EURUSD Price Analysis – January 28

EURUSD came under downside pressure in the prior session but despite the recent price action the selling bias fades at 1.2100 in the present session. A row over vaccines is set to delay the eurozone’s recovery, however, there is more room for risk aversion.

Key Levels

Resistance Levels: 1.2300, 1.2240, 1.2150

Support Levels: 1.2050, 1.1900, 1.1602

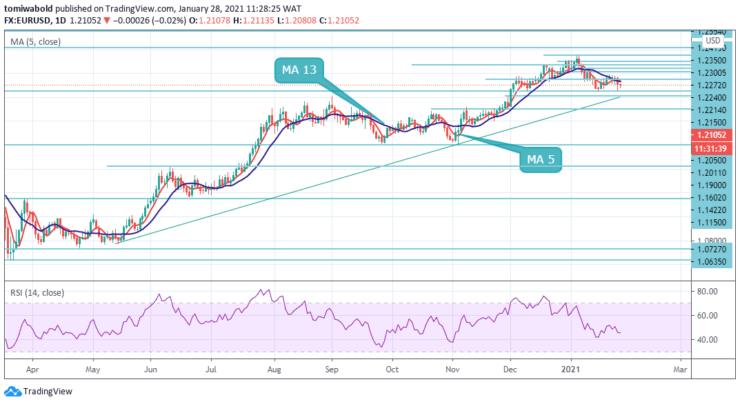

The EURUSD pair has decisively dropped below the 5 and 13 moving average on the daily chart and is suffering from downside momentum. Moreover, the relative strength index is beneath its midline but still above 30 which stays outside the oversold conditions.

Sellers are eyeing 1.2080, the daily low and beneath, as their first target. The key support is at 1.2050 which is Wednesday’s swing low and just under the 2021 trough of 1.2055. This near-perfect double-bottom is critical support. The next level to watch is 1.2000 level.

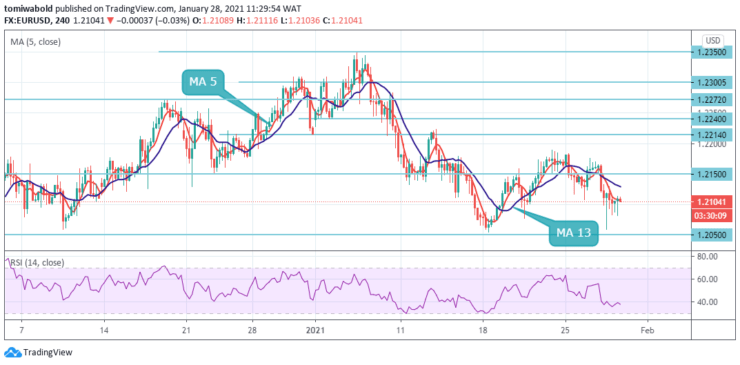

EURUSD came under downside pressure from the prior session. It has eroded the 4 hours moving average of 5 and 13 and attention has dropped towards 1.2050 Jan .18, 2020 low and which may eventually hold. On the upside, a break of 1.2150 would indicate that the current downside risk has dissipated.

On the flip side, the moving average 13 around the 1.2135 marks now seems to act as immediate resistance. A sustained move beyond might assist bulls to make a fresh attempt to make it through the 1.2214 heavy supply zone. The next relevant target on the upside is pegged near the 1.2240 regions, above which the momentum could push the pair back towards the 1.2300 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.