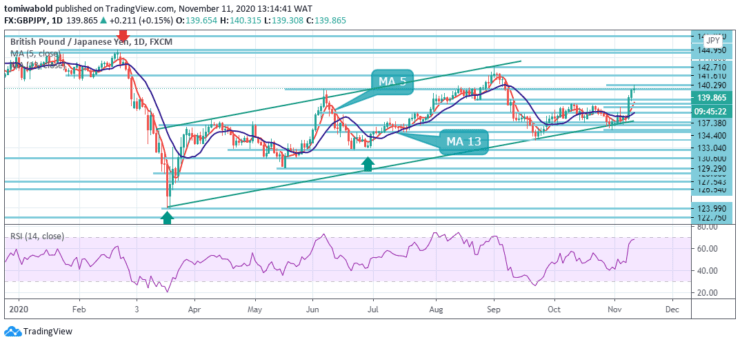

GBPJPY Price Analysis – November 11

The GBPJPY surge past the key 140.00 psychological marks while maintaining strength towards two-month highs during the early European session. GBPJPY continued gaining traction for the 3rd day in a row on Wednesday. Refreshed optimism for a Brexit deal boosts the British pound, while the upbeat market mood suppressed the Japanese yen’s safe-haven status.

Key Levels

Resistance Levels: 144.95, 142.71, 140.29

Support Levels: 138.38, 136.62, 134.40

As seen on the daily chart, with the recent upside phase, the GBPJPY is now struggling to hold above 140.00. Therefore, some strength of continuation towards the horizontal resistance of 140.70 on the way to the level of 141.61 now looks quite likely.

As long as the resistance level of 144.95 stays, a possible downside breakout stays in support. However, a solid breach of the 144.95 level would raise the likelihood of a long-term bullish reversal. The attention will then be moved to the 147.95 level for validation.

GBPJPY rally from 133.04 is still ongoing. The intraday bias stays upward: forecast of 161.8% from 133.04 to 137.84 from 134.40 at 142.16, close to the high of 142.71 level. However, technical indicators on intraday charts are already indicating overbought conditions and require some caution for aggressive bullish traders.

On the other hand, a solid breach of 137.84 resistance, which has become a support level, is now required to indicate the completion of the bounce. Nevertheless, further growth may stay in support even in the event of a reverse. Some subsequent buying may lift the pair as early as 141.00 on the way to the 141.61 supply zone.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.