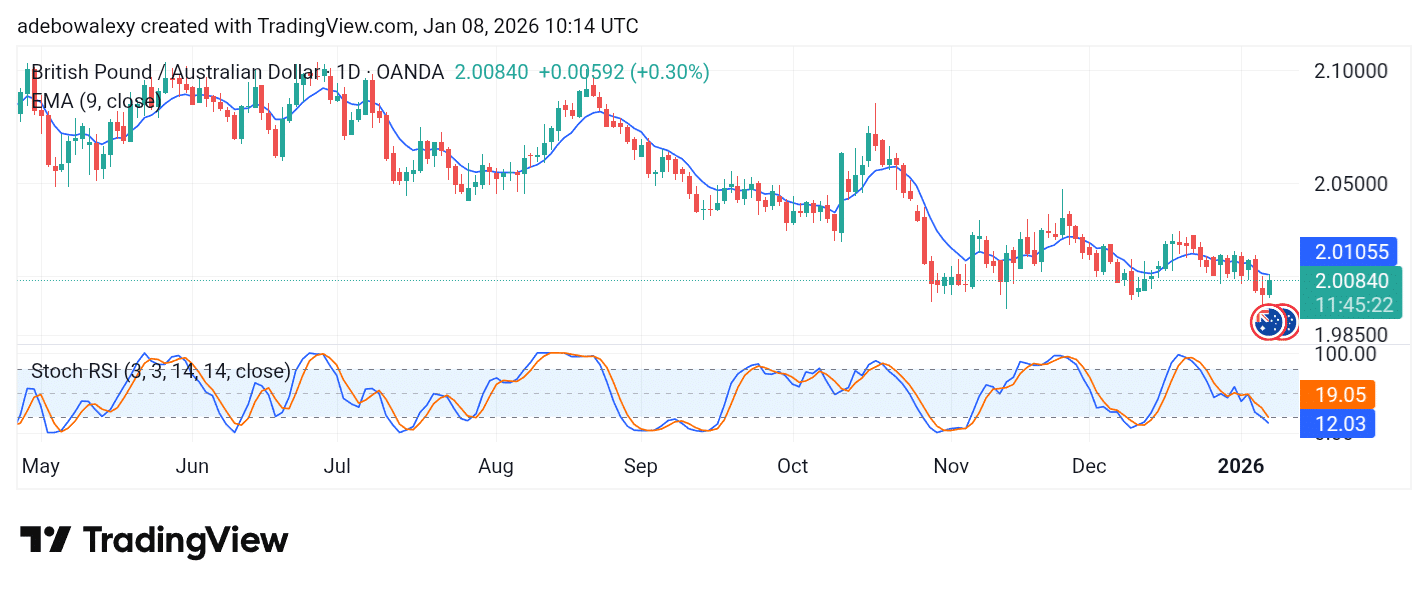

Since the start of the new year, the Australian dollar has been able to gather significant momentum. This has created headwinds for the GBP/AUD pair, keeping it on a downward trajectory. As a result, even with today’s rebound, the market remains under pressure.

Key Levels

Resistance: 2.0100, 2.0250, 2.0500

Support: 2.0000, 1.9800, 1.9500

GBP/AUD Registers a Strong Bounce but Stays Vulnerable

The ongoing session in the GBP/AUD market is marked by a notable green price candle. However, despite this rebound, the pair continues to trade below the 9-day EMA curve. This maintains the impression that downside forces remain dominant in the market.

The Stochastic Relative Strength Index (SRSI) lines are diving deep into the oversold region without any sign of convergence. This further confirms that bears remain in control and that the market may extend its decline.

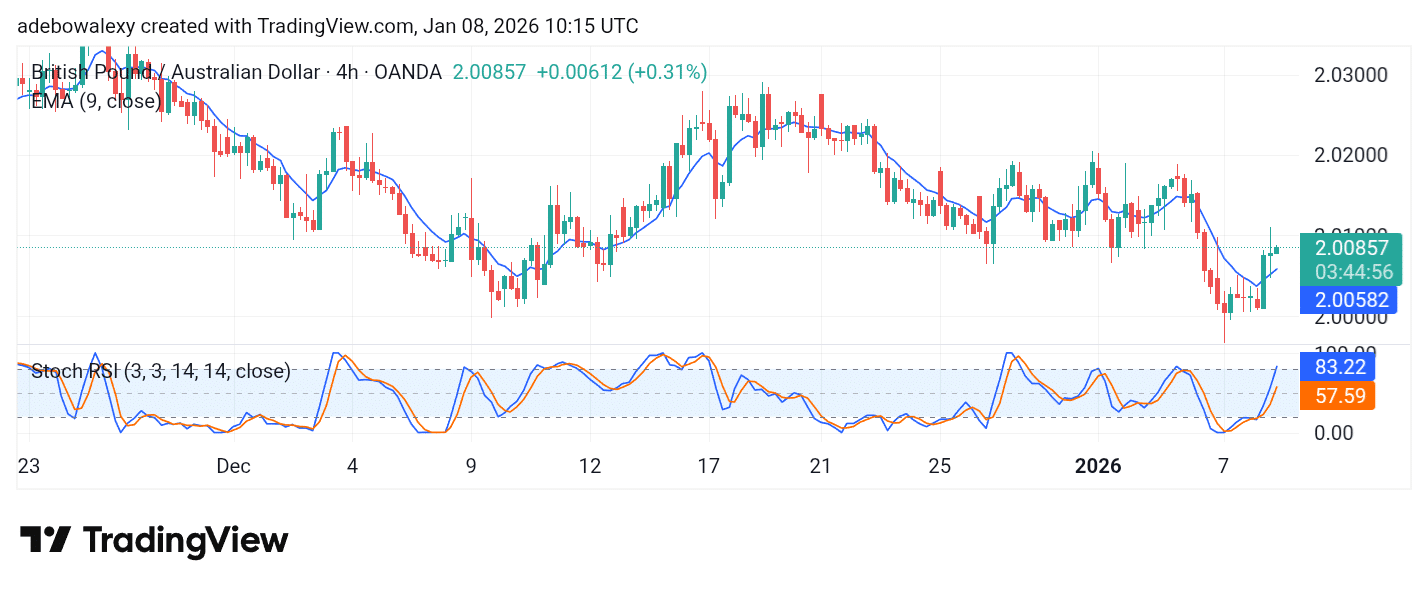

GBP/AUD Eyes Short-Term Gains Around 2.0100

Although the GBP/AUD market remains largely downwind, short-term opportunities may still emerge. The latest price candle is bullish and shows a more pronounced body than the previous session. Additionally, recent price candles are forming above the 9-day EMA curve.

Meanwhile, the SRSI lines are rising steeply upward from the oversold region. As a result, traders may consider a short-term target around the 2.0100 price level in the interim.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.