GBPJPY Price Analysis – June 10

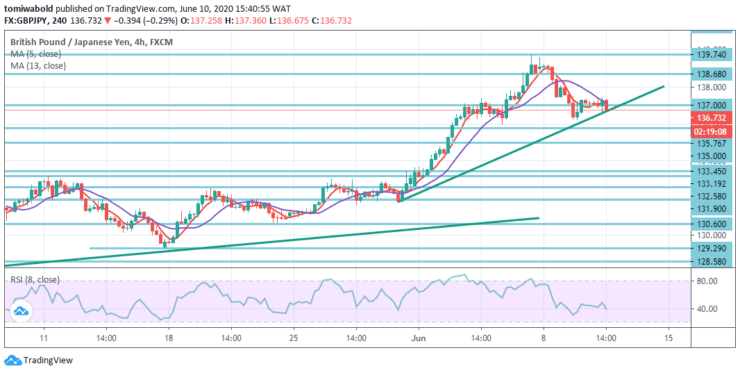

GBPJPY declines to level 136.65 within Wednesday’s European session. While doing so, the pair aims to break roughly 60 pips of the trading range established since the previous day’s mid-US session amid slightly risk-averse markets. Similarly, the Japanese foreign minister’s remarks, indicating no border opening with China just yet, are already an extra harmful to the risks.

Key levels

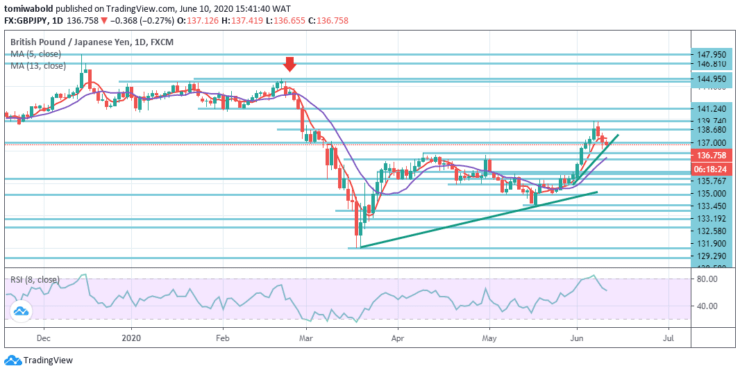

Resistance Levels: 147.95, 144.95, 139.74

Support Levels: 135.76, 129.29, 122.75

The collapse of the pair beneath the key level of 137.00, currently below the moving average of 5, seems to drag it beyond the moving average and around 135.76 to the near-term support level. Alternatively, level 138.68 may offer an extra upside barrier beyond the moving average 5 during the FX pair’s rebound.

As long as resistance level 147.95 holds, there remains an eventual downside breakout in favor. But a strong 147.95-level breach may increase the chance of a long-term bullish reversal. Validation of the emphasis will then be switched to a resistance level of 156.59.

In GBPJPY, the intraday bias stays first neutral. A further increase is predicted as long as it maintains the support level of 135.76. A breach of 139.74 level may stretch the expansion from 123.99 level to a 100% projection of 123.99 to 135.76 at 141.24 levels, from 129.29 level.

That being said, for the low test of the horizontal support level at 133.45, a strong breach of 135.76 level may suggest short term topping and switch bias to the downside.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.