FTSE 100 Analysis – November 5

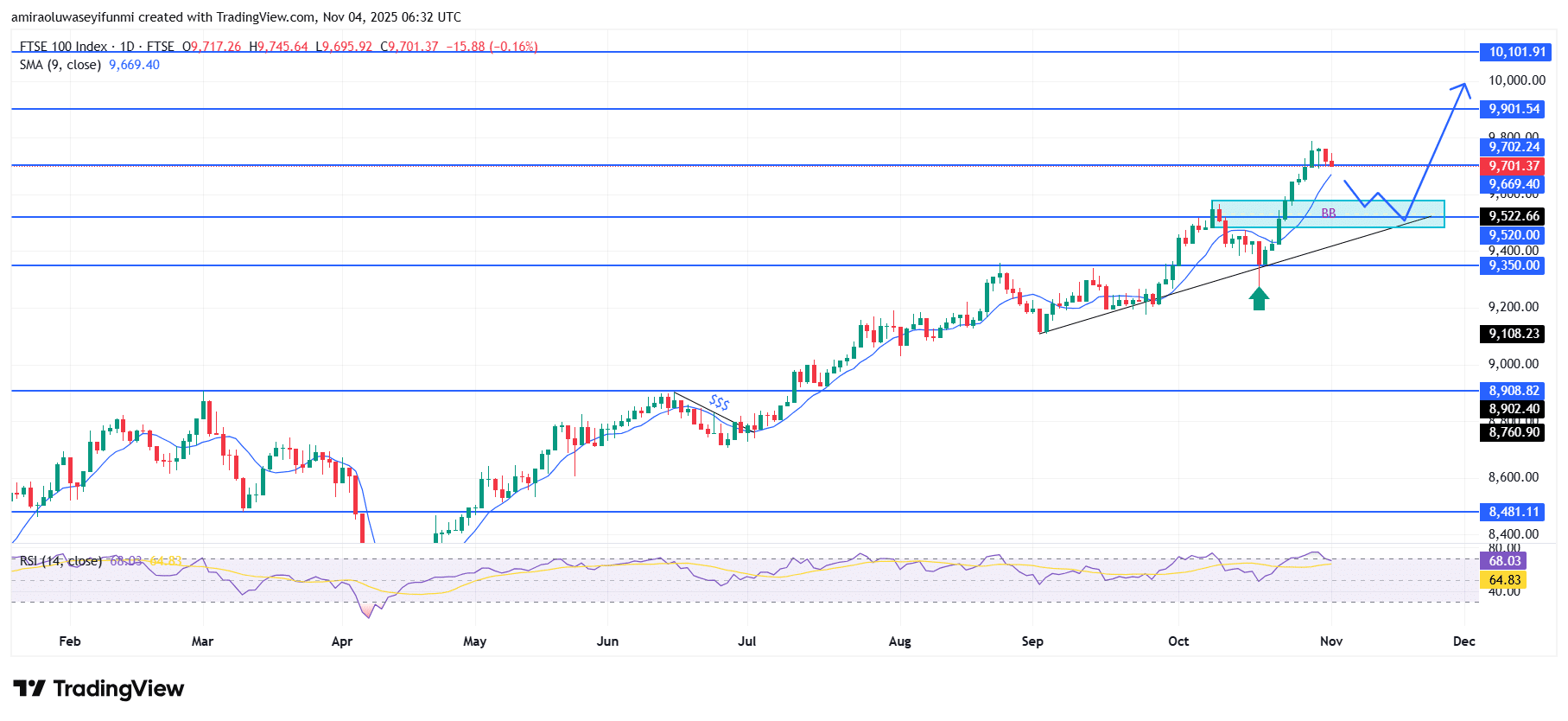

FTSE 100 upholds its bullish drive as momentum remains resilient. The FTSE 100 index continues to display an upward trend, with price action holding firmly above the 9-day moving average around $9,670. This setup reflects sustained buyer engagement and a well-defined short-term trend. The consistent formation of higher highs and higher lows emphasizes market strength, while the gentle slope of the moving average indicates a steady directional bias favoring the bulls.

FTSE 100 Key Levels

Resistance Levels: $9700, $9900, $10100

Support Levels: $9520, $9350, $8900

FTSE100 Long-Term Trend: Bullish

From a technical perspective, the recent pullback after the move toward $9,900 appears corrective rather than a structural reversal. The price is currently testing a crucial reaction zone between $9,520 and $9,670, a region that previously acted as resistance but now aligns as a potential support base. The convergence of this zone with the ascending trendline adds significance, hinting at the possibility of renewed accumulation and continuation of the prevailing bullish trend.

Looking ahead, maintaining stability above $9,520 could pave the way for a rebound targeting $9,900, with further extension toward $10,100 if momentum persists. A confirmed daily close above this threshold would likely strengthen investor confidence and attract additional buying interest. Conversely, a drop below $9,350 could temporarily interrupt the structure, though the overall trend context still leans toward sustained upward movement supported by forex signals indicating positive sentiment.

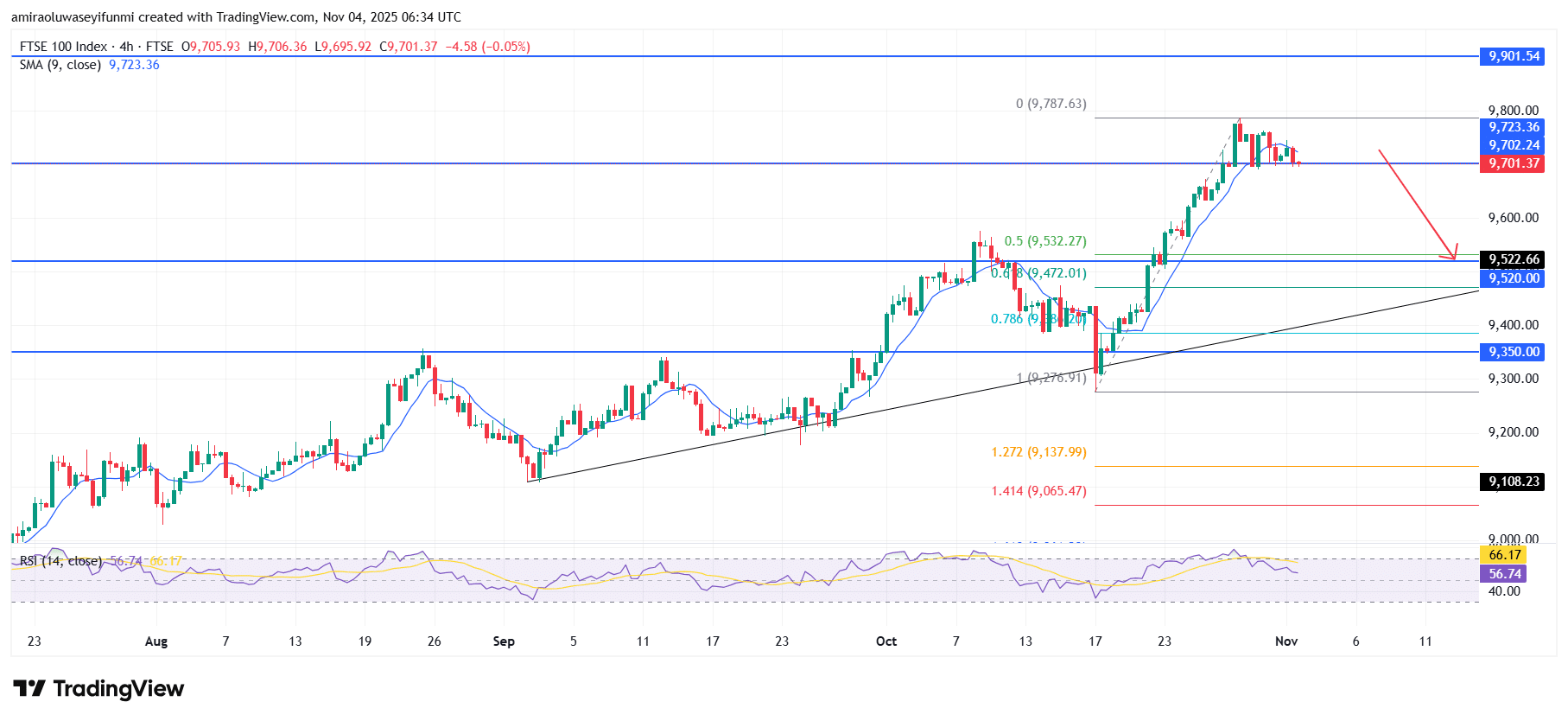

FTSE100 Short-Term Trend: Bearish

FTSE 100 shows short-term bearish pressure as price trades below the 9-period moving average near $9,720, signaling reduced buyer dominance. The recent rejection around $9,780 suggests that sellers are regaining control after an extended rally.

Immediate support is seen between $9,520 and $9,470, corresponding with the 0.618 Fibonacci retracement zone. A decisive break below this area could lead to further decline toward $9,350 before any potential recovery occurs.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.