FTSE 100 Analysis – March 12

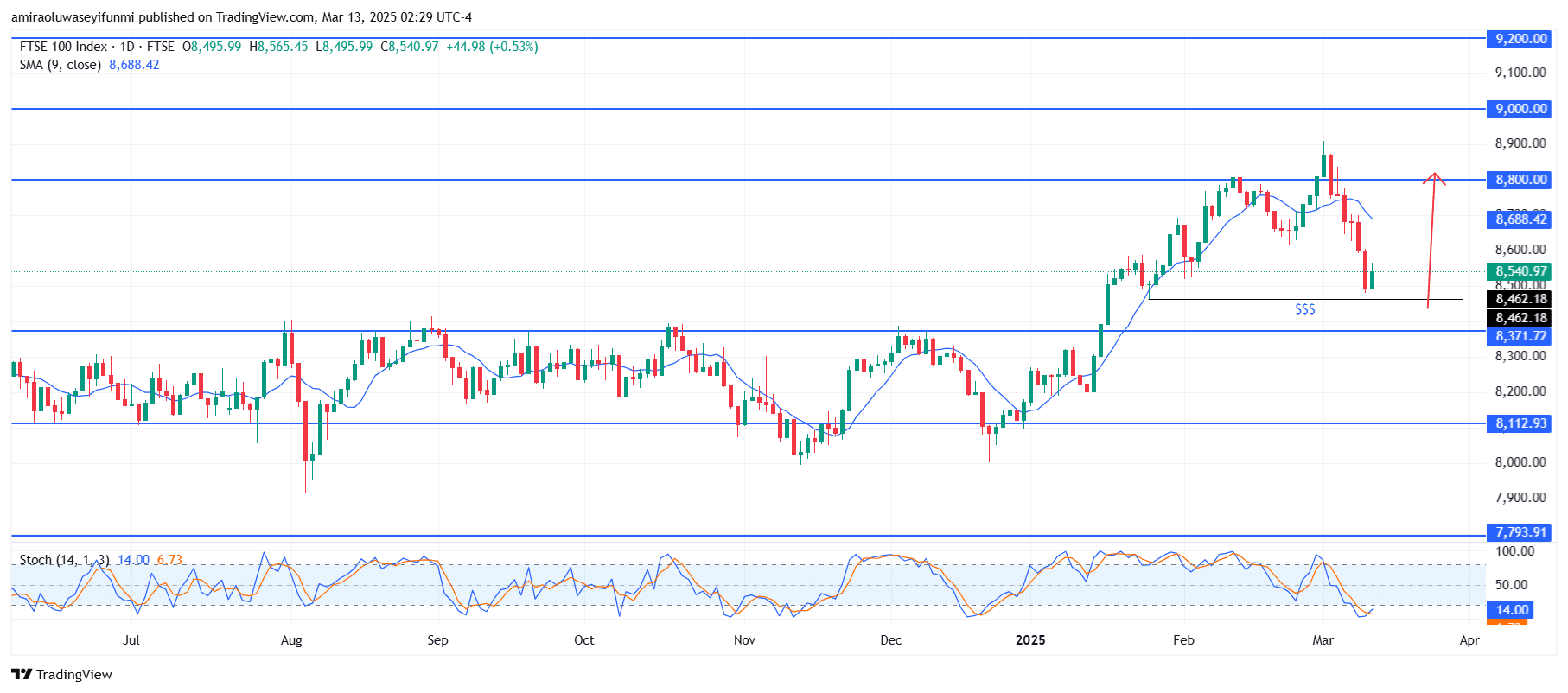

FTSE 100 is poised for a bullish reversal following a liquidity sweep. Currently trading around $8,540, the 9-day SMA is positioned at $8,690, reflecting short-term bearish pressure. The Stochastic Oscillator is hovering at 14, signaling oversold conditions and a potential turning point. This suggests that selling momentum may be fading, creating an opportunity for buyers to regain control. A sustained move above the SMA could reinforce bullish sentiment and confirm a trend shift.

FTSE 100 Key Levels

Resistance Levels: $8,800, $9,000, $9,200

Support Levels: $8,370, $8,110, $7,790

FTSE 100 Long-Term Trend: Bullish

From a price action perspective, the recent decline may reach the $8,460 liquidity zone, sweeping sell-side liquidity below a key support level. This liquidity grab often precedes a reversal as institutional buyers step in. The price has shown signs of stabilizing above $8,370, a crucial support level that aligns with previous consolidation zones. A break above $8,560 would confirm a bullish reversal, whereas failure to hold $8,370 could indicate further downside risk.

Looking ahead, FTSE 100 is set to revisit the $8,800 resistance level if bullish momentum strengthens. A successful breakout above $8,800 could pave the way for a rally toward $9,000 and potentially $9,200 as the next major targets. However, if the price retests the $8,460 zone and holds, it may act as a launching point for further upside. Buyers should closely monitor the $8,370–$8,460 range for signs of a confirmed reversal before positioning for higher levels. Traders seeking forex signals should watch for bullish confirmations within this key range.

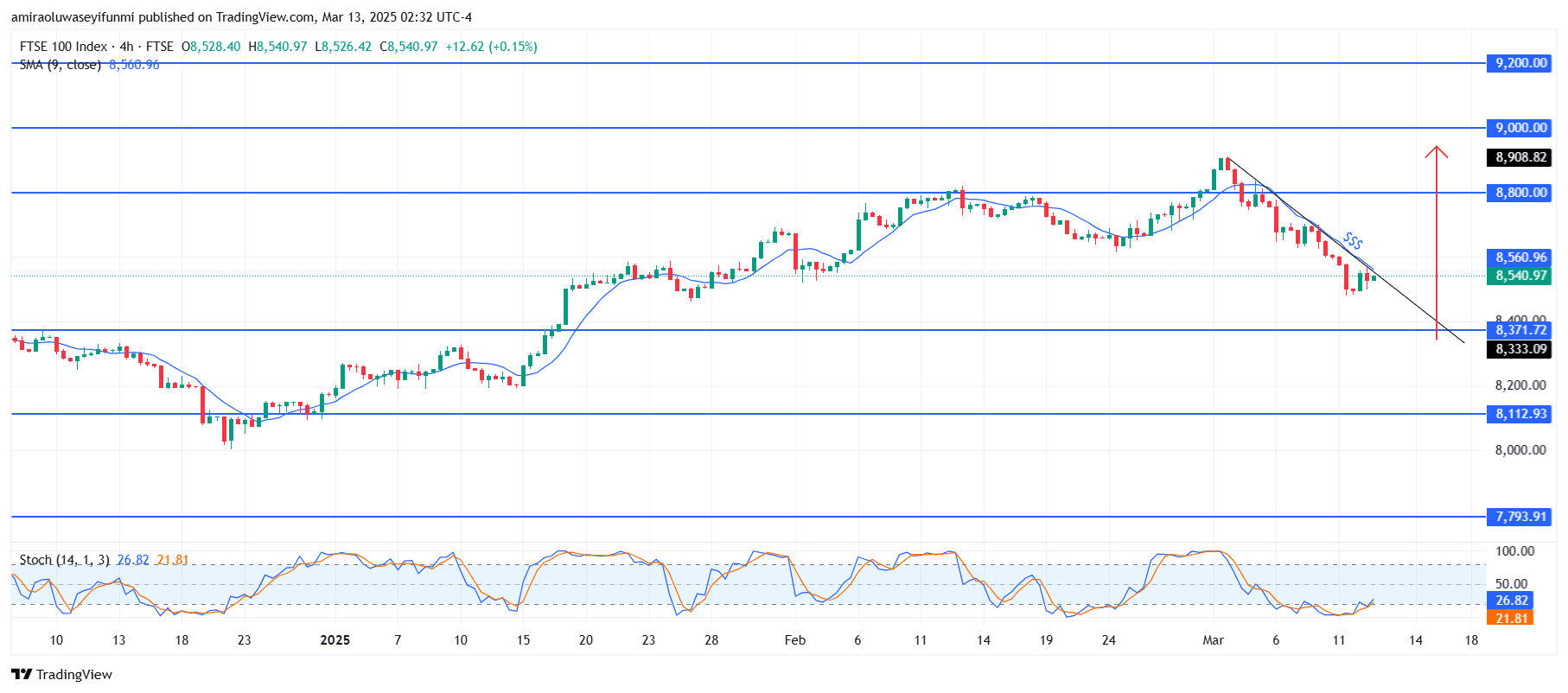

FTSE 100 Short-Term Trend: Bullish

FTSE 100 remains in a corrective downtrend but is approaching key support near $8,370. The price is currently testing a descending trendline, and a breakout above it could signal a shift toward the $8,800 resistance level.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.