EURUSD Price Analysis – March 1

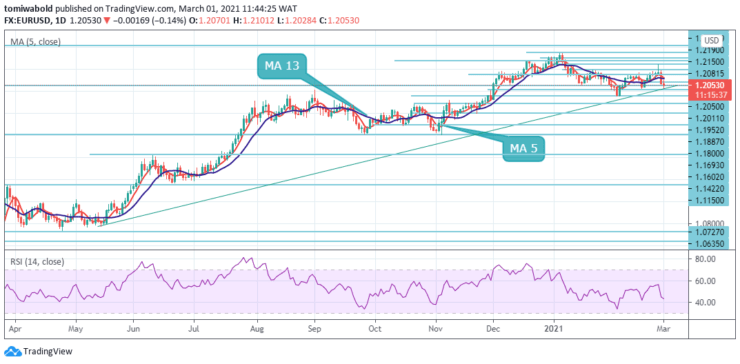

The EURUSD pair topped near 1.2101 early on Monday during the European session and started a fresh decline. The currency pair looks south faces the probability of increased selling traction towards the 1.2020 levels during the session. The expected release of US- ISM may likely show robust growth in the industrial sector, boosting USD-strength.

Key levels

Resistance Levels: 1.2350, 1.2240, 1.2150

Support Levels: 1.2011, 1.1952, 1.1887

As seen on the daily, EURUSD dives to new multi-day lows, after extending the recent breakdown beneath the moving average 5 and 13 around the level at 1.2100. This opens the door to a deeper pullback and a potential re-test of the psychological support around the 1.20 mark. The underlying bullish sentiment in the euro remains threatened beneath the 1.2100.

At the moment, the pair is losing 0.24% at 1.2040 and faces immediate contention at 1.2011 (low Feb. 2) followed by 1.2000 marks and finally 1.1952 level (2021 low Feb. 5). On the upside, a breakout of the 1.2190 level may approach the 1.2240 (2021 Feb .25) en route to 1.2350 levels.

Meanwhile, the intraday bias in EURUSD is mildly on the downside for the moment. The breach of 1.2022 ascending trendline support may validate the start of the third phase, towards a 100% forecast of 1.2350 to 1.1952 levels from 1.2240 at 1.1887 levels. On the upside, above 1.2150 minor resistance level may alter intraday bias neutral first.

An initial support on the downside is near the 1.2011 zones. The next key support is near the 1.2000 marks. Any more losses might call for a test of the 1.2350 extension level of the upward move from the 1.2011 low level to 1.2240 high at 1.1952 low level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.