Fed interest-rate cuts are widely anticipated on Wednesday, but how the stock market will respond to this policy shift remains uncertain. Historical patterns suggest that the reasons behind the Federal Reserve’s decision to lower rates play a more significant role in shaping market reactions than the simple fact that borrowing costs are being reduced.

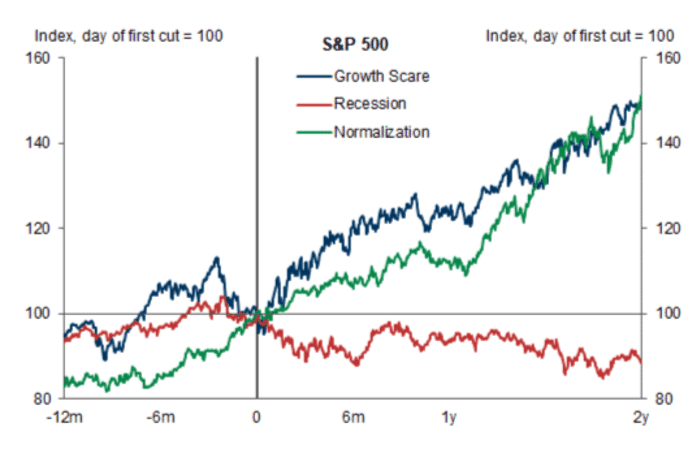

Goldman Sachs Group’s macro strategist, Vickie Chang, points out that since the mid-1980s, the Fed has loosened monetary policy 10 times. During recessionary cycles, the S&P 500 index typically dropped by 10% within the first six months, according to median data.

What Will Wednesday’s Decision Signal About the Economy?

The size of the expected rate cut on Wednesday could shape investor sentiment for the remainder of the year. With recent U.S. economic data showing mixed signals, such as slower hiring rates and a growing workforce, investors are seeking more clarity. Although inflation has eased, lingering price pressures in key services like rent and housing remain a concern.

All eyes on the #FOMC meeting! 👀

— metainvestor.base.eth (@meta1nvestor) September 16, 2024

With a possible interest rate cut on the horizon, the markets could get interesting. If the Fed cuts by 25 bps, it could be seen as a disappointment compared to expectations, leading to a short-term drop. And if they cut by 50 bps, it may…

Stock market gains in 2024 have been driven by confidence in the economy, but recent worries about potential increases in unemployment have triggered sharp sell-offs, particularly in August and September.

Has the Fed Lagged Behind?

Some analysts argue that the Fed has fallen behind in addressing economic shifts and should have cut rates earlier in July. As a result, many on Wall Street fear that a significant 50 basis-point rate cut could lead to negative stock market reactions. By last Friday, expectations for such a substantial cut were growing, making it difficult to predict how the markets will respond.

Strategists at Deutsche Bank suggested that regardless of the Fed’s decision, the outcome might surprise the market to the greatest extent in 15 years. Along with the size of the cut, the latest economic projections from the Fed will be closely examined.

John Velis, macro strategist at BNY, anticipates the Fed will likely revise its unemployment forecast upward while downgrading expectations for GDP growth. While this doesn’t necessarily signal an impending recession, investors should watch closely as these changes could influence the market’s view on the depth of future rate cuts.

On the Edge of a Significant Achievement

Although recession indicators are absent, investors remain concerned. Successfully navigating the economy to a soft landing after such a prolonged period of inflation would mark a significant achievement for Fed Chair Jerome Powell. According to Diane Swonk, KPMG U.S. chief economist, such a feat would be unprecedented.

The Fed has demonstrated its ability to guide the economy through challenging times before. For example, in 1995, a series of rate cuts marked a “mid-cycle adjustment” that did not harm the markets, says Jurrien Timmer, director of global macro at Fidelity.

U.S. stocks surged on Friday, with both the S&P 500 and Nasdaq Composite extending gains for a fifth consecutive day, their largest weekly rise since November 2023, according to Dow Jones Market Data. The Dow Jones Industrial Average also experienced its best week in a month.

The Fed’s two-day policy meeting begins Tuesday, with the highly anticipated interest-rate decision to be revealed at 2 p.m. Eastern Time on Wednesday.

Make money without lifting your fingers: Start using a world-class auto trading solution.

LonghornFX, your trusted Partner in CFDs, Cryptocurrencies and Stocks.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.