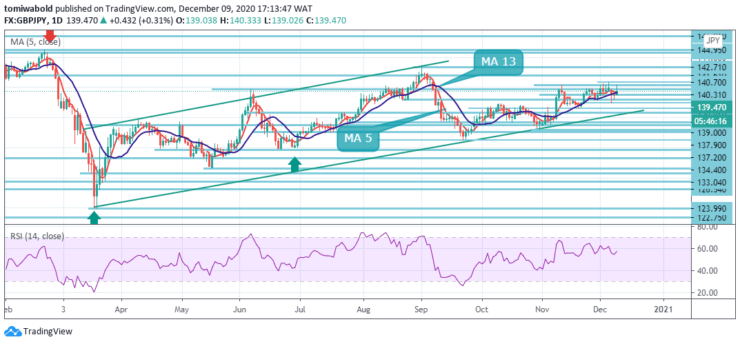

GBPJPY rallies to new weekly highs at the start of the American session, gaining steady positive traction breaking the 140.31 barriers. Optimism for the COVID-19 vaccine has eroded the yen as the Brexit deal gave a strong boost to the British pound.

Key Levels

Resistance Levels: 147.95, 144.95, 142.71

Support Levels: 138.38, 137.50, 134.40

As seen in the daily chart, the GBPJPY pair has now found a move past the key 140.31 barriers and looks set to continue to rise. On the other hand, a sustained breakout of the 140.70 level could lead to the 142.00 thresholds in the long term. If the GBPJPY bulls are holding the reins higher, the 142.71 high will be visible on the radar.

In a broader context, the rally from 123.99 remains as a cycle of increasing sideways from 122.75 (low). As long as the resistance level of 147.95 remains unchanged, a possible downside breakout remains in effect. However, a break of the 147.95 level could increase the chance of a long-term bullish reversal.

The GBPJPY intraday bias stays initially neutral. On the other hand, a breakout of the 140.70 resistance level could resume the sharp rebound from the 133.04 level. The intraday bias could then be revised upward to retest the 142.71 high.

The GBPJPY cross could then accelerate the upside to 142.71 en route to midpoint 141.50. On the other hand, a break of the 137.90 level could restore the scenario in which the corrective advance from the 133.04 level has ended. Where intraday bias returns to the downside towards the 134.40 support level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.