- Resistance Level: 7500, 7600, 7700

Support Level: 7300, 7200, 7100

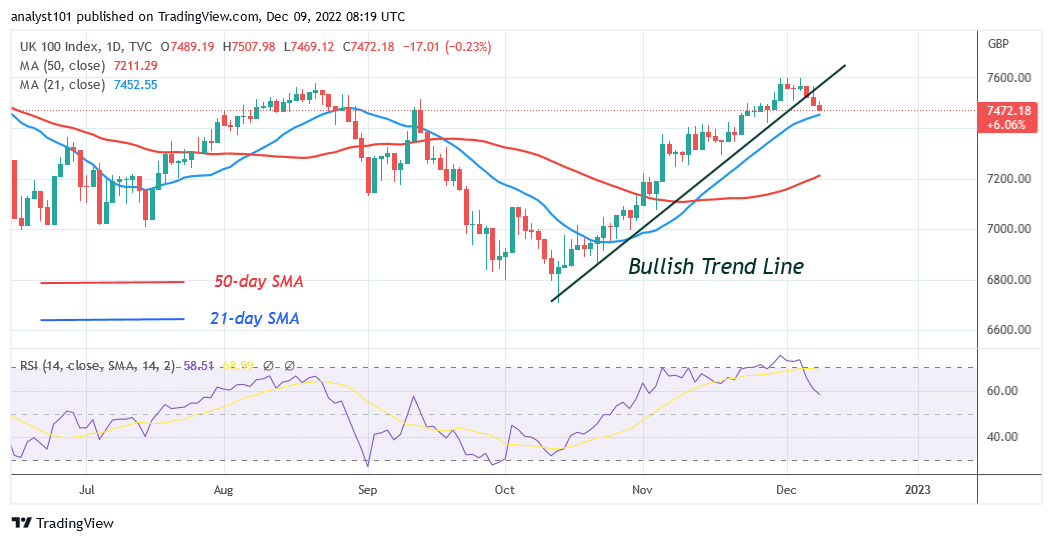

FTSE 100 (UKX) Long-term Trend: Bullish

The FTSE 100 (UKX) price had been rising since October 12 as it declines to level 7461. The index surged to a high of 7600 on November 30. UKX is currently declining after hitting resistance in the overbought area. The moving average lines or level 7472 have been crossed. If the price remains above the moving average lines, the index will start heading up again. On the other side, if the price drops below the moving average lines, selling pressure would pick up again.

Daily Chart Indicators Reading:

The UKX is at level 60 on the Relative Strength Index for period 14. After entering the overbought area, the index is now retracing. A trend upward is shown by the rising 21-day and 50-day SMA lines. Since the index price bars are higher than the moving average lines, an uptrend may be developing.

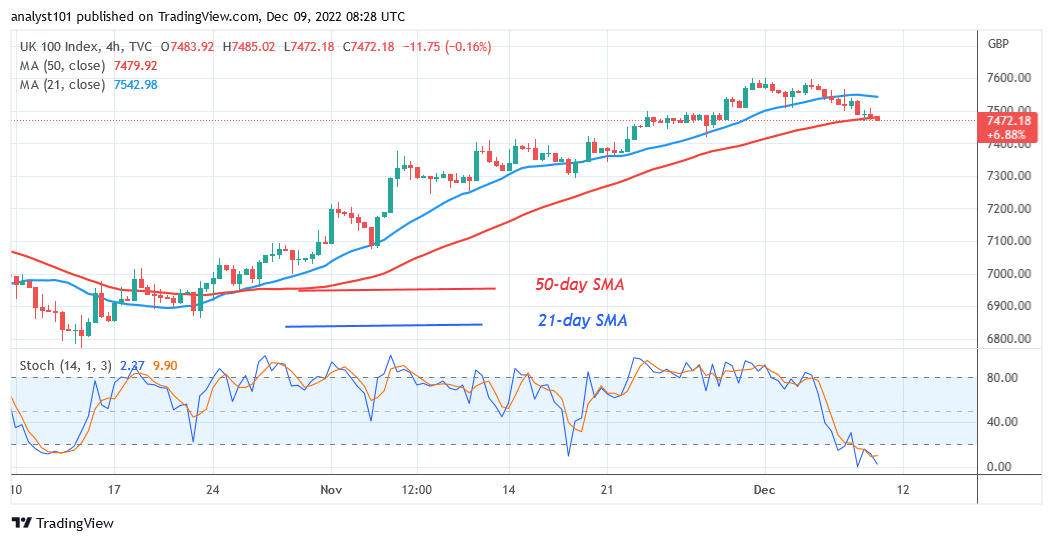

FTSE 100 (UKX) Medium-term Trend: bullish

The UKX price is rising steadily on the 4-hour chart, pointing to an uptrend. The price of UKX increased before falling after testing level 7600 as resistance. The moving average lines have been breached by the negative momentum, signaling a further slide.

4-hour Chart Indicators Reading

Due to its decline below the daily stochastic level of 20, UKX has reached the oversold area. The moving average lines are below the price bars, signaling a further decrease. The 21-day and 50-day lines’ SMAs are going upward, which denotes an uptrend.

General Outlook for FTSE 100 (UKX)

The FTSE 100 has hit its limit of bullishness as it declines to level 7461. In the overbought area, sellers have emerged to drive prices lower. The oversold area has been reached by the current decrease. Selling will probably slow off.

You can purchase crypto coins here: Buy LBLOCK

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.