Investors in the GBPAUD market are already betting against the pound. This seems to be a result of the aftermath of market anticipation of a softer interest rate, as well as expectations of other weaker fundamentals for the pound. A more careful examination of the market lies below.

Key Levels

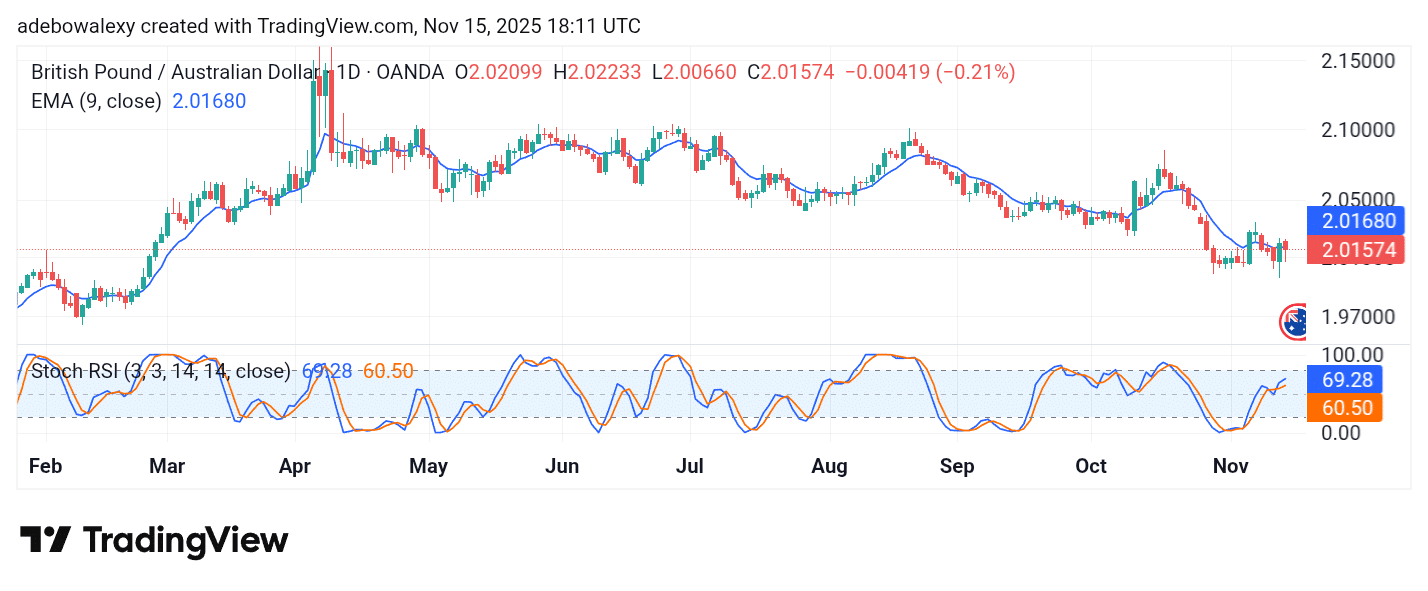

Resistance: 2.0500, 2.1000, 2.1500

Support: 2.0000, 1.9500, 1.9000

GBPAUD Sees a Short-Term Retreat

Although the GBPAUD edged higher on Thursday, the market quickly saw a reversal to that effect. On Friday, trading activities took a dip, as revealed by the corresponding price candle.

As a result, this pair now trades below the 9-day Exponential Moving Average line. Nevertheless, the lines of the Stochastic Relative Strength Index (SRSI) indicator retain a general upward trajectory toward the 80 mark of the indicator.

GBPAUD Short-Term Outlook Appears Fair

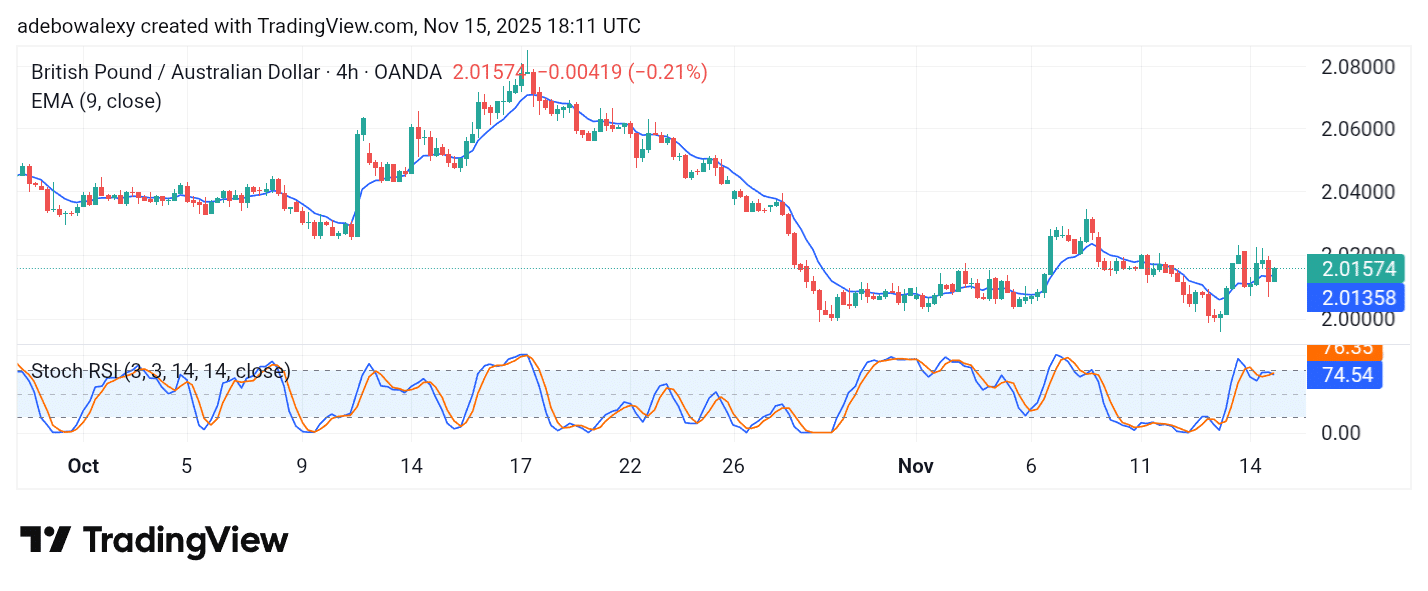

On a GBPAUD 4-hour market chart, it appears that traders have been taking short-term stances. The last price candle on the chart sharply returns the market back above the 9-day Exponential Moving Average (EMA) curve.

The mentioned price candle stays green. Meanwhile, the SRSI indicator lines have what could be called a downward crossover just below the 9-day Exponential Moving Average (EMA) line. Consequently, price action in this market seems a bit unstable. Therefore, traders can wait until price action finds a base above the 9-day EMA curve before aiming at the 2.1000 price mark.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.