Buyers may prevail over sellers in the EURUSD market

EURUSD Price Analysis –23 October

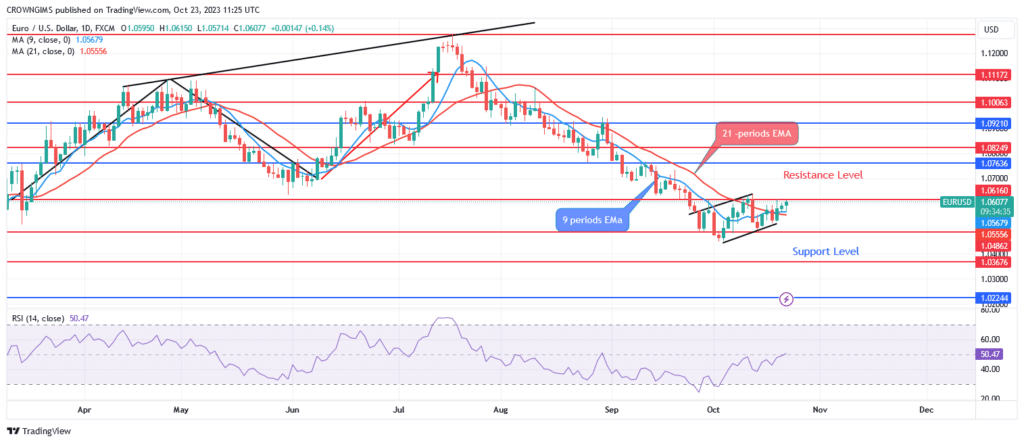

The price may drop considerably lower toward the $1.03 and $1.02 barrier levels if sellers are able to breach the $1.04 support level. The price may move higher in the direction of the $1.07 and $1.08 resistance levels if buyers are able to hold the price over the $1.06 barrier level.

EUR/USD Market

Key Levels:

Resistance levels: $1.06, $1.07, $1.08

Support levels: $1.04, $1.03, $1.02

EURUSD Long-term Trend: Bullish

In the long run, the EURUSD picture is bleak. There is a ranging movement in the EURUSD market, as sellers and buyers are vying with one another to stop further declines. On September 27, the currency pair tested the $1.04 support level. It rose and tested $1.06 again last week. The bull’s light was extinguished. As long as bears continued to exert pressure, the bearish momentum would continue. It is less expensive than the $1.06 that it was previously. Right now, there’s going to be a bullish reversal in the price.

The currency pair are currently trading above the 9-period and 21-period exponential moving averages. Indicating that the bulls are gaining momentum. The two EMAs are below the EURUSD. The price may drop considerably lower toward the $1.03 and $1.02 barrier levels if sellers are able to breach the $1.04 support level. The price may move higher in the direction of the $1.07 and $1.08 resistance levels if buyers are able to hold the price over the $1.06 barrier level.

EURUSD medium-term Trend: Bullish

For the medium run, the EURUSD outlook is favorable. For almost three weeks, there has been bearish pressure on the currency pair. The buying accelerated as soon as the $1.04 support level was put to the test. Large bullish candles have formed several times as the price is rising toward $1.06 now. The price may soon begin to rise once more.

The beginning of an upward trend is indicated by the price position that is above the 9- and 21-period moving averages. The period 14 signal lines of the Relative Strength Index are inclining and displaying a buy signal at level 61.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.