EURUSD Price Analysis – May 11

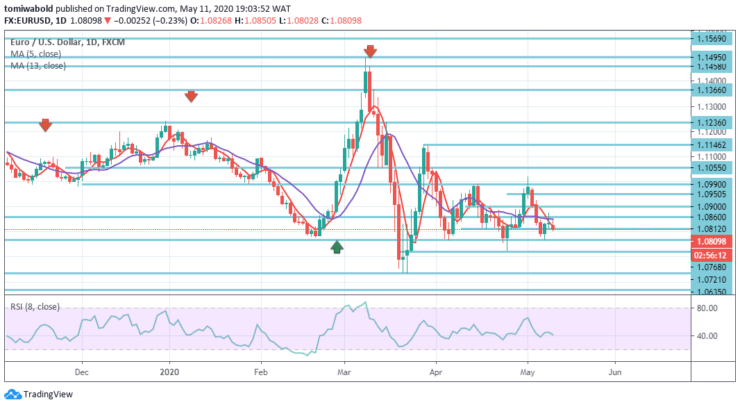

EURUSD confronts the risk of attempting to push higher in the fresh week of reversal and trading around the 1.0800 thresholds this Monday, restricted to a small range of 40 pips since the day commenced. Whereas, the optimism of investors simply looks for near-term guidance towards the disruptions from the coronavirus as economic activity re-opens.

Key Levels

Resistance Levels: 1.1495, 1.1146, 1.0900

Support Levels: 1.0768, 1.0721, 1.0635

EURUSD Long term Trend: Ranging

As seen in the daily chart, resistance appears at level 1.0900 through which a breach transforms risk to level 1.0950. A violation of that as well reaches the level of 1.1000. Even farther upward, resistance is also at level 1.1050.

Alternatively, on the contrary, support comes in at level 1.0812 with such a breach leaving the door open to more declines towards level 1.0800. Lower down, support stands at level 1.0768. A breakthrough that level may open the path for a transition to level 1.0721. Overall, EURUSD is aiming for further risks to recovery.

EURUSD Short term Trend: Ranging

EURUSD ‘s pattern stays constant, and its intraday bias holds firm. The corrective trend may advance much beyond level 1.0635. On the upside, the bias for the 1.0900 resistance level may transform over beyond the 1.0860 minor resistance level to the upside.

As a whole, although, recovery will be constrained by a retracement of 61.8 percent from 1.1495 to 1.0635 at 1.1146 levels as shown more explicitly on the larger time frame. On the downside, a break of 1.0721 level may aim at a low-level test of 1.0635.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.