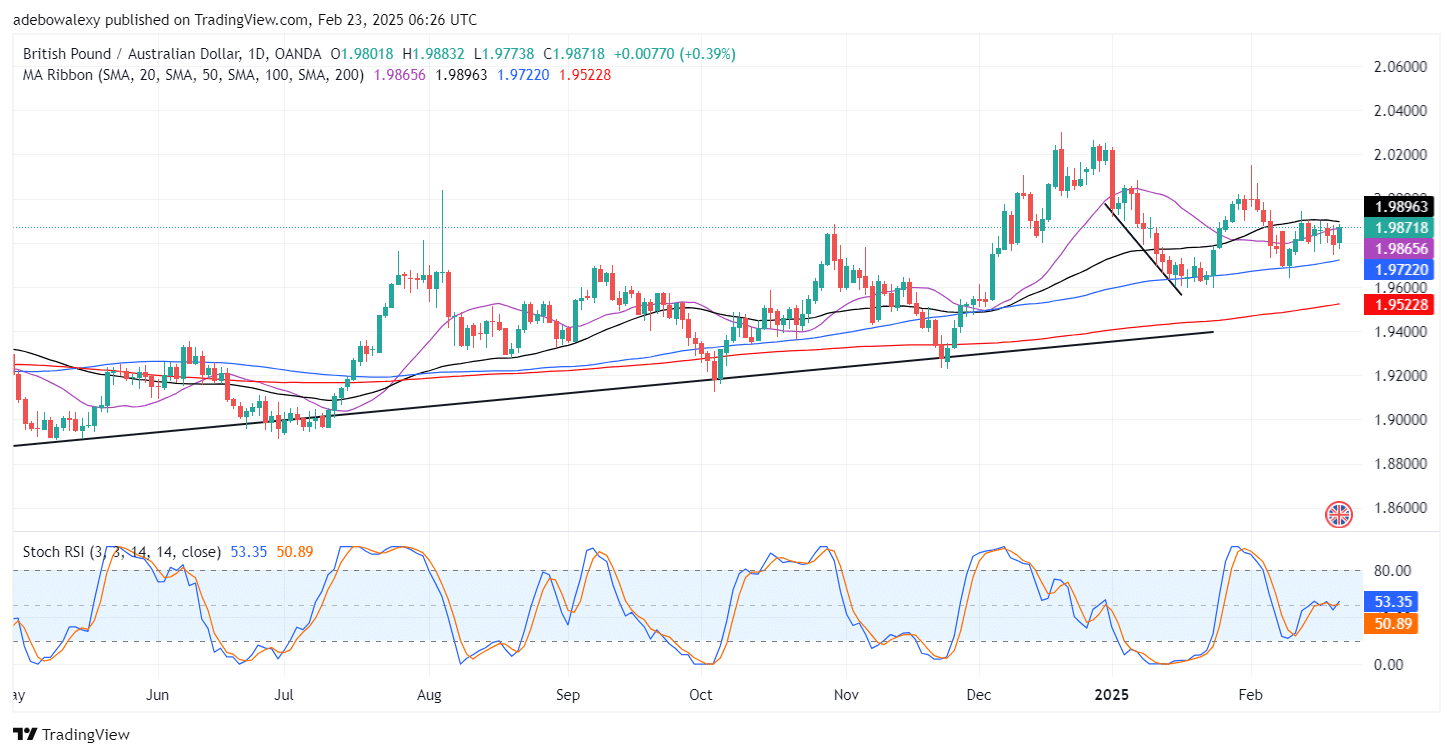

The GBPAUD market closed in the green on Friday. This seemed to be particularly aided by better-than-expected retail sales. With the S&P Global Manufacturing PMI Flash yet to arrive, price action in the market has already occupied a promising position. As a result, the market may rise further shortly.

Key Price Levels:

Resistance Levels: 2.0000, 2.0200, 2.0400

Support Levels: 1.9500, 1.9000, 1.8500

GBPAUD Pips Through the 20-Day MA

As mentioned, the GBPAUD market maintained positive momentum, closing the previous week in the green. Consequently, the current price of the pair lies above three out of the four Moving Average (MA) lines on the chart.

Additionally, the Stochastic RSI lines are projected upward following a bullish crossover above the 50 threshold of the indicator. Given the extension of the RSI lines after the crossover and the recorded gains, it appears that upside forces are quite strong and may propel prices higher.

GBPAUD Market Eyeing the 2.00 Mark

It has been a while since price action started eyeing the price ceiling at the 2.000 mark. Once again, price action has resurfaced above all the MA lines on this chart. The 20, 50, and 200 MA lines are converging below all price movements.

The last price candle on the chart currently places the market above the 100-day MA line, which is positioned above all other MA lines. Similarly, the Stochastic RSI lines are rising steeply into the overbought region. Therefore, while keeping tabs on fundamentals, traders may target 1.9950 for short-term profits.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.