EURUSD Price Analysis – February 22

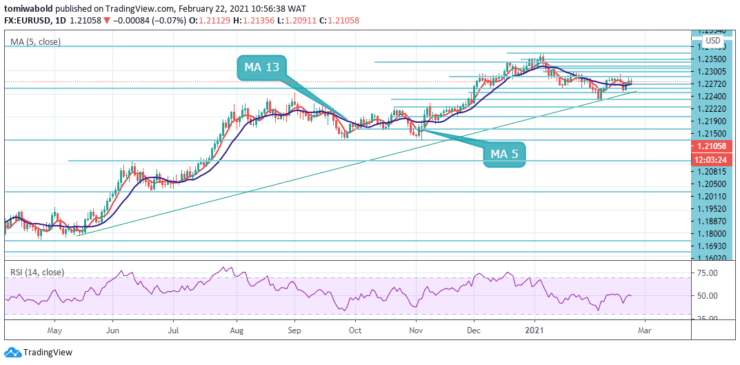

EURUSD has reversed from session highs and now trading near 1.2100, having reached a high of 1.2135 level at the day’s beginning. The dollar recovers as US yields extend gains, equities drop. A continued rise in yields could trigger a market correction while boosting the USD.

Key Levels

Resistance Levels: 1.2350, 1.2240, 1.2150

Support Levels: 1.2081, 1.2011, 1.1952

The advance from the prior week low at 1.2023 level to as high as the 1.2144 level on Friday is due to renewed dollar’s weakness on continued risk appetite and suggests reversal from the prior week’s high at 1.2169 has ended where the upsurge from the trough at 1.1952 level may extend marginal gain.

However, on the downside, a daily exit beneath 1.2081 low level signals a high is reached and shifts the risk to downside for weakness towards 1.2050 level. On the flip side, Looking up, resistance awaits at 1.2150, which was a high point on Friday. It is followed by 1.2190 and support is at 1.2081, where the MA 13 hits the price.

Looking at the 4-hour chart, the pair recovered nicely above 1.2050 and the moving average 13. The pair broke the 50% retracement level of the downward move from the 1.2169 high to 1.2022 marks. The pair is now facing a strong resistance near 76.4% retracement level of the downward move from the 1.2169 high to 1.2022 marks.

Meanwhile, EURUSD is still bounded in the range of 1.1952/1.2169 levels and intraday bias remains neutral for the moment. On the upside, a break of 1.2169 may restart the rebound from the 1.1952 level for retesting the 1.2350 level. On the downside, a break of 1.1952 may extend the correction from 1.2350 with another plunge.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.