Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – August 2nd

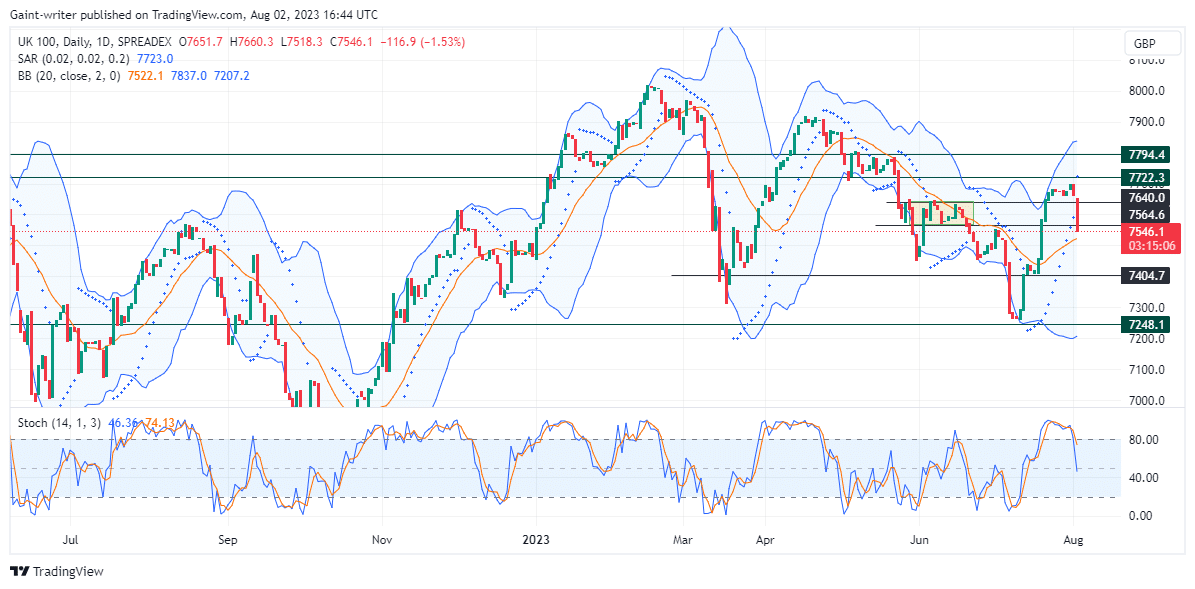

The FTSE 100 continues to decline as bears take control, breaking below the 7640.00 market level. After a period of bullish favor, the market saw a significant boost from the 7248.10 level in June. The buyers managed to gain momentum, pushing the price higher to a significant level of $7640.00. However, at the beginning of this week, instead of resuming bullish strength, the market began to experience a decline.

FTSE 100 Key Levels

Resistance Levels: 7794.40, 7722.30

Support Levels: 7404.70, 7248.10

FTSE Long-Term Trend: Bullish

The bears took advantage of the situation and crashed the price lower in the market. Sellers successfully broke through the key zone at 7564.60. It appears that this bearish trend may continue to prevail in the market. The Stochastic Oscillator indicates a crossover that confirms the selling trend’s control in the market.

As the FTSE 100 continues its downward trajectory, traders should exercise caution and closely monitor the market’s movements. The bearish momentum and breakdown at key levels indicate sustained bearish sentiment. Traders can utilize technical indicators and market analysis to assess potential entry or exit points and adjust their strategies accordingly. The ongoing market decline presents opportunities for traders to adapt their positions and potentially capitalize on bearish movements. Close attention to the price action and confirmation from indicators can help guide traders’ decisions and manage risk effectively.

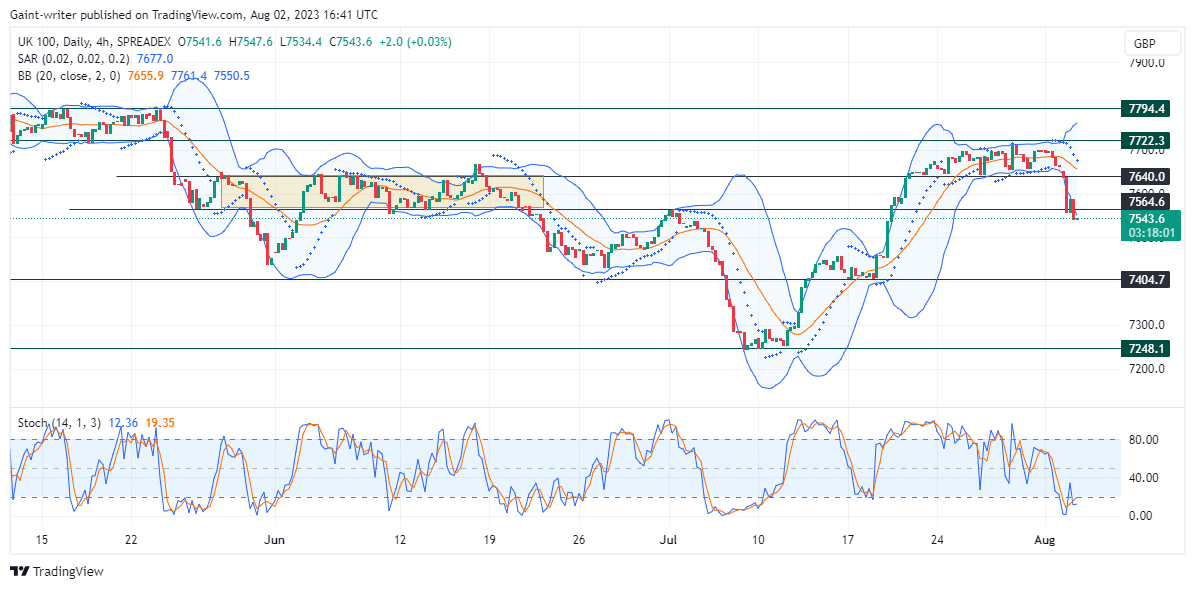

FTSE 100 Short-Term Trend: Bearish

Analyzing the 4-hour time frame, it becomes evident that sellers are making significant progress in driving the price lower. A breakout from the compression phase suggests that bears have established their presence. The Parabolic SAR (Stop and Reverse) indicator aligns with the seller’s dominance in the market. It signals that sellers hold the power in the current situation. Further breaches below the 7404.70 level may be experienced in the coming days.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.