EURUSD Price Analysis – February 11

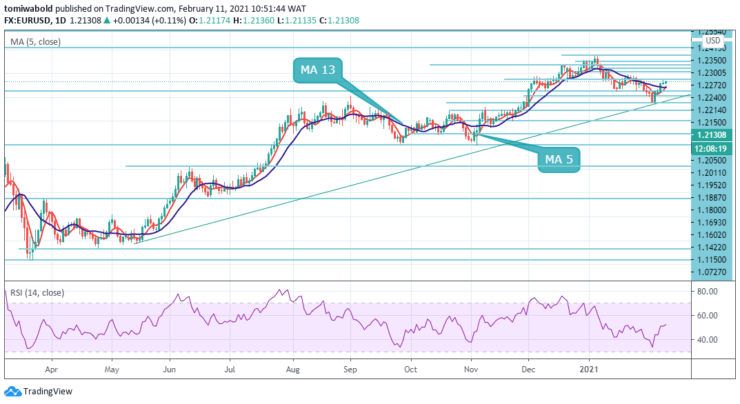

The EURUSD pair upside sentiment has held continuously for 4 days in a row after the pair bounced from the 1.1952 recent low. The major European currency pair rises higher as weak US inflation and labor market’s challenges weigh on the dollar.

Key Levels

Resistance Levels: 1.2350, 1.2272, 1.2150

Support Levels: 1.2050, 1.1952, 1.1887

The EURUSD continues to push higher, rising for the 4th day in a row, to a two-week high at the time of this post to 1.2136 with eyes on the 1.2150 level. Meanwhile, the EURUSD advance is easing on approach resistance at 1.2150 level. We also continue to see the hidden bearish divergence on the chart, which could suggest a pullback.

On the flip side, the price is likely to stall near the 1.2050 level of support for the moment in a case of an unexpected pullback. However, a close below this level could see the Feb 5 lows of 1.1952 come into the picture. If the current bullish moment continues, then the EURUSD may require to break out above 1.2272 level to confirm further upside.

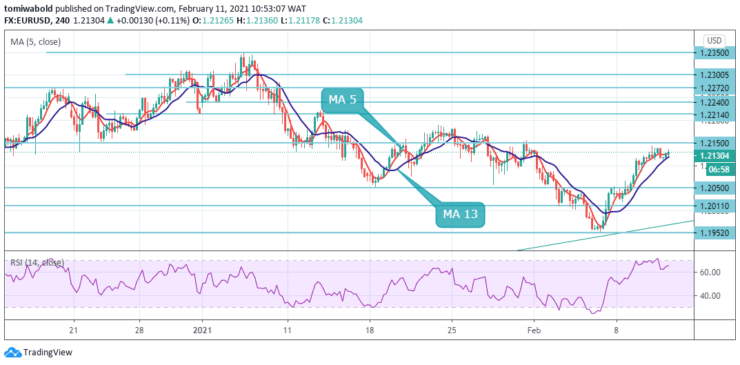

The 4-hour chart shows that EURUSD is trading ahead of the moderately bullish with the 5 moving average about to cross the moving average 13 upwards. The RSI has turned north beyond its middle lines. An ongoing bullish trend could target a 61.8% forecast from 1.0635 levels to 1.2011 levels from 1.1602 at 1.2150 levels next.

The price recovery from 1.1952 low on the 4-hour chart indicates the path of least resistance to the higher side. So far, a compelling breach beyond the 1.2200 level is now in the range for this session. The currency pair is presently trading near the 1.2150 level, registering high at the 1.2132 level during the London session.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.