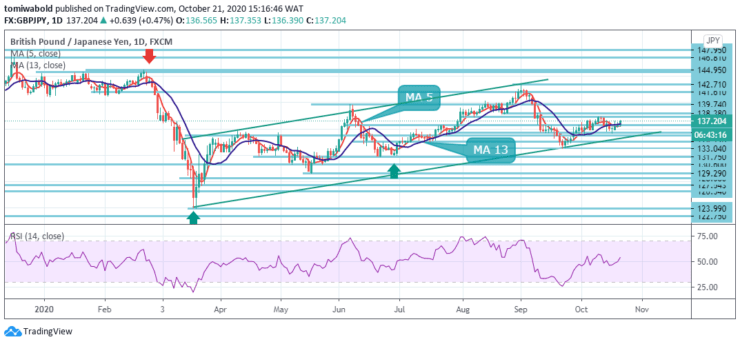

GBPJPY Price Analysis – October 21

Buying interest in the British pound picks up at the start of the European session as the GBPJPY moves to its weekly range highs around 137.20. The resumption of Brexit negotiations and the prevailing risk environment are undermining the Japanese yen. This arrangement favors buyers and supports further growth prospects throughout the day.

Key levels

Resistance levels: 147.95, 142.71, 137.84

Support levels: 135.38, 133.04, 131.75

Bullish technical indicators on the daily charts support the outlook for continued intraday upward movement amid the proposed tone surrounding JPY. The subsequent upward movement pushed the cross beyond the 5 and 13 moving averages and the bulls are now seeking to return momentum to overnight swing highs around the 137.20 area.

In a broader context, the rise from 123.99 is seen only as of the upward phase of the sideways consolidation pattern from 122.75 (low). As long as the resistance level of 147.95 remains, a possible downside breakout remains in favor. However, a solid break of the 147.95 level would increase the likelihood of a long-term bullish reversal. Attention will then be drawn to the 156.59 resistance level for confirmation.

Trading in the GBPJPY continues and the intraday bias remains neutral. On the other hand, a break above 137.84 will resume the rebound from 133.04 to retest the 142.71 high. On the other hand, a solid breakout of the 135.38 support level would mean that the rebound from the 133.04 level has ended.

Also, in this case, the fall resumes from the level of 142.71. The intraday bias would be turned down towards 133.04 and then a 61.8% pullback from 123.99 to 142.71 at 131.75. Failure to defend these support levels could trigger some technical selling and negate any short-term bullish sentiment.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.