Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – August 16th

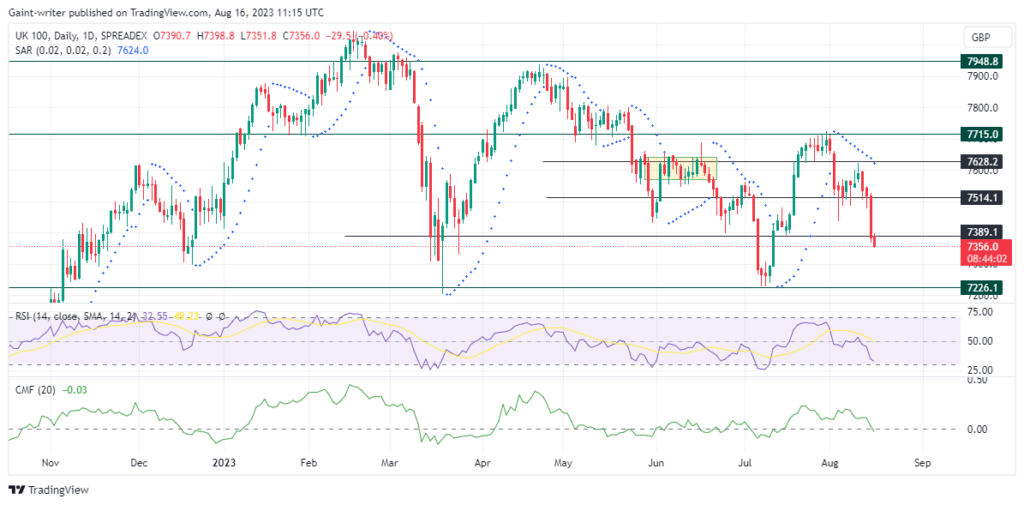

FTSE 100 bears stay offensive as they exert more influence. The sellers have been applying aggressive pressure. They have managed to corner the buy traders around the 7715.00 market zone. June proved to be a strong period for the bears in the FTSE 100.

However, in July, it was a reversal of fortunes. The Bulls made a comeback. The comeback came into play when the sellers drove the price down to the significant zone of 7226.10.

Throughout July, the buyers were able to gather strength. Unfortunately, their bullish momentum was short-lived. The price experienced a decline at the key level of 7715.00. Since then, the sell traders have taken an offensive stance, driving the price lower in the market.

FTSE 100 Key Levels

Resistance Levels: 7948.80, 7715.00

Support Levels: 7628.20, 7226.10

FTSE Long-Term Trend: Bearish

Last week, the market saw a period of consolidation above the 7514.10 market level. As we speak, the bears have resumed their motion. The RSI (Relative Strength Index) indicates that strength accumulation is focused on the bearish side. This further supports the bearish moment.

The Parabolic SAR (Stop and Reverse) indicates a progression in the bearish direction. It also reinforces the current market sentiment. Given the dominance of the bears, the buyers will need to gather greater strength to mount a counterattack.

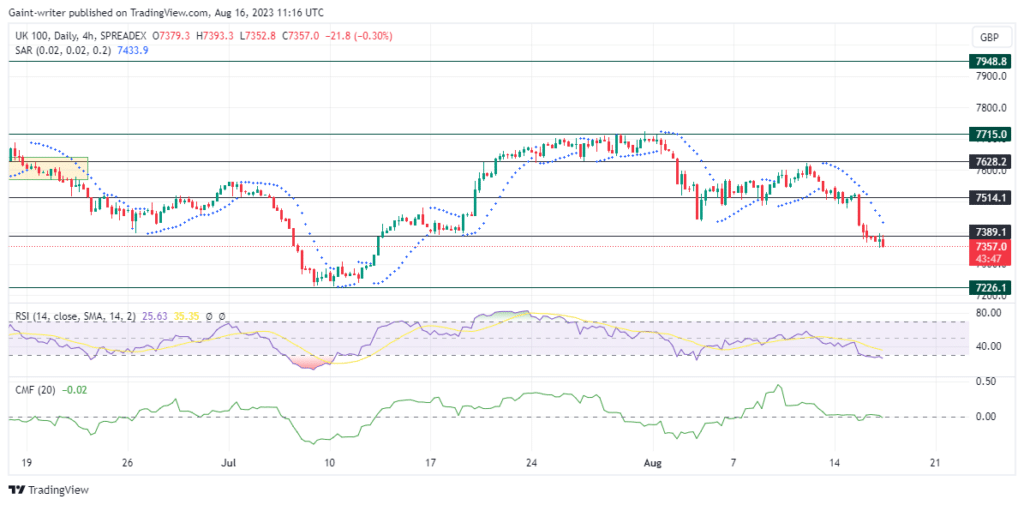

FTSE Short-Term Trend: Bearish

Looking at the 4-hour chart timeframe, we can observe the continued bearish progression. As the bears grow stronger, more zones will likely be breached in the days to come. The retest of the 7389.10 key level further confirms the bearish setup in the market.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.