GBPJPY Analysis – October 7

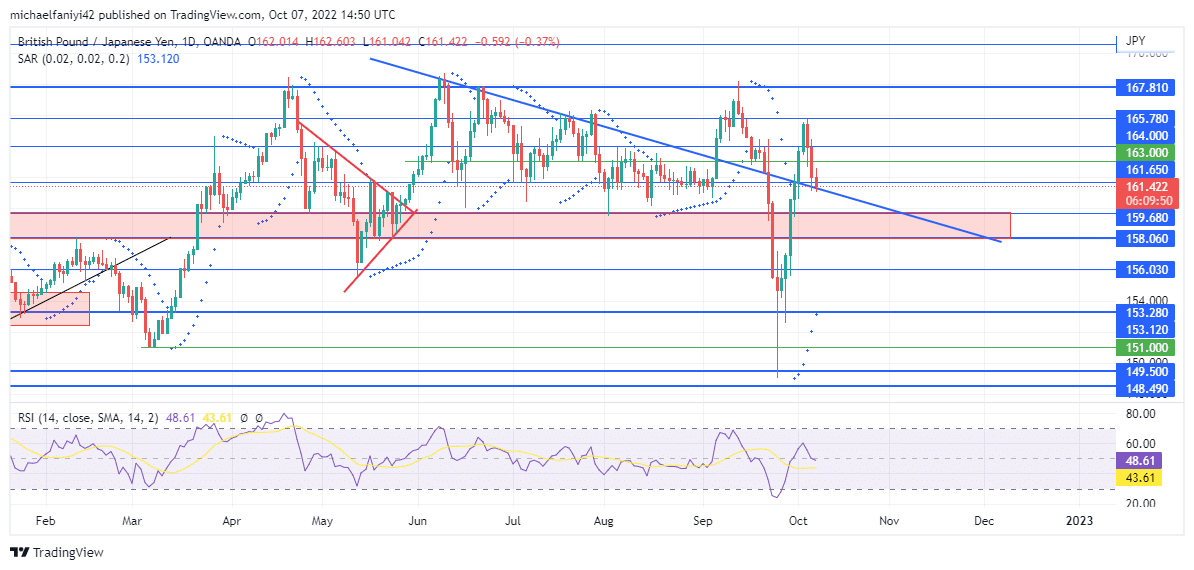

GBPJPY buyers recover above a strong confluence point in which a trendline crosses a weekly support level at 161.260. The buyers are bossing the market, but they are having a tough time breaking down a strong resistance level at 167.810. Time and again they have tested the resistance level, and each time the rejection dampens the strength of the buyers, but they recover each time.

GBPJPY Key Levels

Resistance Levels: 167.810, 165.780, 163.000

Support Levels: 161.260, 159.680, 149.500

GBPJPY Long Term Trend: Bullish

The second major time the 167.810 resistance level was tested was on the 8th of June. The price just recovered after another major rejection. So a second rejection led to increasing weakness on the part of the buyers, as seen by consistent lower highs. Buyers converted the unfavorable trend to their advantage by summoning the strength to rise past the trendline to 167.810. Yet again, the market suffered rejection.

The rejection weighed heavily on the price, so much so that it dropped beyond the weekly support level at 159.680. The drop went all the way down to 149.500. Once again, the bulls revived and surged right back above the trendline. GBPJPY has retraced back to the trendline currently. However, the dots of the Parabolic SAR (Stop and Reverse) below the daily candles shows that the buyers retain the greater influence.

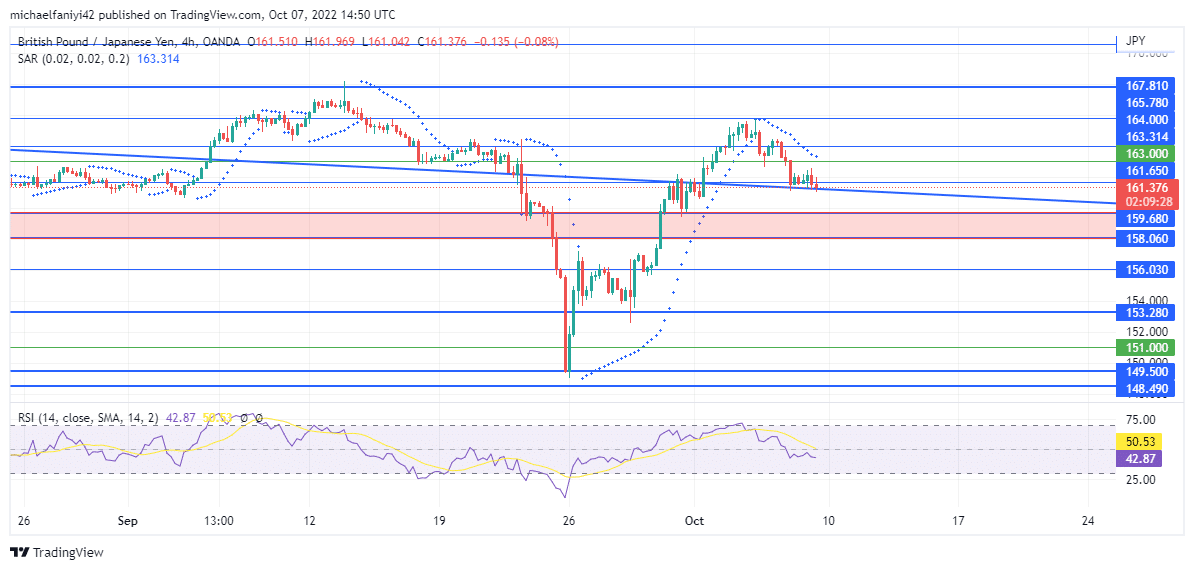

GBPJPY Short Term Trend: Bullish

The market is slated to continue its bullish run as the current retracement comes to an end above the confluence zone at 161.260. The current retracement has brought the RSI (Relative Strength Index) line slightly below the middle level on the daily chart and the 4-hour chart. That is set to change as the price is expected to strengthen again to attack the resistance level.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.