GBPJPY Price Analysis – April 26

During the previous week, the GBPJPY pair rebounded to 133.67 level but slid back, indicating it wasn’t prepared for a bounce while at the same time rebounding from roughly 132.00 level. GBPJPY is trading in a range-bound as risks pitched tent with the bears at level 132.58 ahead of the opening today.

Key Levels

Resistance Levels: 147.95, 139.18, 135.76

Support Levels: 131.90, 126.54, 122.75

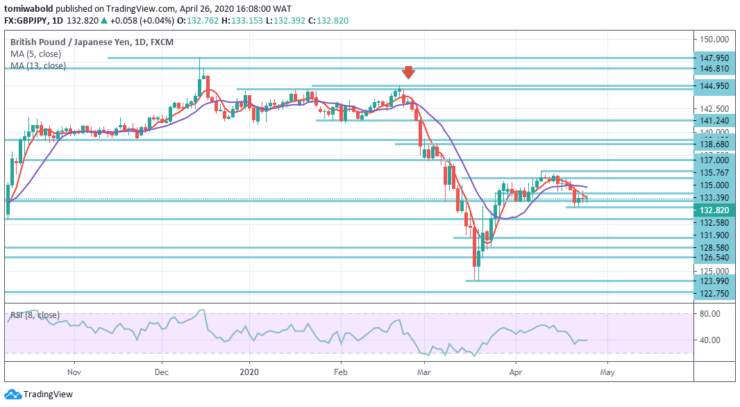

GBPJPY Long term Trend: Ranging

The daily chart reveals pitched tent risks with bears at level 132.58. A firm break beneath the level of 132.00 may leave the door open to further losses. The next obstacle comes up at level 130.60. It is trading vertically, within a range-bound with resistance in the 133.70-134.00 level threshold, and support in the 132.00 level.

In the wider sense, 122.75 (low) level price activities are primarily a vertical consolidation trend, that has been finished at level 147.95. The 122.75 level break may aim a 195.86 to 122.75 forecast of 61.8 percent from 147.95 to 102.76 levels next. The trend may in some scenarios stay bearish as long as the level of resistance stays intact at 147.95 level.

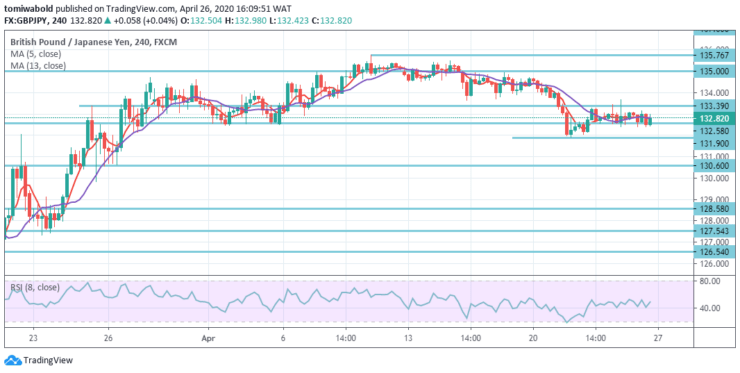

GBPJPY Short term Trend: Ranging

Last week’s plunge in GBPJPY suggests that the corrective recovery from level 123.99 has however ended at level 135.76. However, despite the creation of a temporary low at 131.90 level, the initial bias is a first neutral this week.

On the contrary, the break of level 131.90 may restart the decline from level 135.76 and attempt a retest at a low level of 123.99. On the progress, upside may be constrained at 135.76 level by a 61.8 percent retracement of 144.95 to 123.99 levels to usher in a near-term reversal in the scenario of a further rise.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.