GBPJPY Analysis – November 11

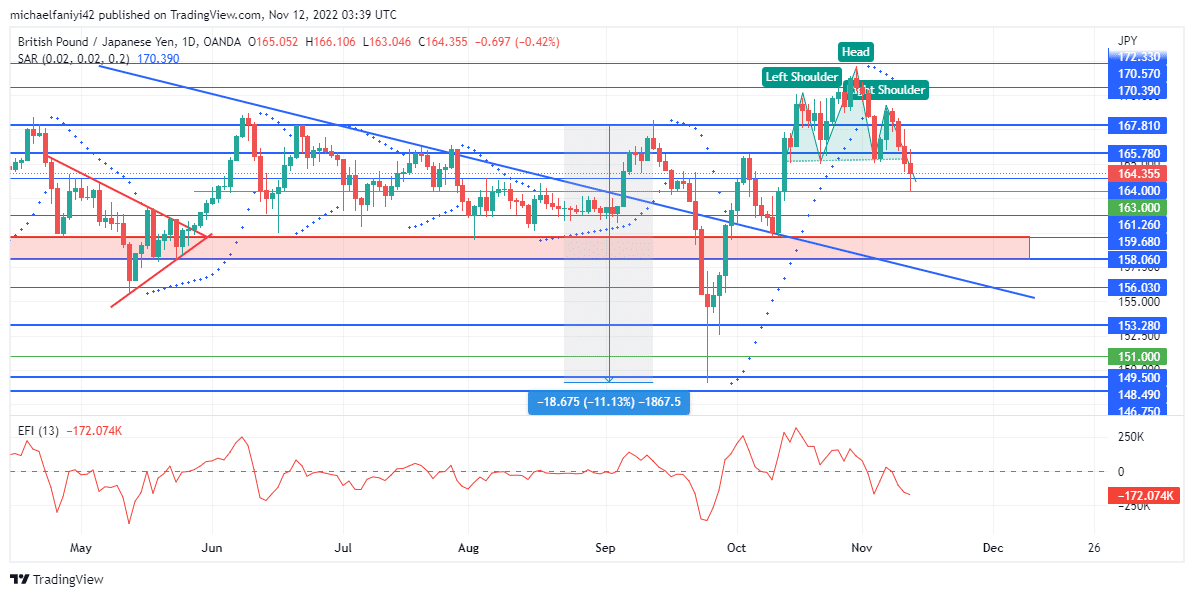

GBPJPY is poised for more downside movement as the sellers strike back with a bearish reversal head-and-shoulders formation. The market has been pushing to rise above the 167.810 resistance level, but it has been consistently rejected. A major rejection happened, which plummeted the price below the strong 159.680 support. The buyer reacted aggressively, such that they pushed up above 167.810. They, however, tire out, and the sellers drop the price.

GBPJPY Significant Zones

Resistance Levels: 170.570, 167.810, 165.780

Support Levels: 164.000, 158.680, 156.030

The market was forced into a downward tapering session after testing the 167.810 resistance on the 22nd of June. Instead of the buyers succumbing to the downward pressure, they used it as an opportunity to strengthen themselves, and the result is a stronger jab at the resistance level. However, this is accompanied by much stronger resistance, resulting in a total breakdown among buyers as the price fell more than 11% to 149.500.

An unrelenting buying base also struck back with greater intensity, which took the price back around the resistance level in about a week. The price was then pushed higher after a retest of the 159.680 support, eventually breaking through the resistance. After exerting so much power, the buyers became exhausted and were unable to maintain their position above the level. The EFI (Elders Force Index) line immediately fell to a negative value.

Market Expectation

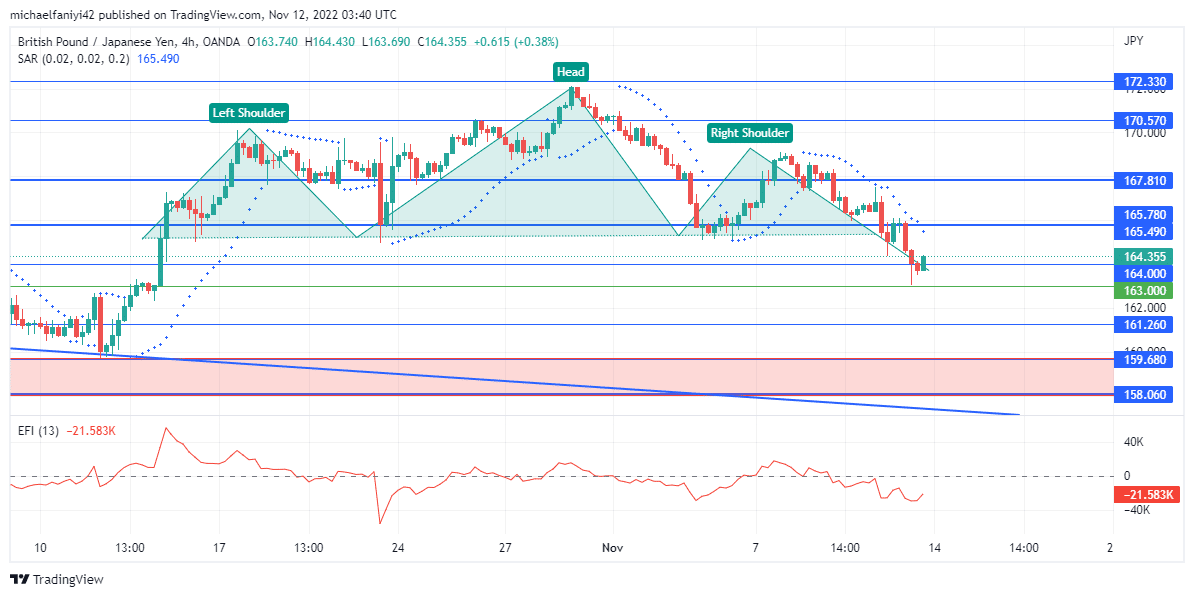

Also on the daily chart, the Parabolic SAR (Stop and Reverse) dots have immediately become visible above the daily candles as the seller enacts a head-and-shoulders formation to drown the price. The situation is much more critical on the 4-hour chart. The EFI line has plunged even lower, and the Parabolic SAR has more dots above the candles than below. The market is expected to drop more under the bearish formation, with a likely destination of the 159.680 strong support level.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.