Liquid staking derivatives (fondly called LSDs) have gained significant traction in the world of Ethereum staking, attracting over $35 billion in investments since December 2020. With their low barriers to entry, LSDs now account for more than 30% of the total staked ETH, with Lido Finance leading the way with $13 billion worth of ETH in its staking pools.

Here, we will embark on a journey to unravel the intricacies of this LSD sector, covering all the relevant topics.

Democratizing Staking with Liquid Staking Protocols

The advent of the Ethereum Beacon Chain’s launch in December 2020 paved the way for liquid staking protocols. These protocols emerged to address the initial limitations of staking, which required a minimum lockup period of two years and a commitment of at least 32 ETH. By circumventing these restrictions, liquid staking protocols democratized staking, making it accessible to any Ethereum holder.

With an estimated 233 million ETH holders today, liquid staking protocols tap directly into this vast user base. It is no surprise that these protocols have attracted over $17.8 billion worth of ETH in just over 2.5 years.

The recent activation of the Shapella upgrade on the Ethereum blockchain in April 2023, which eliminated the lockup period for staked tokens, further increased interest in ETH staking. For smaller crypto investors who may not meet the requirements to run a staking node, liquid staking protocols remain an attractive option.

Unlocking Liquidity and Native Tokens

One key factor driving the popularity of liquid staking protocols is the prospect of unlocked liquidity through native tokens. When users stake ETH on these protocols, they receive equivalent amounts of native tokens, whose values are linked to ETH.

For example, Coinbase offers cbETH as a new token in exchange for locked ETH. These tokens can be further utilized in decentralized finance (DeFi) projects, allowing users to benefit from staking rewards while engaging in other investment opportunities.

The Dominance of Lido Finance and Other Players

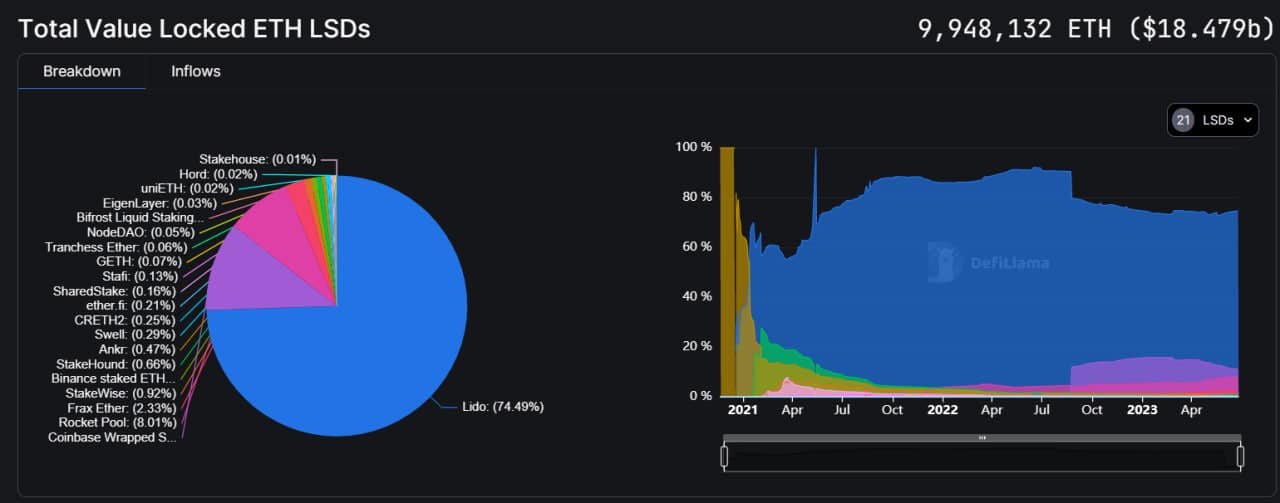

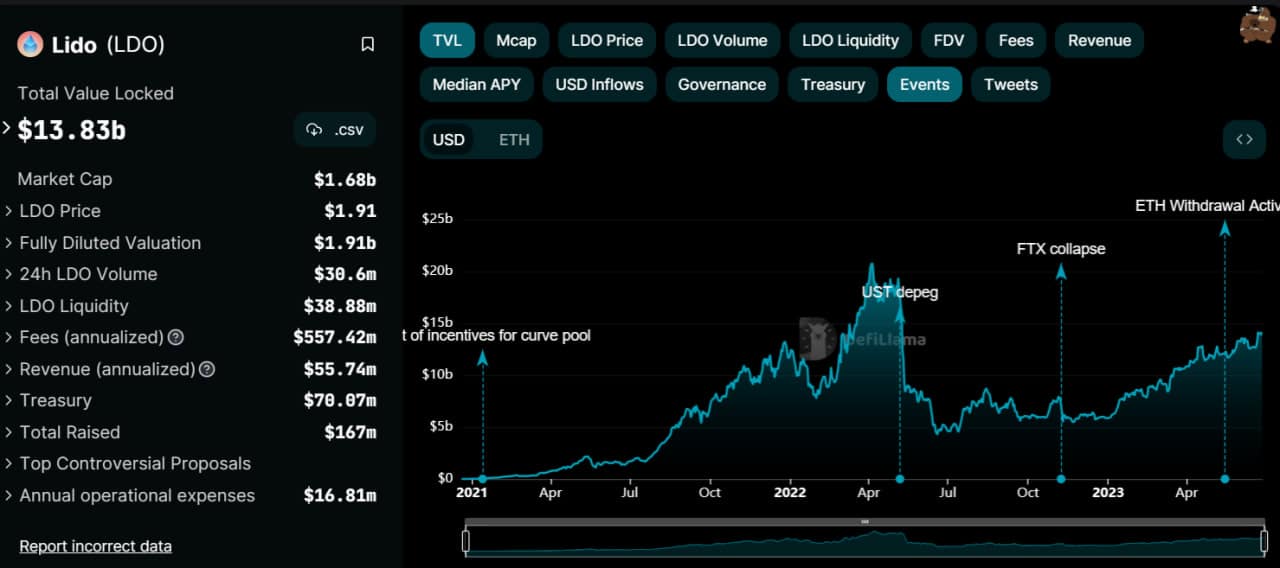

Lido Finance, with over 7.16 million ETH staked, is the clear leader in the liquid staking space, holding a commanding 74.17% market share. Its early mover advantage has contributed to its dominant position.

Other significant players include Coinbase Wrapped Staked Ether and Rocket Pool, with 1.1 million and 762,000 staked ETH, respectively. The total value locked (TVL) in liquid staking protocols is on par with decentralized exchanges (DEXs), reaching approximately $17.47 billion.

Risks in Liquid Staking

While liquid staking offers promising opportunities, it is crucial to acknowledge the associated risks.

- High liquidity risks are inherent in all liquid staking tokens due to limited supply and potentially underdeveloped trading markets.

- Engaging in DeFi investments carries its own set of high-risk, high-reward considerations, and the loss of staking tokens could result in the loss of access to locked ETH.

- Additionally, investors depend on third-party validators in liquid staking pools, and the inefficiency or malicious behavior of validators can lead to losses or penalties, such as slashing.

- Furthermore, the regulatory landscape poses legal risks, as regulators worldwide are cracking down on crypto projects and businesses, potentially subjecting liquid staking protocols to strict regulations and tax implications.

Final Word: What Lies Ahead for Liquid Staking Derivatives?

Liquid staking derivatives have revolutionized the accessibility and flexibility of Ethereum staking, opening up opportunities for a broader range of crypto investors.

With billions of dollars worth of ETH already staked, these protocols offer the potential for unlocked liquidity and engagement in DeFi projects. However, investors must be aware of the risks involved, including liquidity risks, DeFi market risks, validator risks, and legal risks.

As the regulatory landscape evolves, it is essential to stay informed about potential changes that may impact the future of liquid staking and cryptocurrencies as a whole.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.