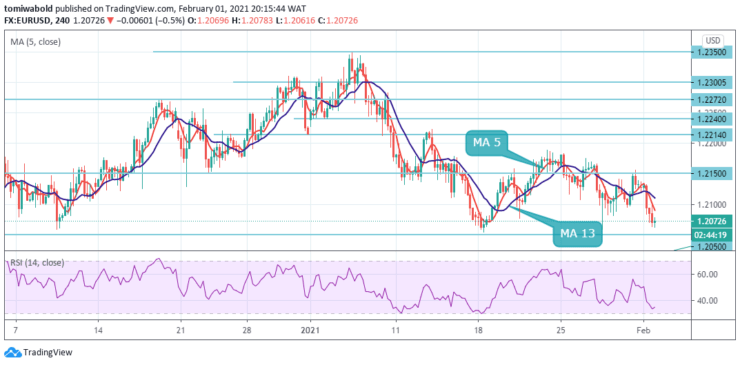

EURUSD Price Analysis – February 1

The EURUSD pair spent the American session plunging lower in a relatively tight range near sub 1.2100 coming under strong downside pressure. Meanwhile, the US Dollar Index inches higher around 91.00, rising 0.50% on the day. As of writing, EURUSD is down 0.50% daily at the 1.2072 level.

Key Levels

Resistance Levels: 1.2350, 1.2240, 1.2150

Support Levels: 1.2050, 1.1900, 1.1602

On the daily charts, a further decline is expected to meet decent contention in the 1.2050 region, where sits the so far yearly lows (Jan 18). A deeper pullback carries the potential to challenge the psychological support at 1.2011 levels, although a move further south of this level is not favored in the near term. Below 1.2000 is located the key level at 1.1900 level.

On the broader picture, the constructive stance in EURUSD remains unchanged while above the critical ascending trendline support and the key level at 1.1900. On the other hand, a breakout of 1.2150 level would target 1.2214 level en route to 1.2240 resistance level. The alternative scenario sees the loss of the 1.20 zone as an initial bearish signal.

The 4-hour chart shows that the risk is skewed to the downside, as the pair is developing below firmly bearish 5 and 13 moving averages. Technical indicators turned south, heading lower within negative levels. However, the RSI is yet to be oversold giving room for further selling.

A steeper decline could be expected on a break below the 1.2050 horizontal support, with investors eyeing an extension towards the 1.1900 level. On the upside, breach of 1.2150 level may aim for 61.8% forecast of 1.0635 to 1.2011 levels from 1.1602 at 1.2214 level next. Any more losses could lead the pair towards the 1.2011 support zone.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.