Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin has experienced several bear markets in its history, and we are currently in the midst of the crypto industry’s fifth bear market. Investing in technology can be tricky for several reasons. One of which is that the technology industry is famously volatile.

Let’s take a look back at past crypto winters and the lessons to learn.

This occurred in 2011, when the price of Bitcoin dropped from $32 to 1 cent within a short time. This was caused by a security breach at Mt. Gox, which accounted for 80% of all Bitcoin transactions at the time. The breach caused about 850,000 BTC to be stolen, valued at about $19 billion now.

The second Bitcoin winter market occurred in 2013, when the cryptocurrency’s value surged past $100 and eventually peaked at an astounding $1,000 by November of the same year. This sudden surge in value came as a surprise to many, but the excitement was cut short as the price plunged to $700 within 30 days. The downward trend went on, reaching $170 in January 2015. This significant price plunge was caused by China’s Apex Bank, which implemented strict regulations barring their banks from accepting Bitcoin.

In January 2017, Bitcoin hit $1,000, and by the end of the year, it had reached $20,000. However, the price experienced a massive drop, losing 60% of its value by the end of February 2018. The first significant “crypto winter” started in December 2018, when Bitcoin hit a low of around $3,200. Anxiety gripped the crypto markets after Coincheck, a Japanese crypto platform, was hacked, resulting in a loss of $530 million in the cryptocurrency NEM (XLM).

This began in April 2021, with Bitcoin dipping from $69,000 to $29,000 within three months. This was because Bitcoin mining fell under scrutiny with the surge of ESG investments. The anxiety grew when Tesla removed Bitcoin as a payment choice, claiming possible environmental issues. Despite China’s crackdown on mining facilities, Bitcoin started to rise in July 2021, peaking at $68,000.

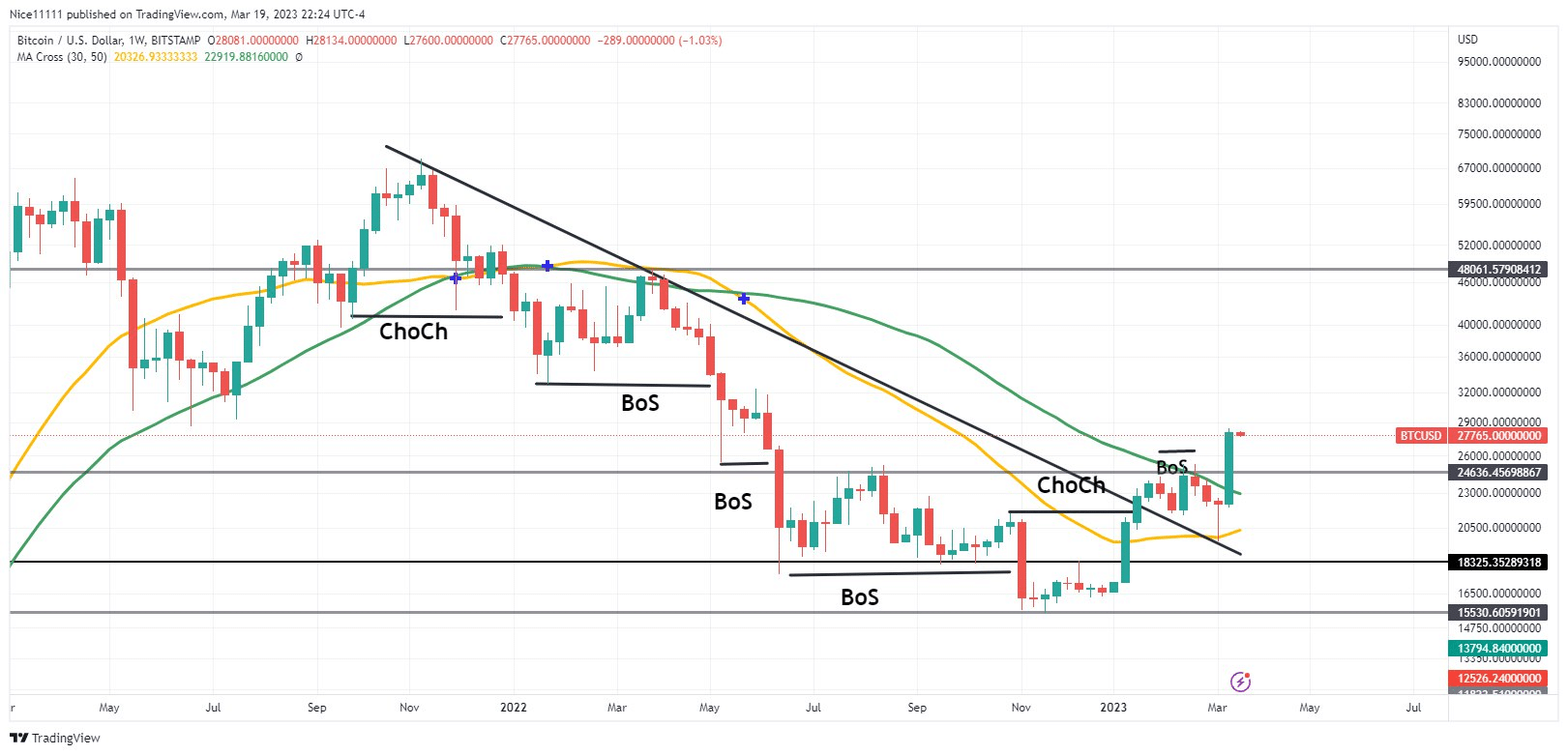

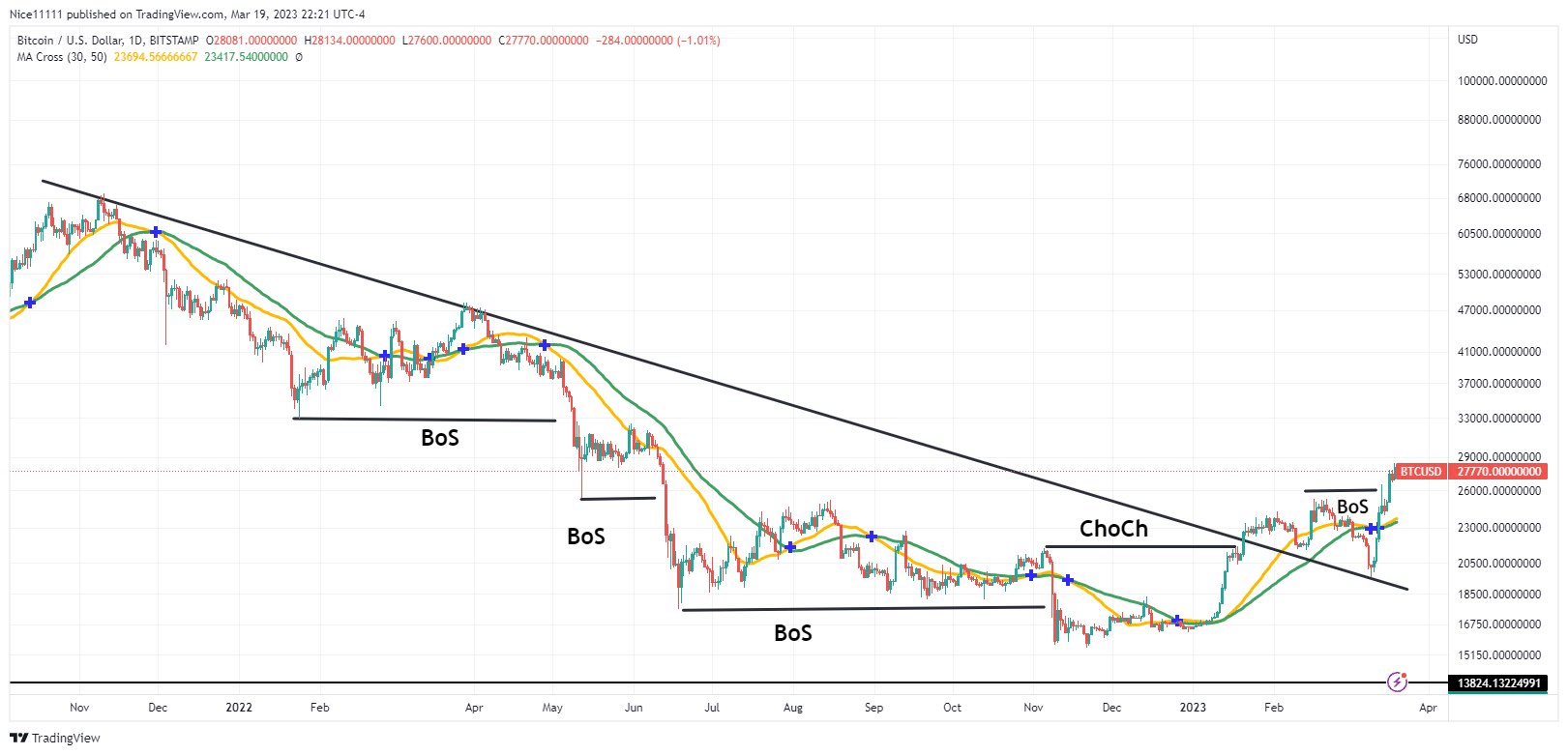

The current one began in late 2021 when BTC’s price fell below $20,000 – the first time since the COVID period. This was caused by the Terra Luna crash, which resulted in a crisis with crypto loans.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.