GBPJPY Analysis – November 5

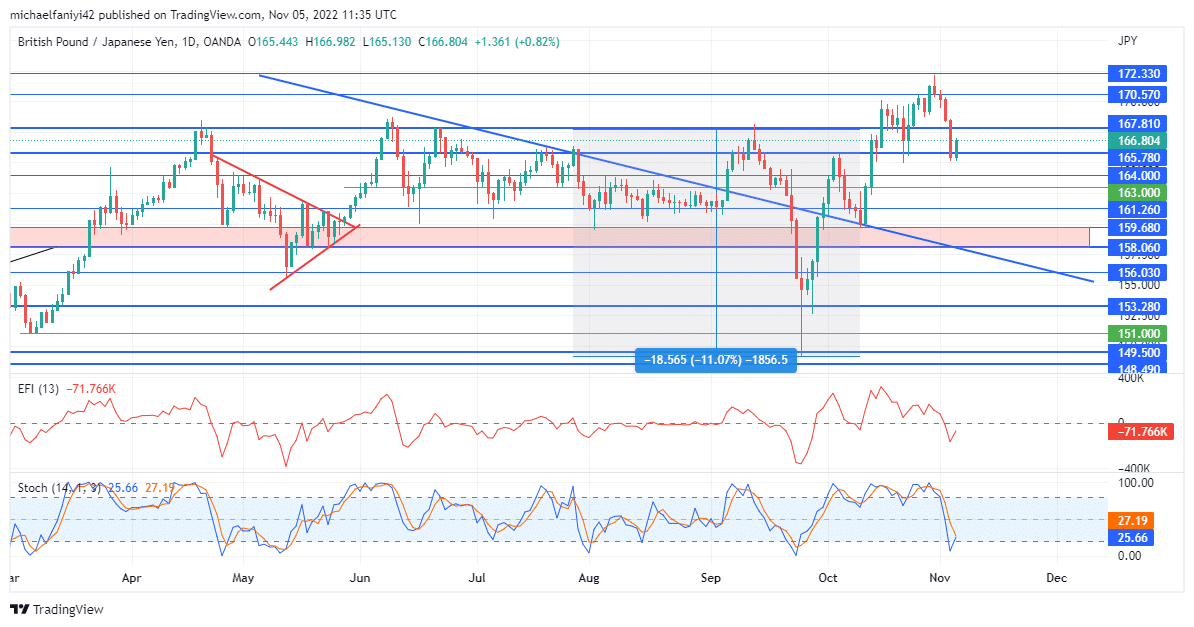

GBPJPY fails to hold over the crucial 167.810 key level and has dropped below it at a very key period. The price summoned courage on the 13th of October for a price surge that pierced through several key levels, including the limiting level at 167.810. The price even retraced temporarily back to 165.780 before pushing back above the crucial 167.810 level to a new high for the year. However, the GBPJPY fails to hold above the crucial key level.

GBPJPY Key Levels

Resistance Levels: 172.330, 167.810

Support Levels: 159.680, 153.280

GBPJPY Long-Term Trend: Bullish

In early September, the market escaped an enforced drill down by the sellers. It immediately used the opportunity to test the limiting level at 167.810, but as in previous times, the coin was rejected, which led to a very serious drop in which the currency pair dropped by more than 11%. The bulls then displayed an extraordinary desire, which helped push the price back above the crucial support level of 159.680.

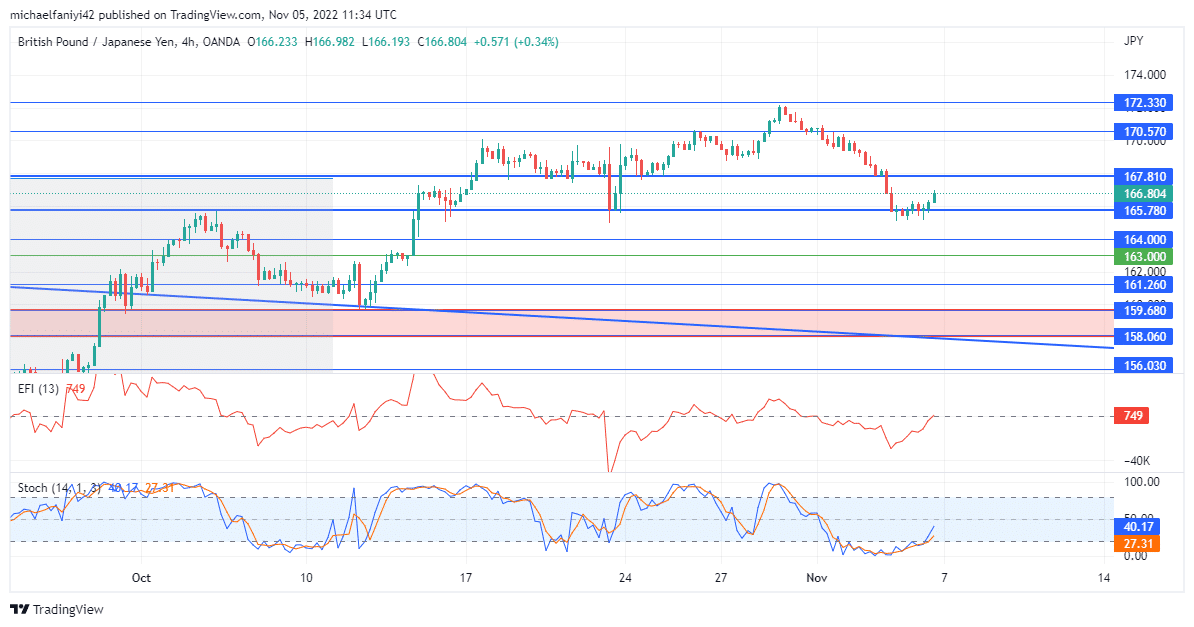

The market retraced to the strong support level at 159.680, from which it launched a powerful assault toward the crucial resistance level. The supply line was breached, and the price grew. However, GBPJPY began struggling to stabilize above the broken resistance. At first, it pulled back and bounced off 165.780. Now, it has dropped a second time back to around 165.780. The Stochastic has dropped to the oversold border but is about to cross upward.

GBPJPY Short-Term Trend: Bullish

Likewise, the EFI (Elders Force Index) power line on the daily chart has dipped into a negative value. However, the positive is that there is now a sharp bend upward at the tip of the power line to show an emerging bullish activity. This is very evident on the 4-hours chart. The EFI has risen back to a positive value as the bulls strengthen themselves again and the Stochastic lines have crossed upward. Therefore, the market has regained its bullishness, and we can expect it to push toward the crucial 167.810 level again.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.