GBPJPY Analysis – November 25

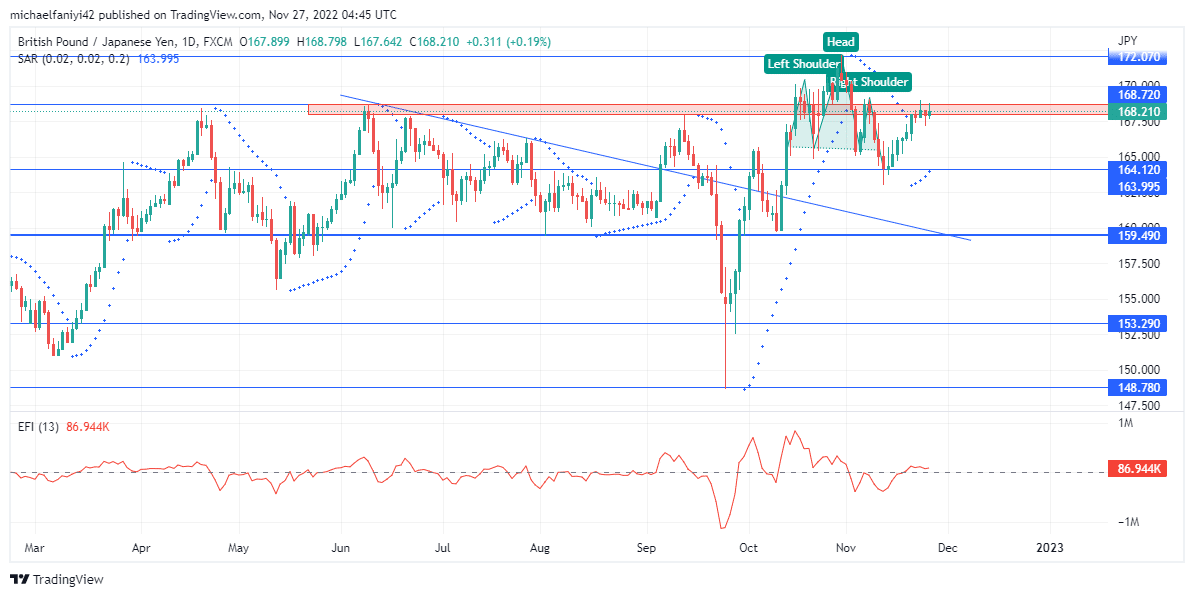

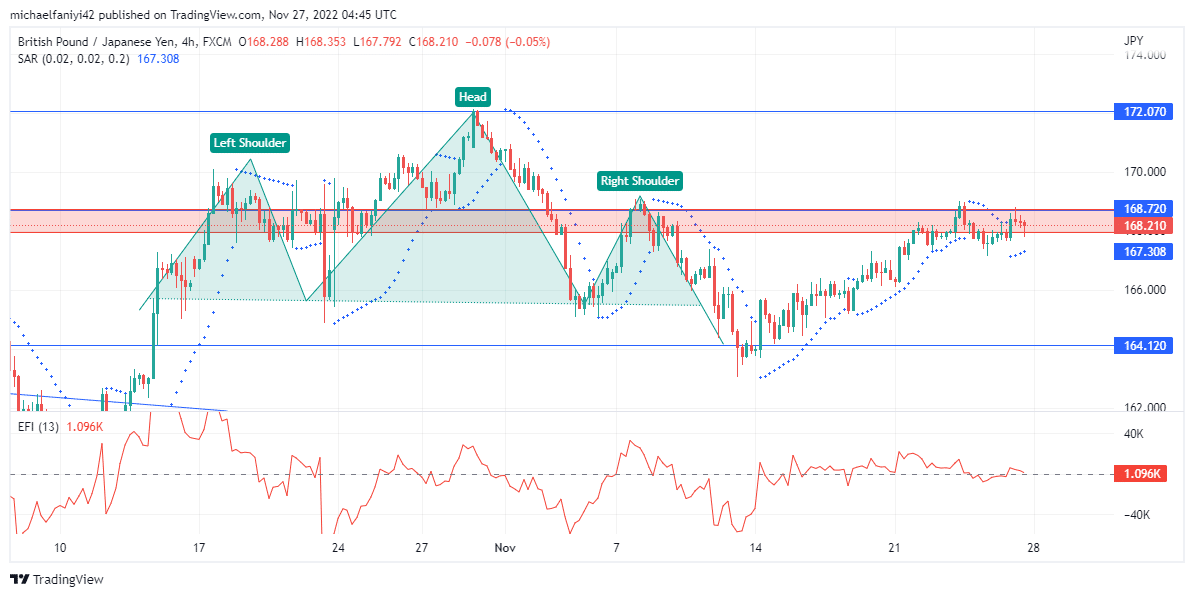

GBPJPY bulls have taken matters into their own hands by abruptly stopping the market’s downtrend at 164.120. The price is now rising aggressively with consecutive bullish candlesticks. The resistance at 168.720 is now under intense scrutiny as the market comes back to test it. The rallying force of the price is expected to lift GBPJPY beyond the resistance level.

GBPJPY Significant Zones

Resistance Levels: 172.070 168.720

Support Levels: 164.120, 154.490

Looking at the play-out of the market from the first quarter of the year, when the price freshly broke above the 159.490 support level, until the current time, it can be concluded that the buy-traders for the GBPJPY market are quite energetic. They can be seen persistently tugging at the 168.720 resistance level.

The bulls’ activities were highlighted by a very strong rejection in mid-September, which culminated in a large price drop that pierced through several key levels, including 159.490. However, the bulls immediately swung to action once the market touched down at 148.780. Presently, the concern of the buyers is to climb above and hold the resistance level.

Market Expectation

After failing to hold above the resistance in the first trial, the price dipped back below the resistance. As their nature is, the bulls have quickly re-empowered the market, and it is back, testing the 168.720 resistance level. The EFI (Elders Force Index) is at a positive level both on the daily and 4-hour chart. This highlights the strength of the buyers. Parabolic SAR (Stop and Reverse) dots are undulating around the candles but more to their downside, which indicates bullishness. GBPJPY is most likely aiming for 176.720.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.