GBPJPY Price Analysis – November 1

The GBPJPY price managed to swing higher at month-end lows and was last seen trading with modest gains, just to mid 135.00 psychological marks. Tomorrow is the 1st trading day in November, and the pound has been struggling over the last few days into the month-end. The rapid pace of growth in COVID-19 cases and persistent Brexit uncertainties kept bulls on the defensive.

Key Levels

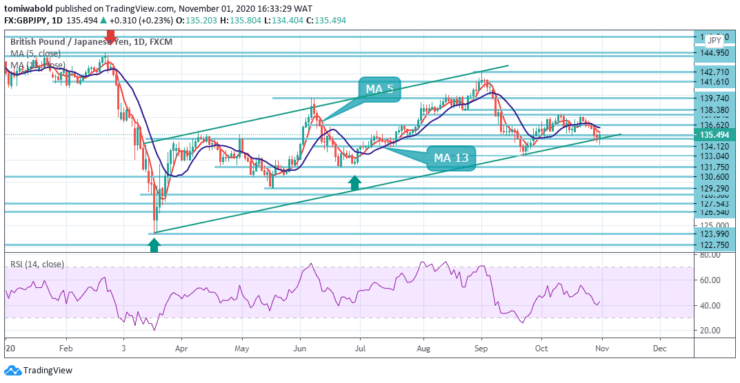

Resistance Levels: 144.95, 138.38, 136.62

Support Levels: 133.04, 131.75, 129.29

GBPJPY managed to bounce about 40-50 pips from monthly lows and last time traded with modest gains, just above the psychological 135.00 marks. This move could disrupt mid-term bearish pressure and confirm the onset of a rebound, initially suspected of being a pullback on a broken ascending trendline.

At the start of the trading day, the pound sterling broke through the support line, turning towards the resistance line at 135.38, but limited by the moving average 5. Traders should be warned that this could be a false break and could return below the ascending trendline. However, a solid breakout of 137.84 would raise the likelihood of a long-term bullish reversal.

GBPJPY fell to 134.40 last week but recovered quickly. The initial bias is neutral this week. As long as the resistance level of 137.84 holds, the further decline may be anticipated. Beneath the level of 134.40 may initially aim the support level of 133.04. Its breach would resume a steeper decline from 142.71 to 61.8%, a pullback of 123.99 to 142.71 at 131.75 levels.

The RSI is also gaining momentum for 4 hours, while the red 5 moving average should cross the 13 blue moving average, reflecting the growing caution in the market. A close beneath the 135.00 horizontal support and more importantly beneath the prior low of 134.40 could trigger a new bearish extension towards 133.04.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.