With the RBA interest rate decision still ahead, investors are beginning to take sides. This has continued to weigh down the GBPAUD market, causing it to extend its bearish correction further south. Let’s take a deeper dive into the market below.

Key Levels

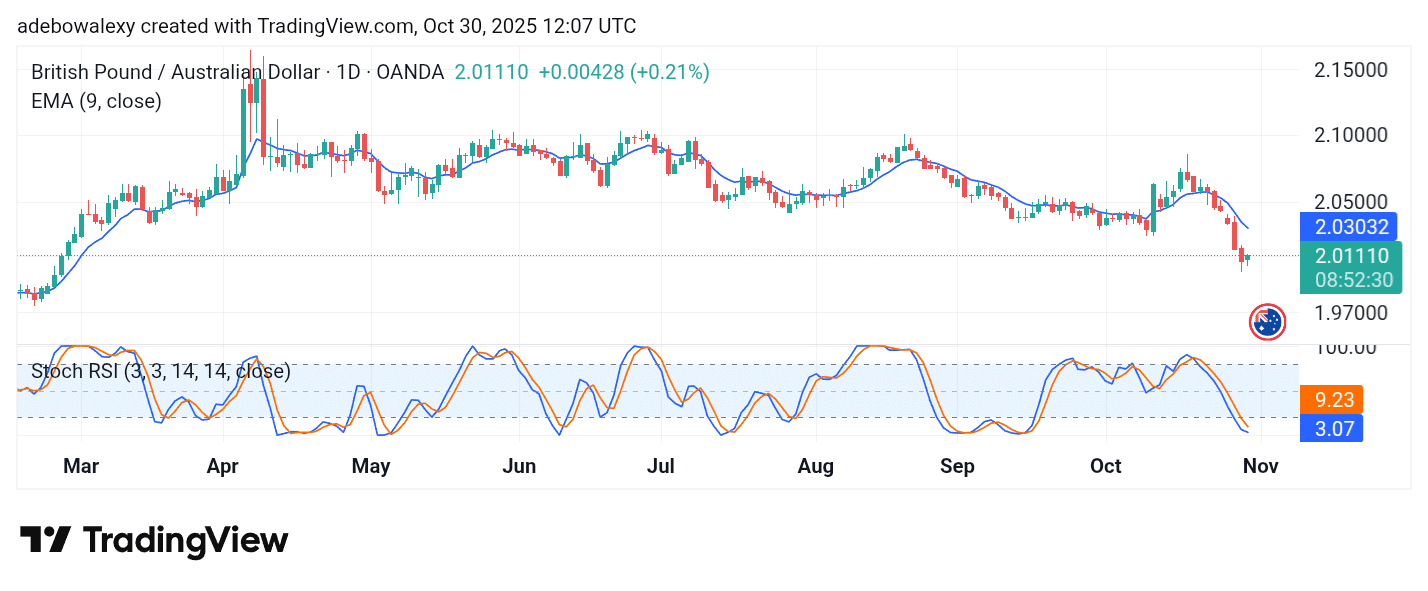

Resistance: 2.0500, 2.1000, 2.1500

Support: 2.0100, 1.9500, 1.9000

GBPAUD Market Sees a Steep Dive

The GBPAUD market has been dipping for almost a week. This has consequently brought the market to an eight-month low.

The ongoing session shows an upward bounce but remains at a significant distance below the 9-day Exponential Moving Average (EMA) line. The lines of the Stochastic Relative Strength Index (SRSI) indicator have fallen deep into the oversold region. This technically suggests that bears are holding sway and may keep the market trending south.

GBPAUD Bullish Rebound Stays Vulnerable

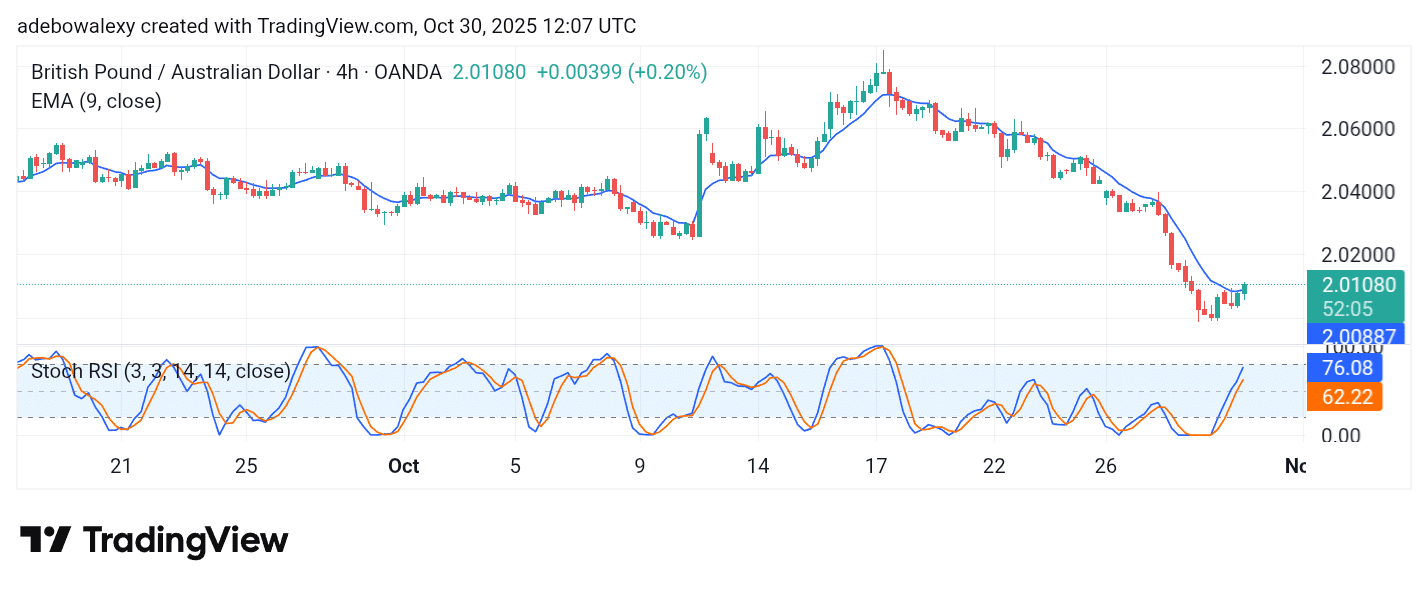

On the GBPAUD 4-hour chart, price action is showing some upside movement. The ongoing session has pushed above the 9-day EMA curve, and the corresponding price candle remains green, keeping short-term bullish hopes alive.

However, the SRSI indicator lines have risen considerably into the overbought region despite only a modest price increase. This indicates that upside forces are losing momentum too quickly. As such, the upward retracement may not extend very far, suggesting the market could continue its descent toward the 2.0000 mark.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.