Buyers are dominating EURUSD market

EURUSD Price Analysis – 26 June

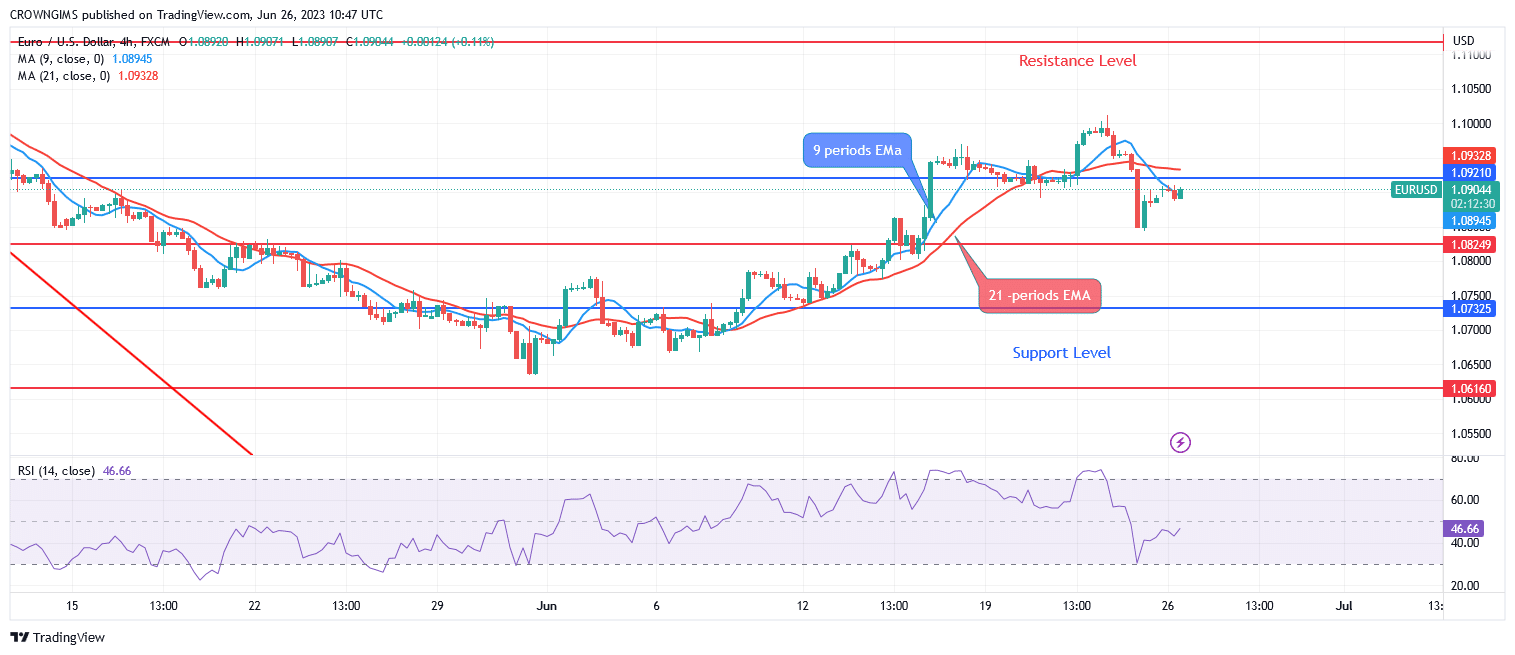

The price may increase substantially more toward the $1.10 and $1.11 barrier levels if buyers are successful in breaking through the $1.09 resistance level. The price may move in the direction of the $1.08, $1.07, and $1.06 support levels if sellers are successful in holding the $1.09 resistance level.

EUR/USD Market

Key Levels:

Resistance levels: $1.09, $1.10, $1.11

Support levels: $1.08, $1.07, $1.06

EURUSD Long-term Trend: Bullish

EURUSD is bullish on the long-term outlook. The bears have been in control ever since the currency pair encountered resistance on May 3 at $1.11. Price reversed off the predicted level, and multiple bearish candles appeared. The price broke through previous support levels at $1.09 and $1.08. The $1.06 barrier was challenged before it was crossed at $1.07. EURUSD is currently moving back towards the north. The upward break of the $1.09 resistance level is an attempt to breach the $1.10 level.

The fact that EURUSD is currently trading above the EMAs shows that the bulls are making progress. The price may increase substantially more toward the $1.10 and $1.11 barrier levels if buyers are successful in breaking through the $1.09 resistance level. The price may move in the direction of the $1.08, $1.07, and $1.06 support levels if sellers are successful in holding the $1.09 resistance level.

EURUSD medium-term Trend: Bullish

EURUSD is bullish on the medium-term outlook. The merchants’ enthusiasm has increased over the previous three weeks. Bears have controlled the EURUSD market. The bulls’ failure to break through the $1.08 resistance level causes the price to fall. There was a danger that the $1.07 level might drop to the $1.06 level. The $1.06 support level was held by bulls, and the price is climbing.

A positive trend is shown by the price’s position above the two moving averages. The signal lines for the Relative Strength Index period 14 are rising and displaying a buy signal at levels 56.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.