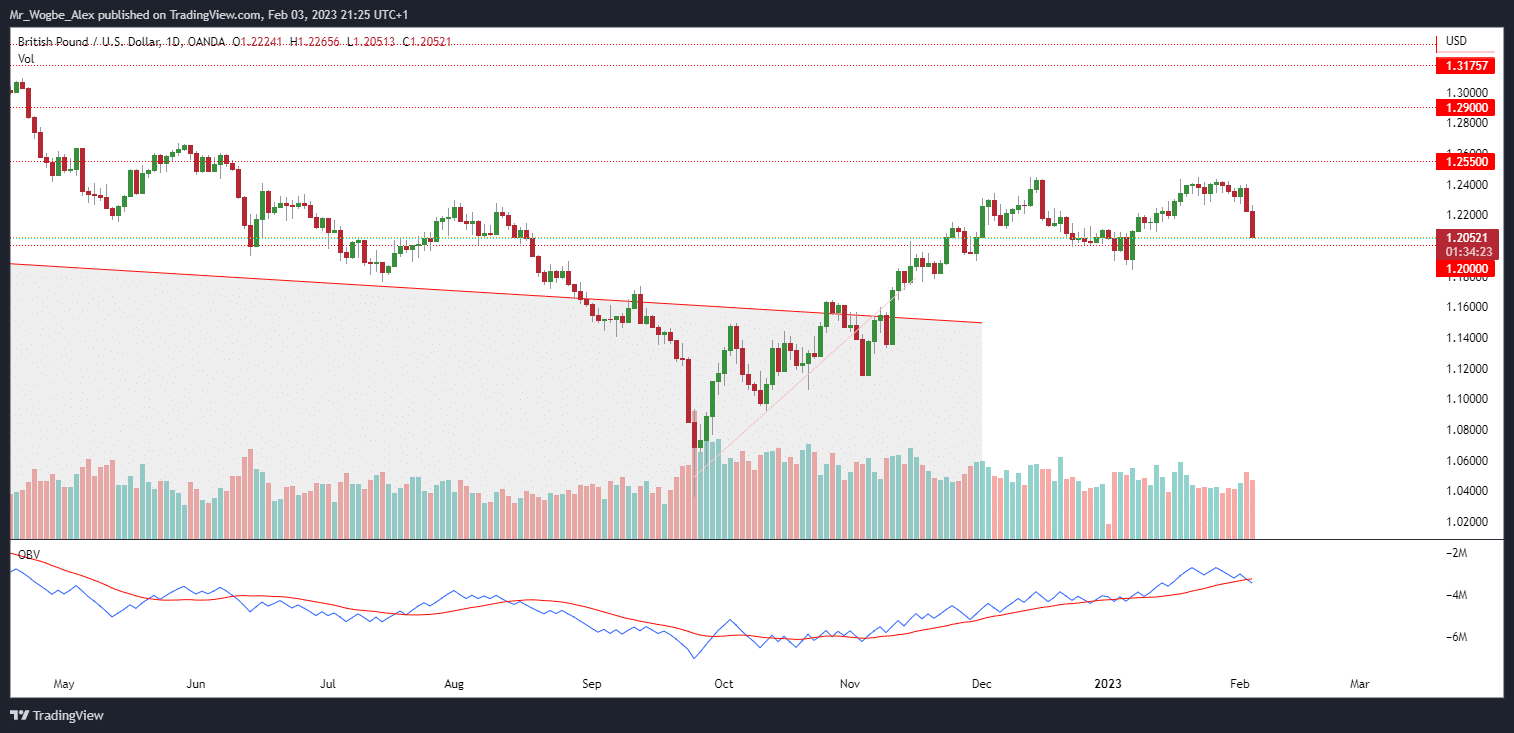

Following an unexpectedly positive jobs report from the United States, which fueled expectations that the Federal Reserve (Fed) would hike rates above Wednesday’s 25 basis point (bps) threshold, the GBP/USD pair took an unexpected bearish turn, and the British pound plunged and widens its losses on Friday (bps). The GBP/USD currency pair is currently trading at 1.2054 after hitting a day high of 1.2265.

Investor sentiment deteriorated following the release of the January nonfarm payrolls report. According to the data, the economy created 517K new jobs as opposed to the 200K predicted, which caused the unemployment rate to decrease from 3.5% to 3.4%. The numbers for December were also revised upward, indicating that the US Federal Reserve still has work to do to control persistently high inflation and achieve its 2% target.

The US Dollar Index (DXY), which gauges the value of the dollar against a basket of six different currencies, increased to 102.95, a new three-week high, up 1.2%.

Later, the Institute for Supply Management (ISM) reported that while prices paid decreased, service industry activity rose above expansionary territory thanks to new orders. The ISM non-manufacturing PMI increased by 55.2 last month, compared to 49.2 in December, which was higher than the 50.4 analysts had predicted.

Meanwhile, the UK S&P Global/CIPS Services PMI had its weakest month in two years earlier in the European session, falling to 48.7 from December’s 49.9, its lowest level since January 2021. As a result, the S&P Composite PMI, which combines data from the manufacturing and services sectors, declined from 49.0 in December to 48.5 in January.

GBP/USD Traders to Look Forward to Comments from US Fed Lawmakers

The Monetary Policy Report Hearings and the Gross Domestic Product (GDP) MoM and QoQ are on the UK economic schedule for the following week. Speakers from the US Federal Reserve will be on the agenda, including Jerome Powell and John C. Williams from the New York Fed. Initial jobless claims and the Consumer Sentiment Index from the University of Michigan (UoM) would also provide some insight into the state of the US economy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.