FTSE 100 Analysis – April 30

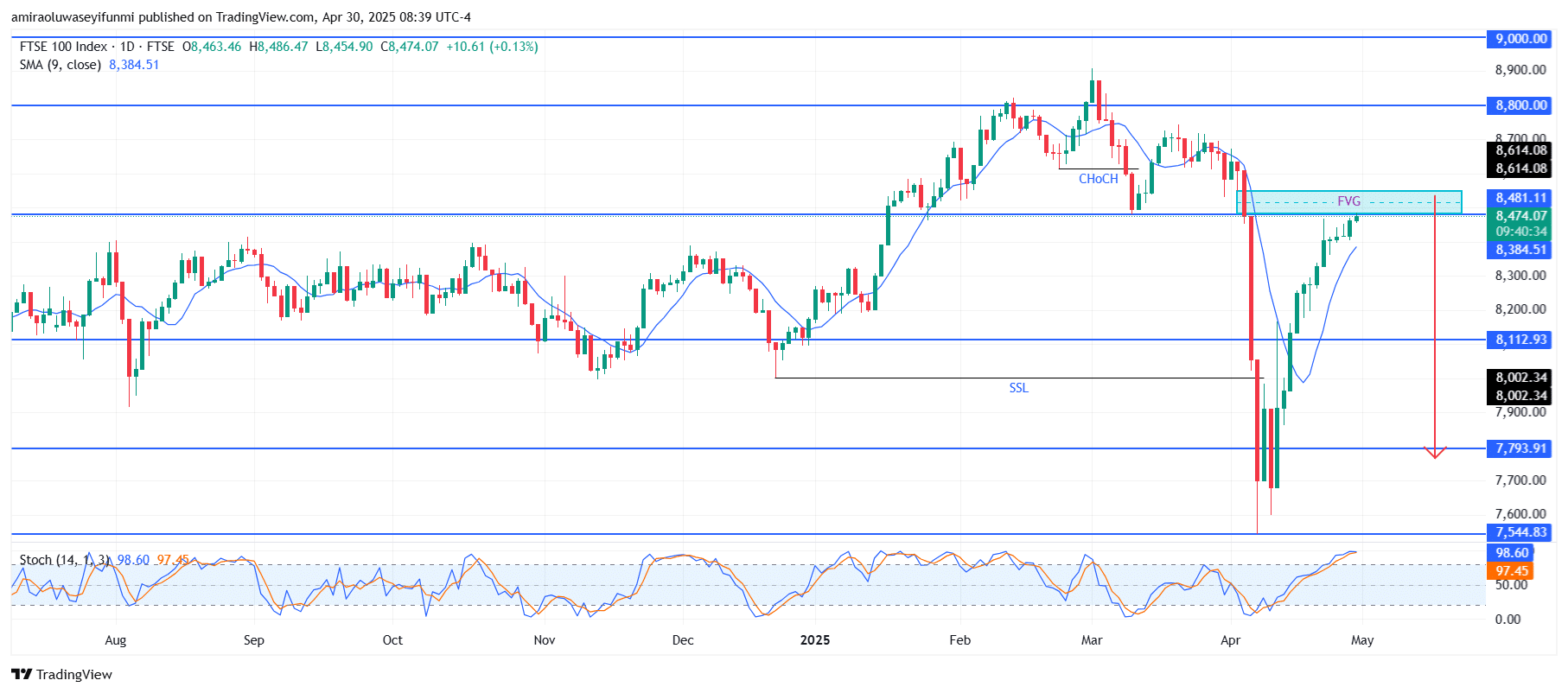

FTSE 100 is showing signs of a potential reversal as bearish indicators dominate the market sentiment. The Stochastic Oscillator is deeply overbought, hovering around 98, which points to fading bullish momentum. This reading, combined with the recent sharp rally in price, indicates a probable pullback or reversal. The 9-day Simple Moving Average (SMA) is positioned at $8,380 and is closely tracking the price movement, but signs of it flattening suggest diminishing bullish strength. The current price near $8,470 is challenging significant resistance levels, while indicators continue to warn of a possible correction.

FTSE 100 Key Levels

Resistance Levels: $8,480, $8,800, $9,000

Support Levels: $8,110, $7,790, $7,540

FTSE 100 Long-Term Trend: Bearish

The chart reveals a clear Change of Character (CHoCH) after the market declined from approximately $8,800 to a swing low near $7,540. The ongoing rally has filled a Fair Value Gap (FVG) between roughly $8,380 and $8,480—now serving as a robust supply zone. The price is currently struggling to break through this zone, indicating potential fatigue. The previous swing low at $8,000 remains a crucial liquidity area that could be revisited if the rejection from the FVG persists.

Looking ahead, sustained bearish pressure around the $8,480 resistance zone could lead to a sharp reversal. A decisive break below the SMA could intensify downward momentum, possibly driving the index toward $8,110 and then $8,000, with a further downside target around $7,790. This scenario may confirm the continuation of the prevailing bearish trend.

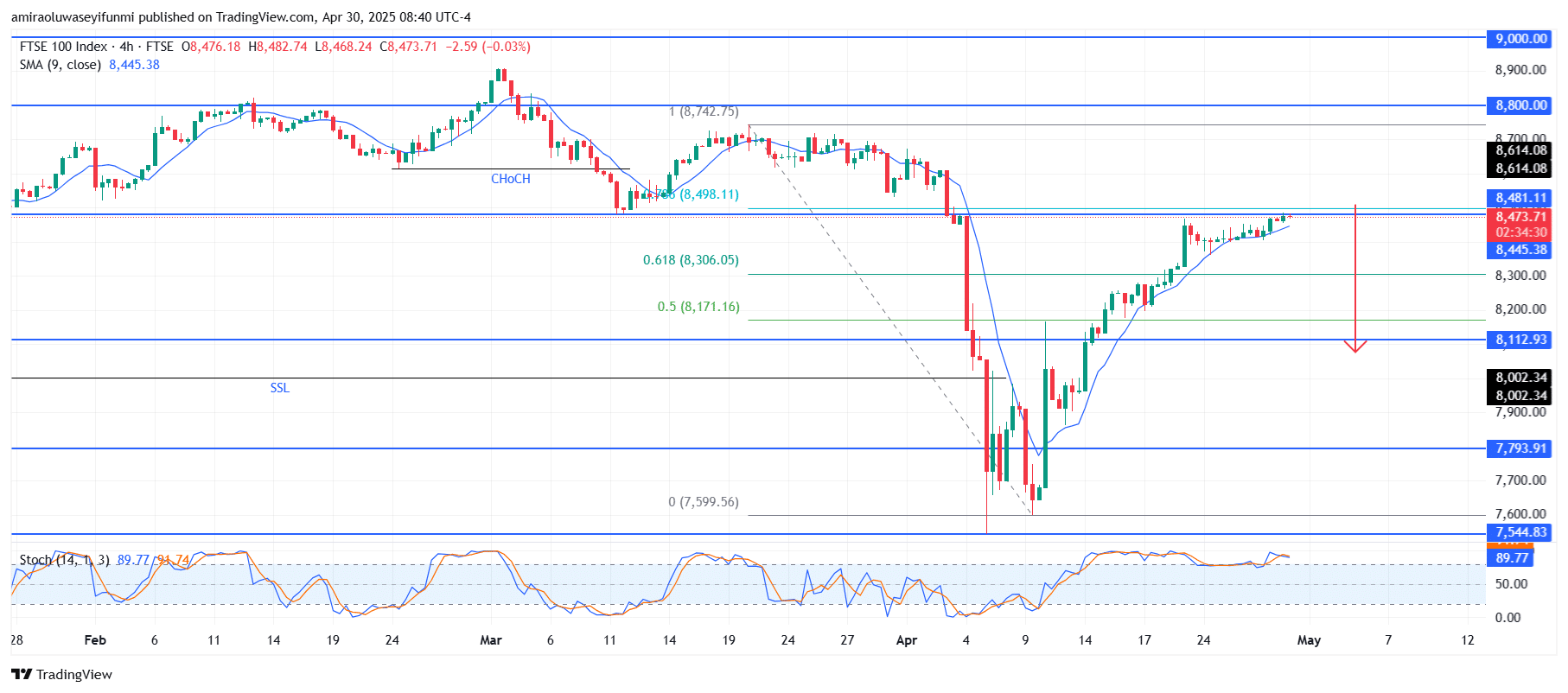

FTSE 100 Short-Term Trend: Bearish

FTSE 100 is encountering firm resistance at the $8,480 level, with a potential double-top formation emerging. The Stochastic Oscillator is highly overbought at 89.80, reinforcing the likelihood of a downward reversal.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.