EURUSD Price Analysis – December 3

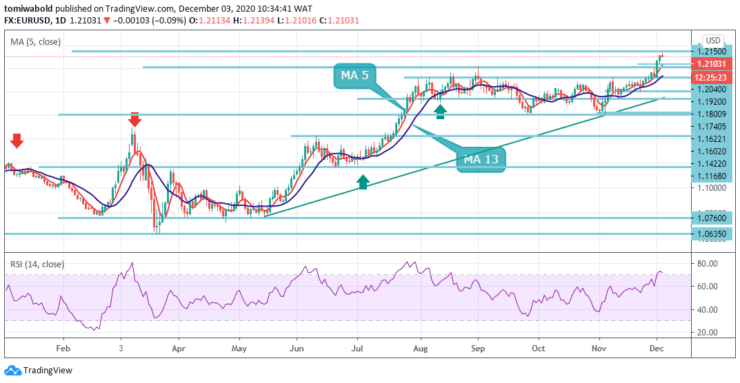

EURUSD has maintained an upside rally following the breach above the 1.2100 level and it’s poised to reach the 1.2150 level. The pair has been influenced by two main market drivers from the recent covid-19 vaccine breakthrough and the US fiscal stimulus package. All in all, it seems like most positive trends are priced in and new optimism is required to maintain the rally.

Key Levels

Resistance Levels: 1.2452, 1.2300, 1.2150

Support Levels: 1.2040, 1.1920, 1.1800

From the daily technical perspective, the pair this week validated an initial bullish breakout through the 1.2011 resistance level and seems poised to prolong its upward trajectory towards the 1.2150 higher resistance level. There seems to be no stopping the EURUSD rally as it’s now trading near the 1.2139 intraday level.

In the larger context, the advance from the 1.0635 level is discovered as the third cycle of the trend from the 1.0339 (low) level. Sustained traction could be seen to cluster resistance at 1.2150 level next. This will remain the favored case as long as the 1.1602 support level stays intact.

EURUSD’s rally is still in progress and intraday bias stays on the upside for 61.8% projection of 1.0635 to 1.2011 levels from 1.1602 at 1.2150 levels next. On the downside, breach of 1.2040 minor support level may alter intraday bias neutral and bring consolidation first, before staging another rally.

EURUSD is benefiting from upside momentum on the four-hour chart, but the Relative Strength Index is well into overbought territory once again. The last time that it happened earlier in the week, the currency pair corrected to the downside. On the downside, only an exit beneath the 1.2040 level will validate temporary high is in place and risks stronger retracement towards the 1.2011 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.