GBPJPY Price Analysis – November 15

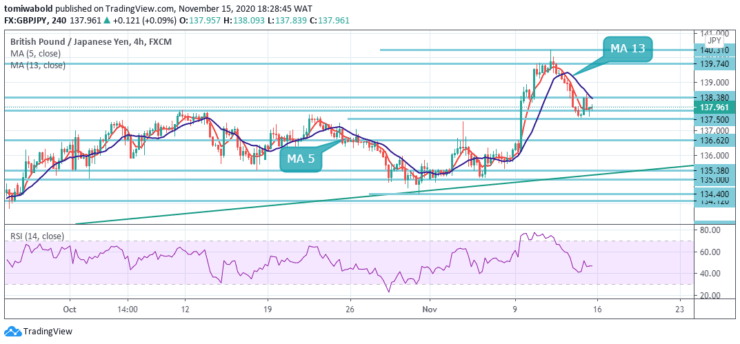

After GBPJPY breach beyond upside barriers around the 137.00 zone with a strong rally, the pair has begun a pullback which may gain traction beneath the 138.00 level in the next session. Although the sell-off has stalled as the pair hits near term correction levels at 137.50 level a combination of Brexit factors contributed to impeding the Pound Sterling.

Key Levels

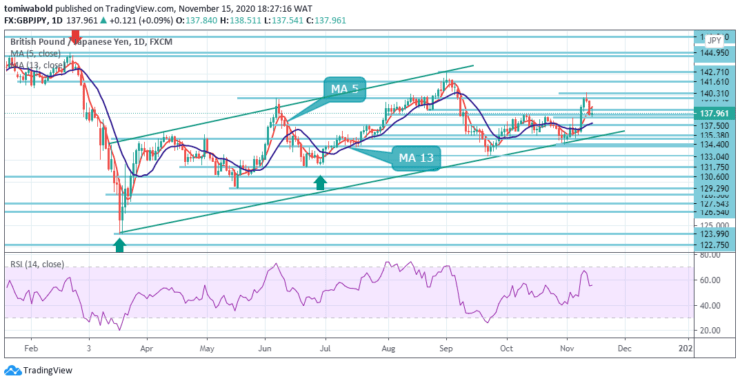

Resistance Levels: 144.95, 142.71, 140.29

Support Levels: 137.50, 134.40, 131.75

GBPJPY is sitting on the horizontal support zone at 137.54 level after topping at 140.31 level, just above the 140.00 mark, which happens to be the 76.4% retracement of the downward phase from 144.95 to 123.99 levels. The horizontal zones and the signals from the moving average 5 and 13 further reflect a sideways market.

As long as the 144.95 resistance level holds, an eventual downside breakout stays in consolidation. However, the firm breach of 144.95 will raise the chance of long term bullish reversal. The medium-term focus will then be turned to the 147.95 resistance level for validation.

GBPJPY rebounded further to the 140.31 level in the prior week but retreated sharply since then. But selling then halted at horizontal support line at 137.50 level. Its initial bias is neutral this week first. On the upside, a breach of 140.31 level may kickstart the rebound from 133.04 level to retest 142.71 high level.

Nevertheless, the sustained breach of 137.50 resistance turned support level will argue that the rebound has completed. Intraday bias will be turned back to the downside for a 133.04/134.40 support zone. Overall, GBPJPY sustains its sideways bearing in the short-to-medium-term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.