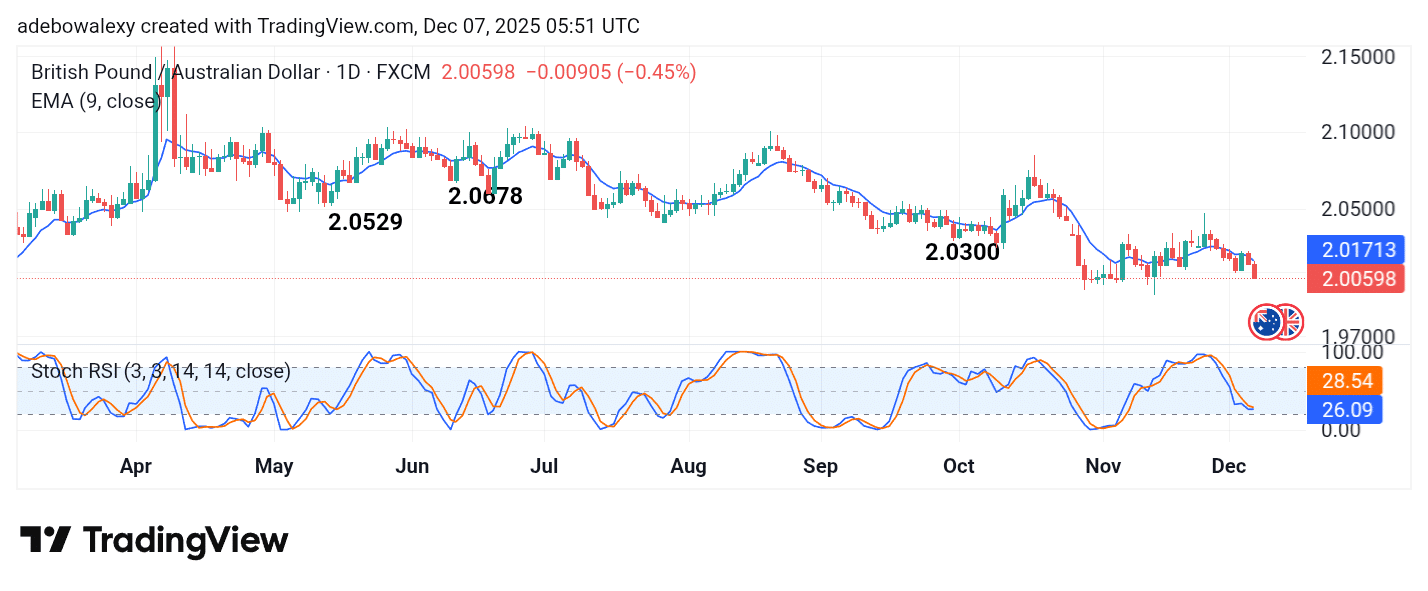

The GBPAUD market has continued its southward move as the RBA interest rate outlook continues to weigh on the pair. The RBA interest rate is expected to remain unchanged at 3.6%. On the pound side, the UK’s GDP data is projected to come in higher than the previous reading, rising to 0.1% from –0.1%.

Key Levels

Resistance: 2.0050, 2.0100, 2.0150

Support: 2.0000, 1.9800, 1.9700

GBPAUD Downward Movement Gains Momentum

Although the GBPAUD market appeared somewhat directionless over the weekend, it edged sharply lower toward the close. This pushed the pair further below the 9-day Exponential Moving Average (EMA) line.

Meanwhile, the Stochastic Relative Strength Index (SRSI) lines are descending toward the 20 level, with their endpoints converging for a potential bearish crossover. With bearish pressures firmly gripping the market, sentiment remains strongly negative.

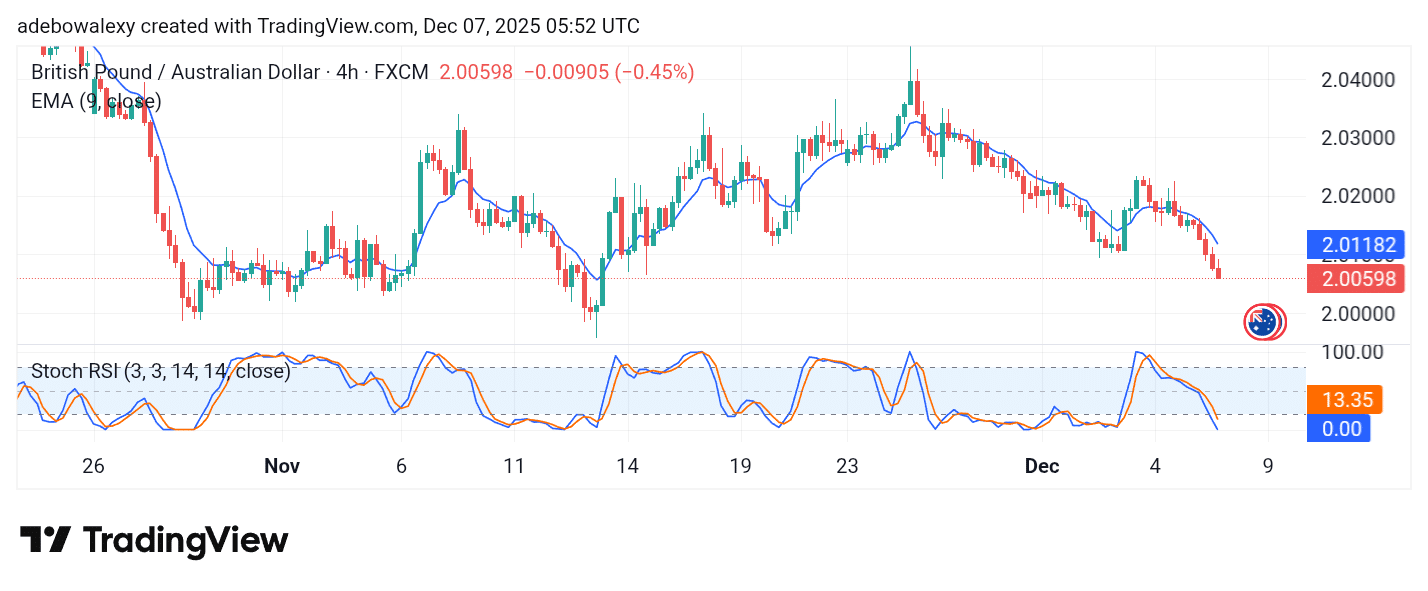

GBPAUD Stays on a Bearish Course

Short-term price action in the GBPAUD market suggests that downward forces remain dominant. Price has followed a downward course for five consecutive sessions.

The latest candle is bearish and has pulled the pair further below the 9-day EMA. Likewise, the SRSI indicator lines have dropped straight into the oversold region. Technically, bearish momentum remains in control and may continue to drive price action lower. As such, traders can maintain a bearish outlook toward 2.0000 or even 1.9500.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.