GBPJPY Price Analysis – November 22

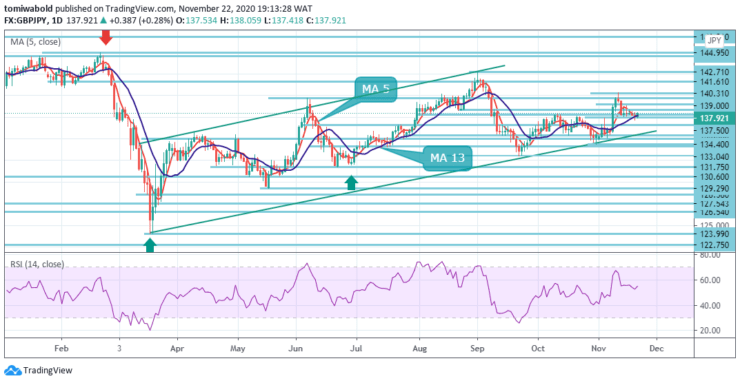

The GBPJPY is stuck within a tight range after recovering from early selling pressure during the prior trading day at 137.50 level. The cross was last seen trading with modest daily gains, around the 137.92 regions. GBPJPY drifted higher on the back of encouraging vaccine news and Brexit hopes last week.

Key Levels

Resistance Levels: 144.95, 142.71, 140.31

Support Levels: 137.50, 134.40, 131.75

GBPJPY is on the defensive after its recent drop. A breach beneath 137.00 is anticipated to result in further losses, while a rebound beyond 138.00 could retest horizontal resistance at 140.31 if 139. 74 gives way.

In a broader context, the rally from 123.99 is seen as an upside consolidation sideways trend from 122.75 (low). As long as the resistance level of 147.95 remains, a possible downside breakout remains in effect. However, a sustained breakout of the 147.95 level could increase the likelihood of a long-term bullish reversal.

The decline in GBPJPY last week suggests that the corrective rebound from 133.04 ended at 140.31. Initial sentiment remains neutral this week with another decline anticipated. A breach of the 137.50 level would lead to the 134.40 support level to validate this bearish scenario.

However, on the other hand, a breach of the minor resistance level of 139.74 could reverse the upward trend towards the 140.31 level. Another downside move could increase selling pressure towards the 133.00 bottoms, breaking the upward pattern in the near term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.