USDCHF Price Analysis – May 12

The USDCHF pair drifted from three-day highs about 75 pips and fell in the last hour to new session lows, around the region of 0.9670. The pair failed to follow up on its initial rebound, rather met another fresh supply close to mid-0.9700s level despite substantial dollar weakness and the intraday selloff gathered up some momentum during the American session.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9766

Support Levels: 0.9650, 0.9440, 0.9181

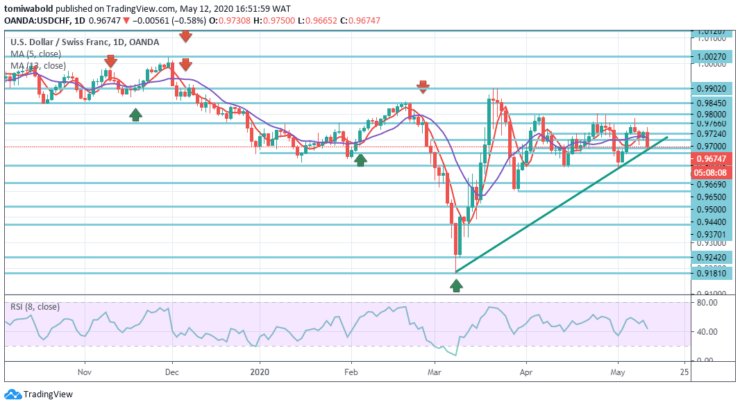

USDCHF Long term Trend: Ranging

While increasing the consolidation range to a level of 0.9750 and then down to a level of 0.9670, USDCHF is shifting not too far from the level of 0.9700 near the center of the range, which can be regarded as a changing continuation trend.

The key possibility suggests that the price will fall beneath the ascending trendline and hit the first goal at level 0.9650. That being said, unless the pair violates the upside barrier, the market may adjust to 0.9724 levels, and then regain upward trading to achieve the above target.

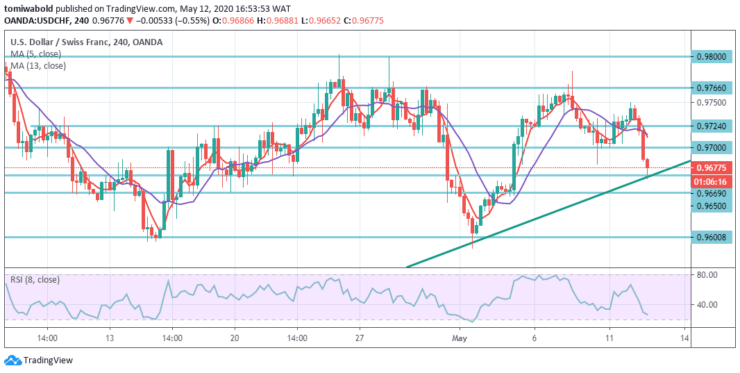

USDCHF Short term Trend: Ranging

USDCHF is plunging from the May Highs whilst also trading on the four-hour chart underneath figure 0.9700 and the main moving average of 5 and 13. Bulls seem to risk losing some grip as the market slides.

The support may be seen close to 0.9650 and the 0.9600 thresholds, but it remains uncertain if bears have what it takes to get through. In the real sense, unless the market regains the figure of 0.9700 the buyers might give another go at the 0.9766 resistance level.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.