EURUSD Price Analysis – August 30

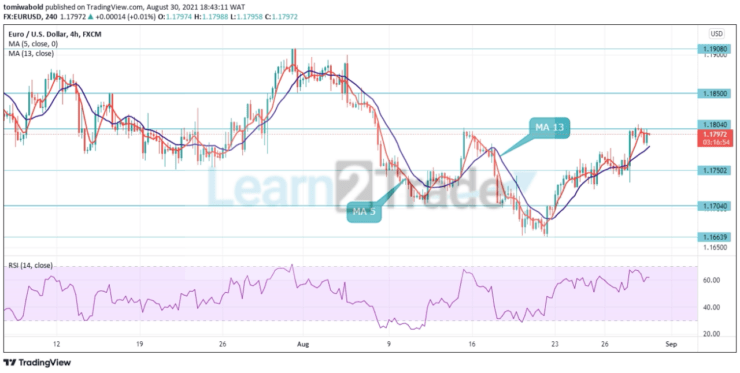

The EURUSD pair reached a high of 1.1809 and is now holding gains around the 1.1800 mark. Although following the release of the latest Eurozone sentiment figures, the euro remained positive posting modest intraday gains.

Key Levels

Resistance Levels: 1.1975, 1.1908, 1.1850

Support Levels: 1.1750, 1.1704, 1.1663

Any following retreat after the recent spike past the 1.1800 level is likely to find some support at the MA 5, which is now around the 1.1775 area. With all eyes beyond the 1.1800 regions, a convincing breach below might trigger some technical selling and drive the decline into the 1.1750 congestion zone.

The increase from 1.1663 is considered as the third phase of the trend from 1.2349 in the long run. The next target for a rally is the 1.2554 level of cluster resistance. As long as the 1.1602 support level holds, this may be the favored situation. However, a sustained break there could signal long-term positive consequences.

The EURUSD is still consolidating from its yearly high of 1.2350, and the intraday bias is neutral. If another dip occurs while range trading continues, the downside may be capped by the 1.1663 support level, allowing recovery to begin. The pair may surge from low levels to higher levels.

A prolonged breach of the 1.1804 level, on the other hand, might trigger a stronger surge to the projection of 1.1663 to 1.1850 levels from 1.1602 at 1.2452 levels next. A bullish break over 1.1850 could push the pair higher, possibly reaching the first target of 1.1908, with extensions at 1.1975 and 1.2050.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.