GBPJPY Analysis – October 14

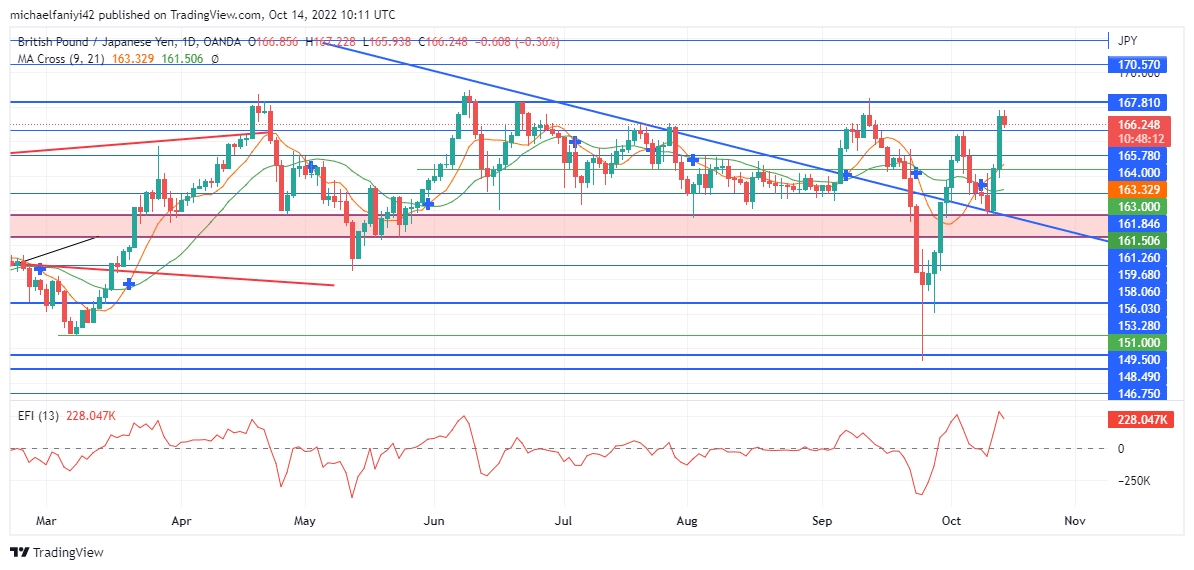

GBPJPY is set to confront the weekly resistance level at 167.810 again after bouncing off a strong confluence point of the trendline and the significant support level at 159.680. The currency pair has tried to breach this resistance level several times unsuccessfully this year already right from April in the second quarter of the year. However, the buyers are persistent and would be giving it another shot.

GBPJPY Significant Zones

Resistance Levels: 170.570, 167.810

Support Levels: 165.780, 158.680

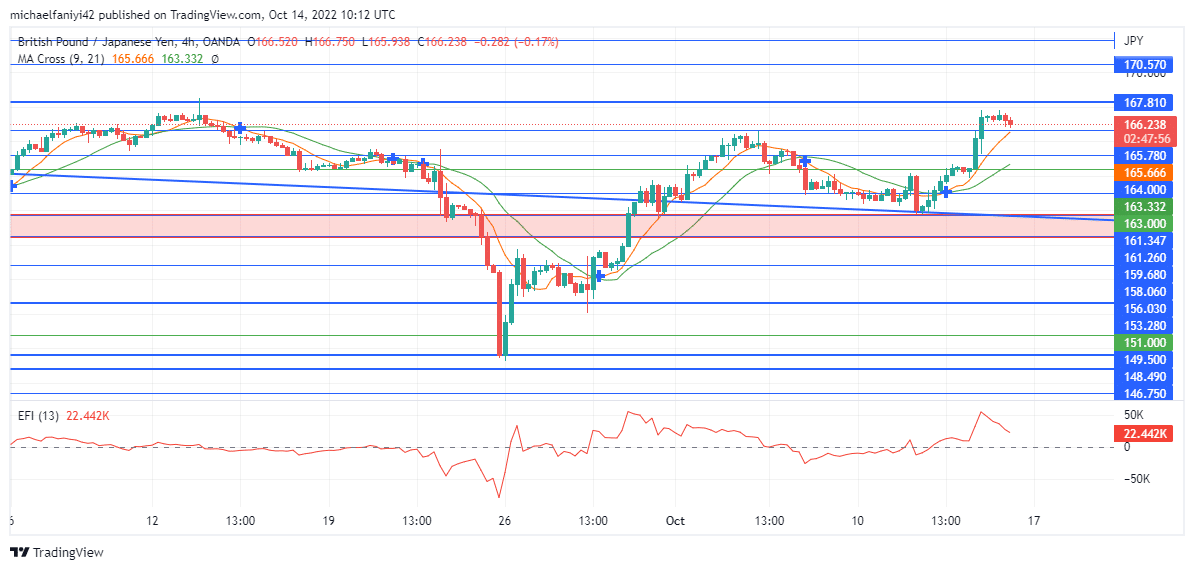

However, on short notice, the bulls usually rally together to restore the price before the bears take advantage of it to overpower them. The latest one happened on the 13th of September and similarly, the market failed again, leading to a stronger dip to 149.500. Yet again, the market recovered even very strongly directly upwards. It retraced sharply at 165.780 and bounced off the confluence zone. Now the price is pumped up to confront the 167.810 resistance level once again. The MA Cross (Moving Average) has crossed upward on confirmation of the rally.

Market Expectation

The EFI (Elders Force Index) line on both the daily chart and the 4-hour chart has risen strongly to a positive value. There is a bit of retracement at the moment, which causes the power line on the 4-hour chart to drop. The 165.780 key level is a trusted level for the bulls to take off again to finally violate the 167.810 resistance level.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.