EURUSD Price Analysis – December 6

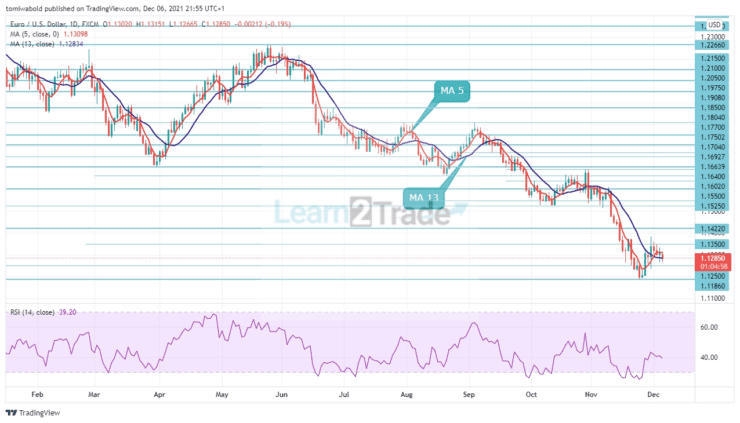

The EURUSD pair continued selling on rallies, taking advantage of the circumstances, and reached a low of 1.1266. The pair has been trading with a selling bias and has just swung back to the south of the daily chart, where it is currently trading 0.21 percent down on the day.

Key Levels

Resistance Levels: 1.1525, 1.1422, 1.1350

Support Levels: 1.1250, 1.1186, 1.1100

On the daily charts, a further slide is projected to find solid support in the 1.1186 region, which contains the year’s lows thus far. A further pullback has the potential to test psychological support at 1.1100 levels, however, a move lower is unlikely in the near term. The crucial level is placed below 1.1250 and at 1.1186.

In the wider context, the EURUSD stays bearish while trading below the horizontal resistance and significant level at 1.1350. A breakout of the 1.1350 level, on the other hand, would aim for the 1.1422 level on the way to the 1.1500 resistance zone. The fall of the 1.1250 zones, in the alternative scenario, is viewed as a first bearish continuation indicator.

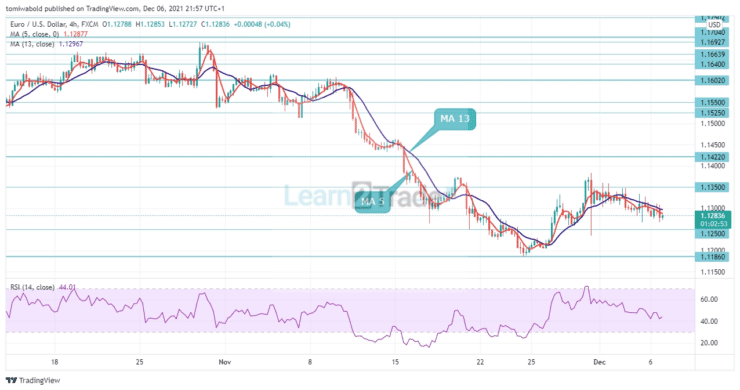

EURUSD risk is weighted to the negative on the 4-hour chart, as the pair is developing below the firmly bearish 5 and 13 moving averages. Technical indicators have shifted to the downside, with negative levels. However, the RSI has not yet reached oversold territory, allowing for more selling.

A breach below the 1.1250 horizontal support might lead to a deeper loss, with investors targeting a move towards the 1.1000 level. Because this is a strong area of support, the price should hold at this point. The bears, on the other hand, will be looking for a move into the 1.1100 if the consolidation breaks down.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.